USD/CAD Signal Update

Yesterday’s signals were not triggered.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be taken before 5pm New York time today only.

Long Trades

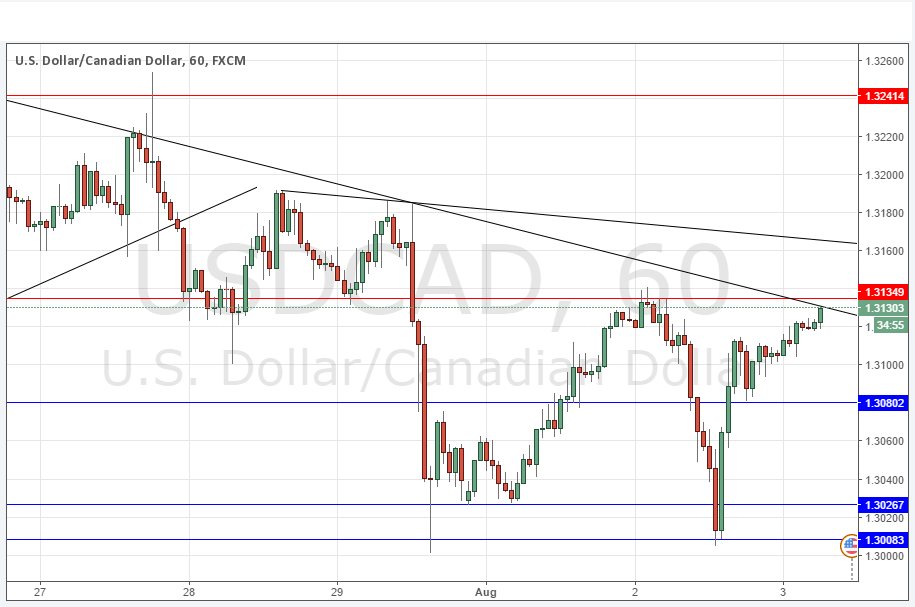

Long entry after bullish price action on the H1 time frame following the next touch of 1.3080 or an entry into the zone between 1.3027 and 1.3000.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 1.3135.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

It has been an interesting 24 hours for this pair. We had support flip to resistance at 1.3135 and push the price down sharply to its former origin just above the psychologically crucial level at 1.3000, from where the price then shot up again rapidly. It is now again approaching the 1.3135 resistance level as well as a couple of significant trend lines. It is hard to say what is likely to happen next as the long-term charts show a lot of indecision, but that is good news for trading rejections of levels for fairly conservative targets.

There is nothing of high importance due today concerning the CAD. Regarding the USD, there will be a release of ADP Non-Farm Employment data at 1:15pm London time, followed by ISM Non-Manufacturing PMI at 3pm and then Crude Oil Inventories at 3:30pm.