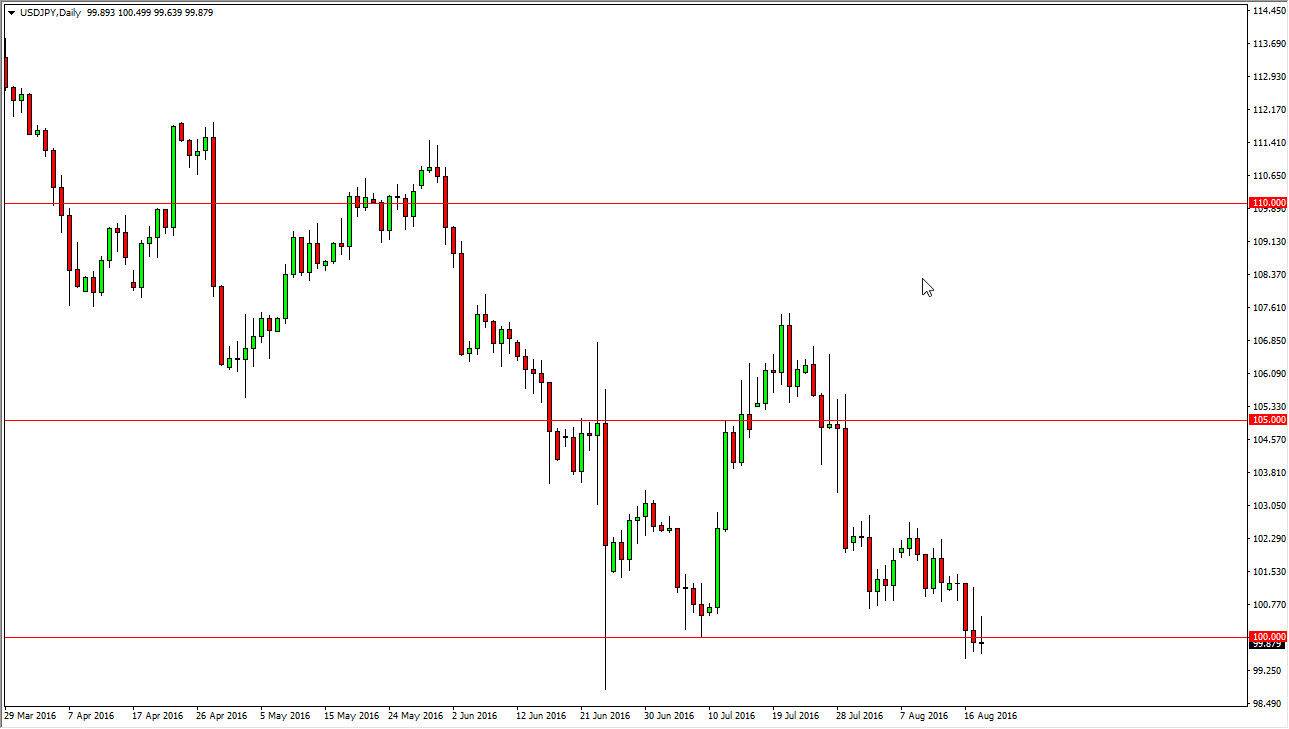

USD/JPY

The US dollar initially tried to rally during the course of the day on Thursday, but turned right back around to form a bit of a shooting star. The shooting star was preceded by a shooting star on Wednesday as well, so quite frankly I think we are starting to build up serious pressure to the downside. However, it to keep in mind that the Bank of Japan below will be very interested in keeping this market somewhat afloat, because quite frankly the value of the yen is something that they worry about as far as exports are concerned. With this, I think if we can either get a supportive candle, a bounce, or break above the top of the shooting star from the Thursday session, it’s time to start buying, at least for the short-term.

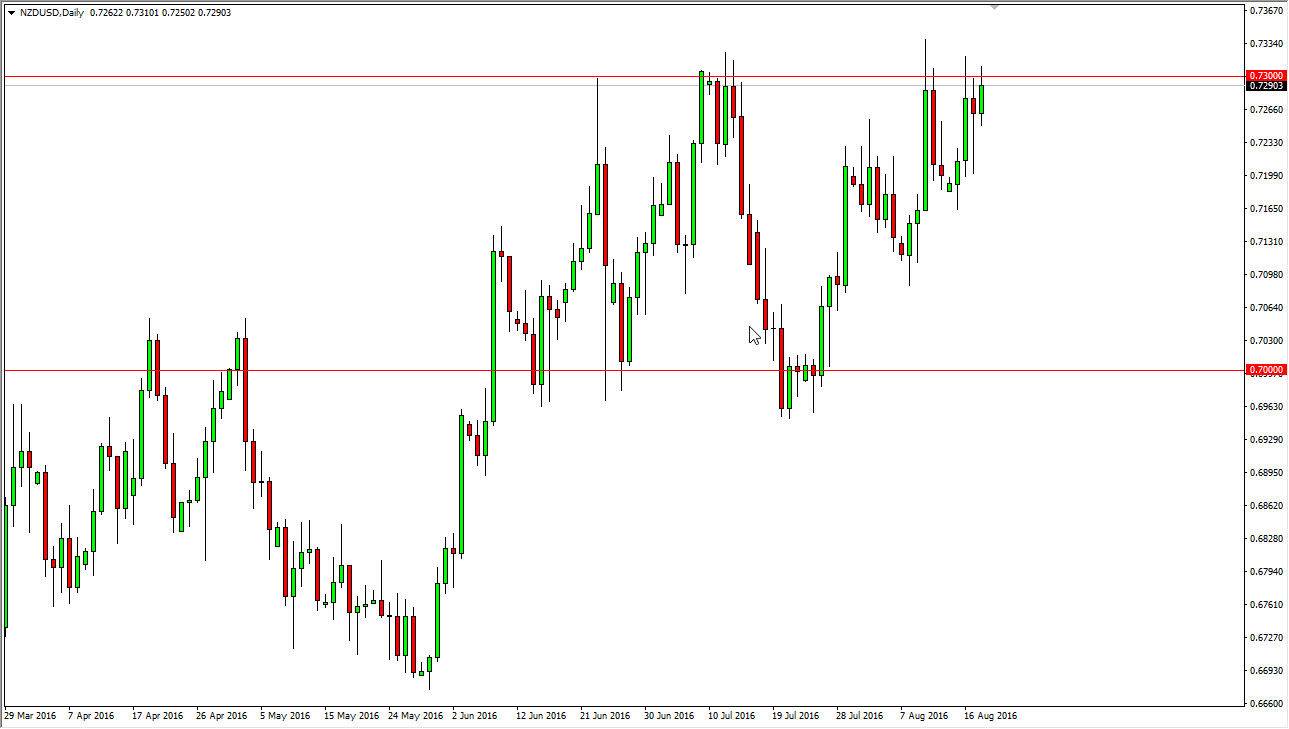

NZD/USD

The New Zealand dollar rally during the course of the day on Thursday, slamming into the 0.73 handle. This is an area that has been massively resistive, so having said that it doesn’t surprise me that we could not break above there in one shot. I do think we will eventually though, because the lows keep getting higher, and that of course is a very bullish sign. Eventually, I feel that the buyers will overcome the resistance but it’s probably only a matter of time so even if we pullback I feel that you can start buying based upon support. After all, we formed a very nice hammer during the course of the session on Wednesday, and that is a very strong sign of us breaking above and leaving this area behind.

This is an interest-rate differential play, because quite frankly there is no interest rate that you can take advantage of around the financial world. With this being the case, I think that the New Zealand dollar will continue to strengthen based upon that alone.