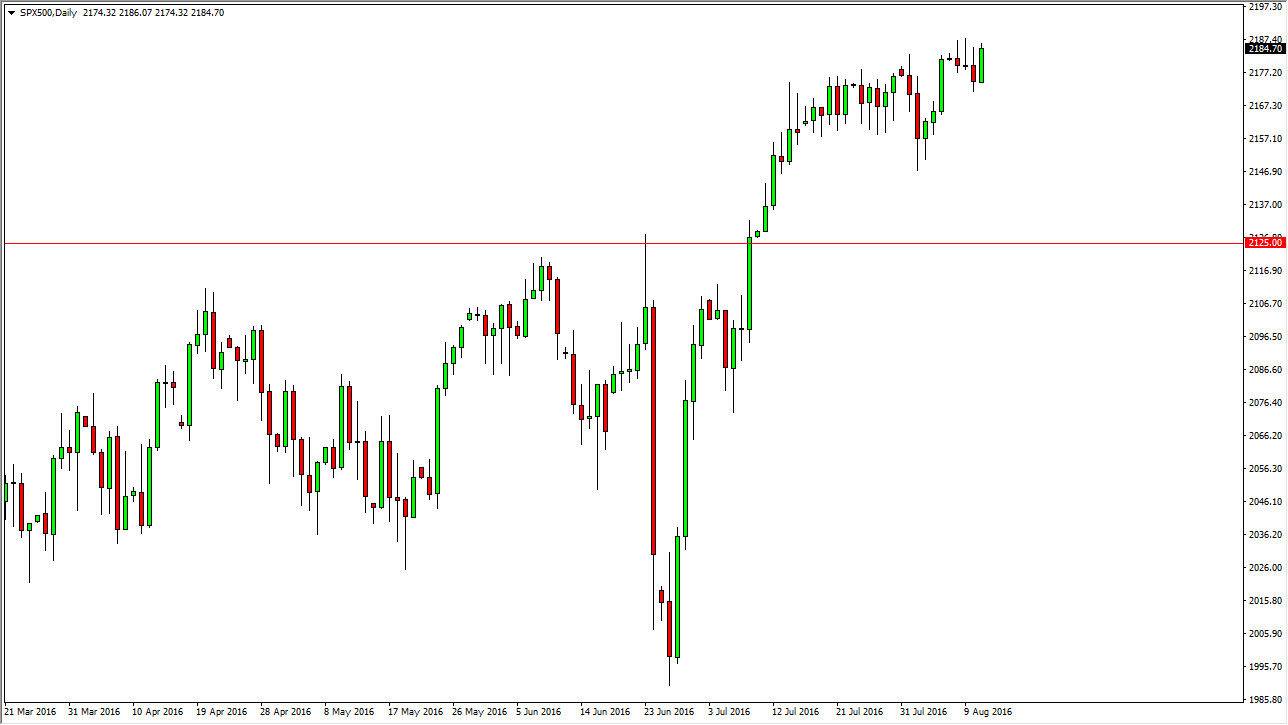

S&P 500

The S&P 500 broke higher during the course of the session on Thursday, but as you can see we are still just below the top of the couple of shooting stars. Ultimately, a pullback from here should be a buying opportunity as we have seen such a massive breakout recently. This is a market that has had quite a bit of bullish pressure in it, so it makes sense that we been consolidating a bit in order to build up pressure. A pullback should represent value, and I believe that at this point in time the 2125 level is now the “absolute floor” in the uptrend that was this market looks very likely. I believe at this point time the S&P 500 will continue to reach towards the 2250 handle.

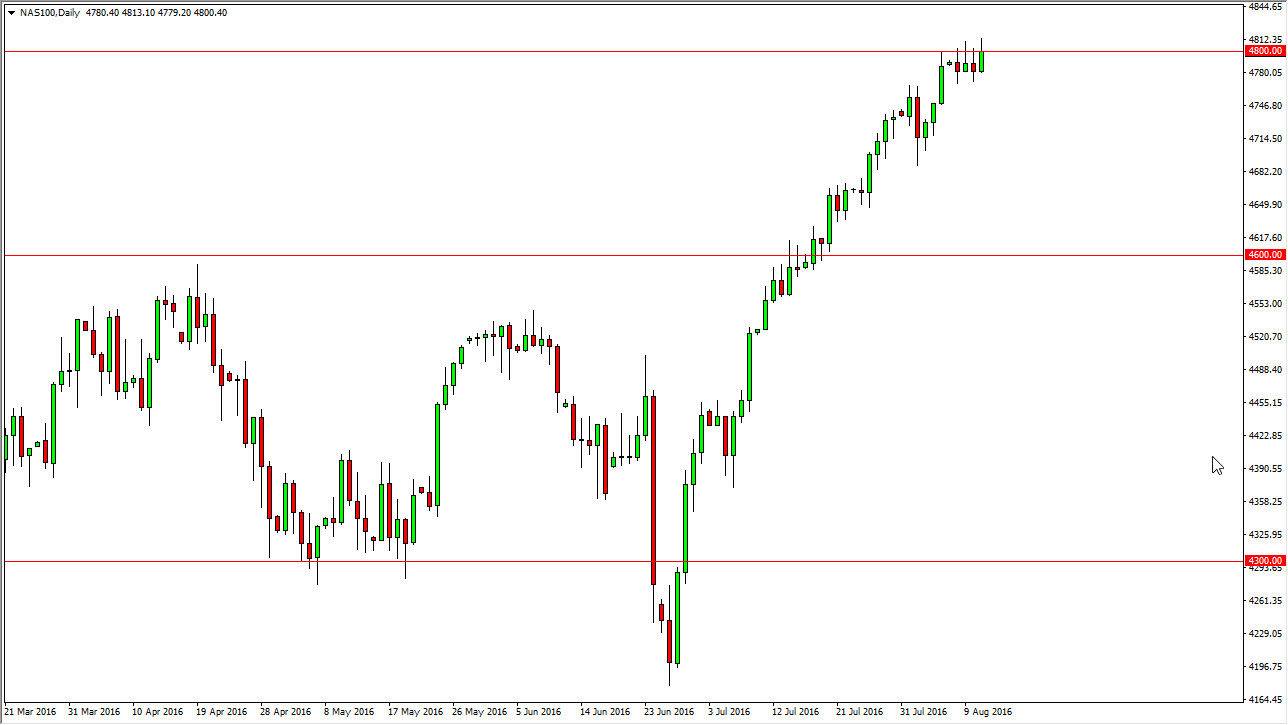

NASDAQ 100

The NASDAQ 100 tried to rally during the course of the day on Thursday, and it keep some of the gains but as you can see the 4800 level above has offered quite a bit of resistance. If we can break above the top of the candle for the session on Thursday, I feel we are then going to start reaching towards the 5000 level over the longer term. In fact, that is my target but I think we may have to pull back a few times in order to build up enough pressure to finally break out. I have no interest in selling this market, there is more than enough support below to keep this market going higher, and as a result I feel it’s only matter of time before the buyers take over every time we fall based upon the low interest rate environment the United States finds itself in, and of course the fact that US companies are starting a higher again. Ultimately, this is probably the safest country to be invested in, so of course the indices get a bit of a boost from that as well.