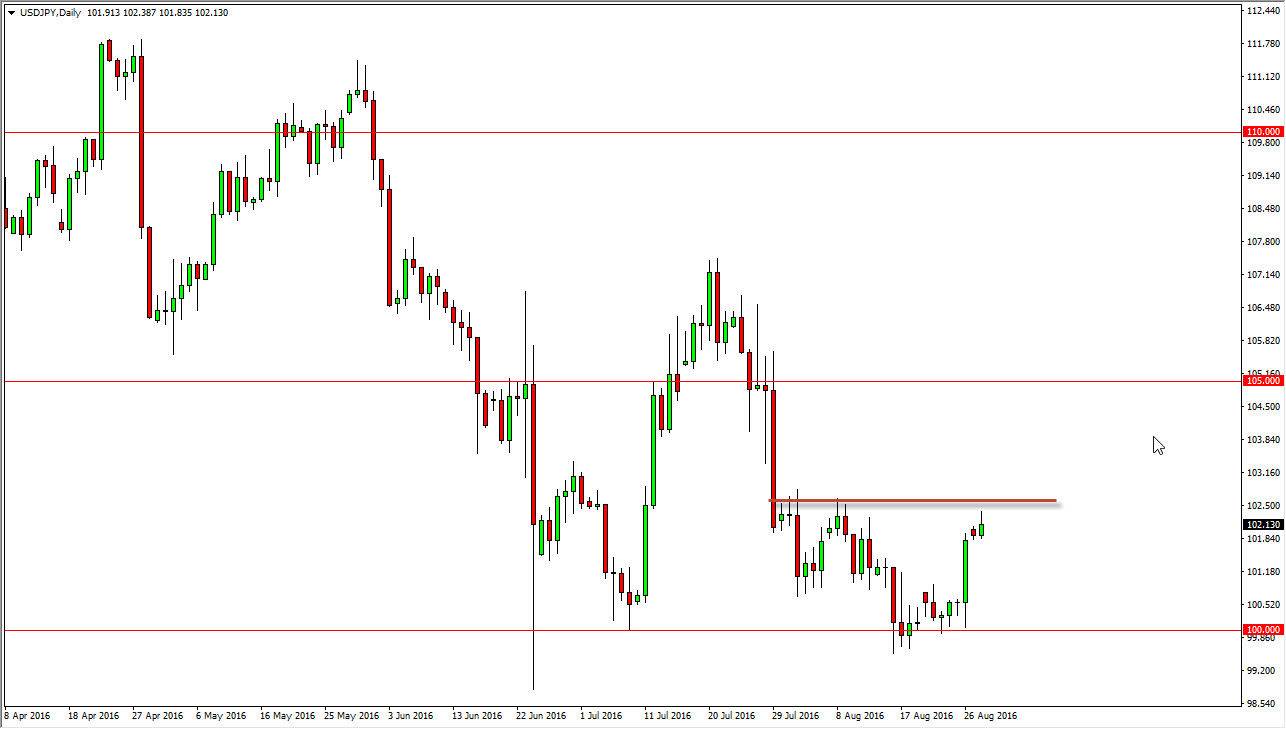

USD/JPY

The USD/JPY pair initially rallied during the course of the session on Monday, but then turned right back around to form a shooting star. The shooting star of course is a negative sign, and therefore we could drift lower. However, I think we are starting to try to build up a bit of a base in this market, so every time we pullback I’m looking for signs of support that I can start buying. I believe that the 100 level is essentially the “floor” in this market that the Bank of Japan is going to adhere to. They are already talking about some quantitative easing, and of course the Federal Reserve has suggested that perhaps a rate hike in September isn’t out of the question.

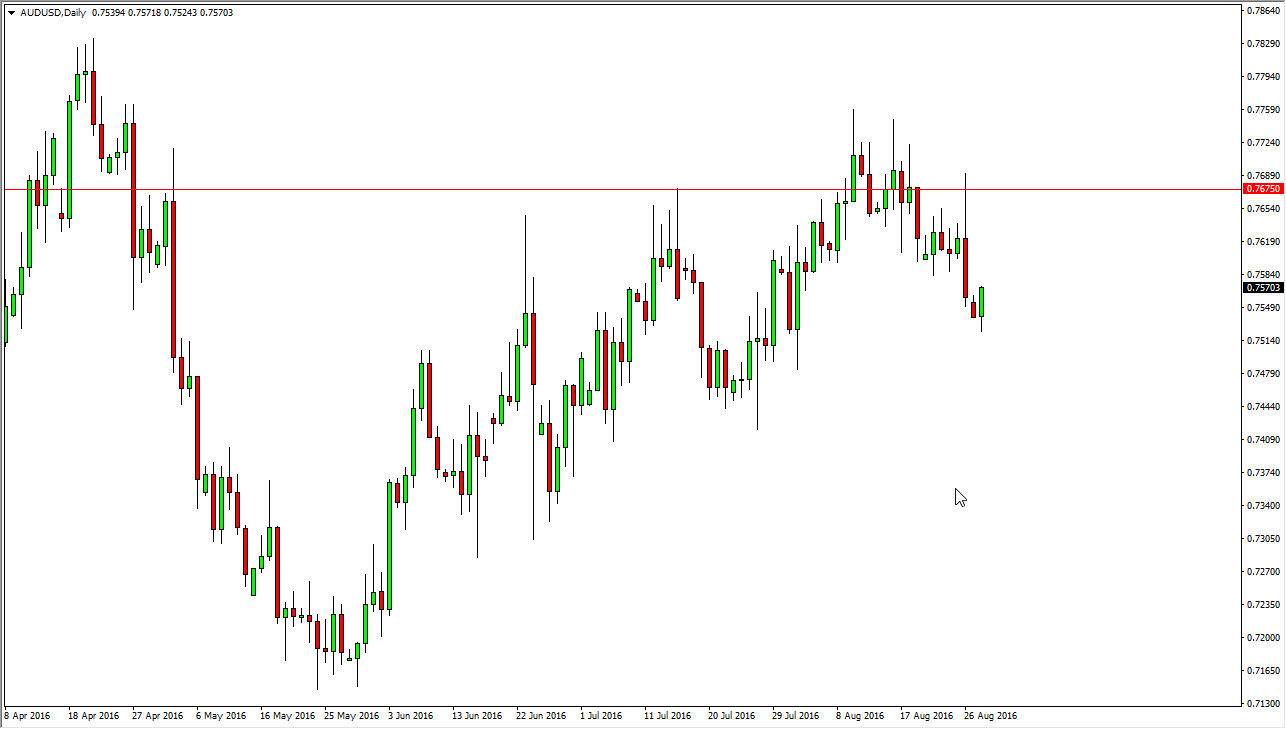

AUD/USD

The Australian dollar initially fell but then turned right back around to form a bullish candle. With this being the case, I believe that we are going to continue to go back and forth and perhaps grind sideways, reaching towards the 0.7675 level. Ultimately, I do think that there is going to be a lot of resistance above some waiting to see an exhaustive candle. If we get that, it’s likely that the sellers would continue to get involved in this market when they see “value” in the US dollar. Ultimately though, you also have to keep in mind that the gold markets have a massive amount of influence on the Australian dollar, and with that being the case it’s likely that the direction of the gold market will greatly influenced where we go in the next couple of weeks. However, the volumes are very light at the moment as we are still in vacation season. Pay attention to the gold market, and as a result it’s likely that you will have to follow both charts.