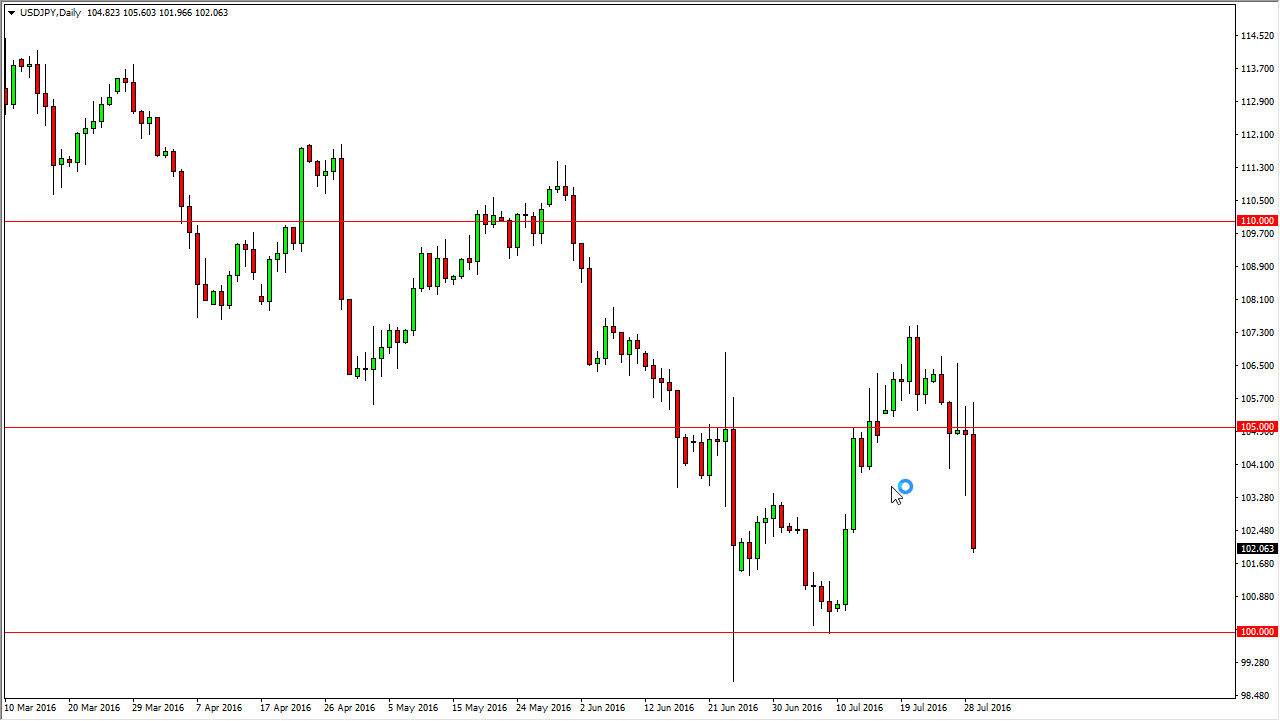

USD/JPY

The US dollar initially rallied against the Japanese yen but found so much pressure above the 105 level that we just rolled right over. We ended up closing the day just above the 102 level, so this was a significantly bearish candle. I believe at this point in time that we will probably try to break down to the 100 handle, but somewhere in that area you have to believe that the Bank of Japan will lose it sense of humor when it comes to the strengthening Yen. With this, I believe that the downside is probably going to be the right play for the next couple of sessions, but I’m not expecting much beyond a retest of previous support.

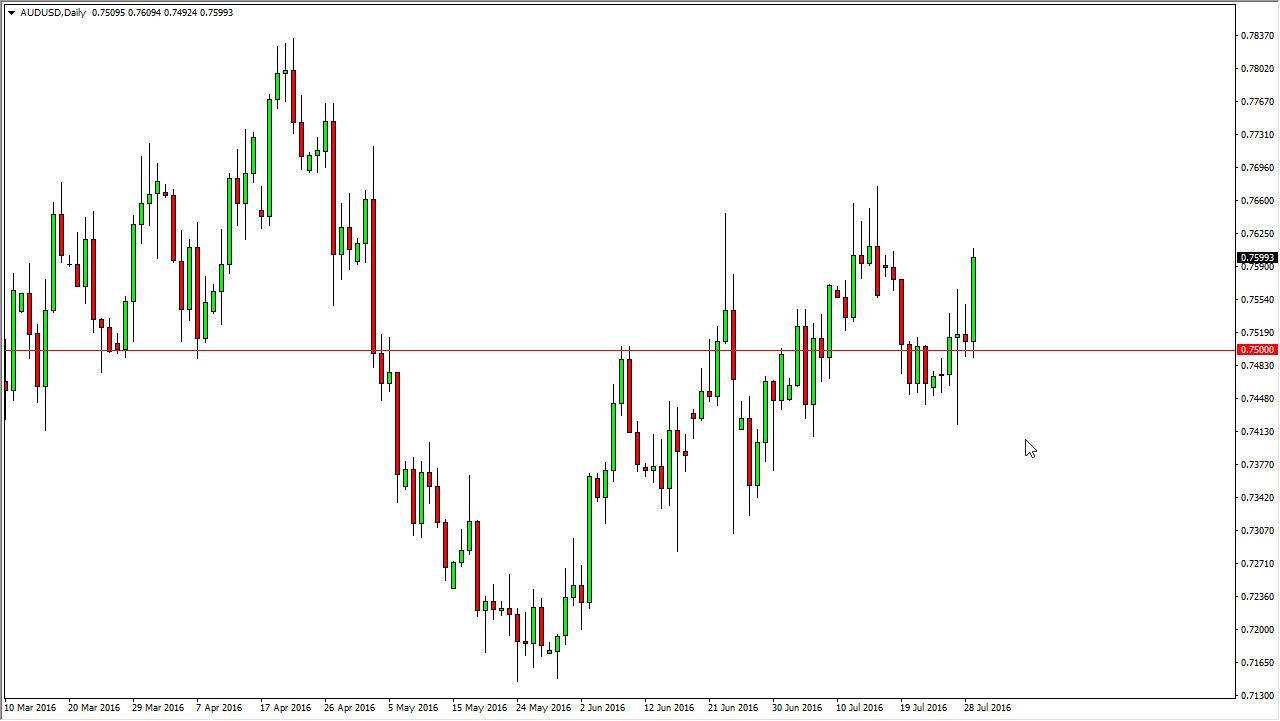

AUD/USD

The Australian dollar initially dipped but ended up finding quite a bit of support at the 0.75 handle. By doing so, we ended up bouncing significantly and forming a very bullish candle. The bullish candle of course suggesting that the Australian dollar is going to continue to go higher, and if we can get any type of upward pressure from the gold markets, I believe that will be more than enough reason to start buying. After all, we have broken above the top of the hammer from the Wednesday session, and that’s a very bullish sign in and of itself.

Because of all of this, I believe that the market will continue to go higher, and pullbacks should end up being short-term buying opportunities. I believe that the market will then eventually reach towards the 0.78 handle, and possibly even the 0.80 handle given enough time. I don’t think it can be easy, but that very well could be where we are heading. I think the 0.74 level is a bit of a “floor” in this market. Because of that, I don’t really have any interest in selling.