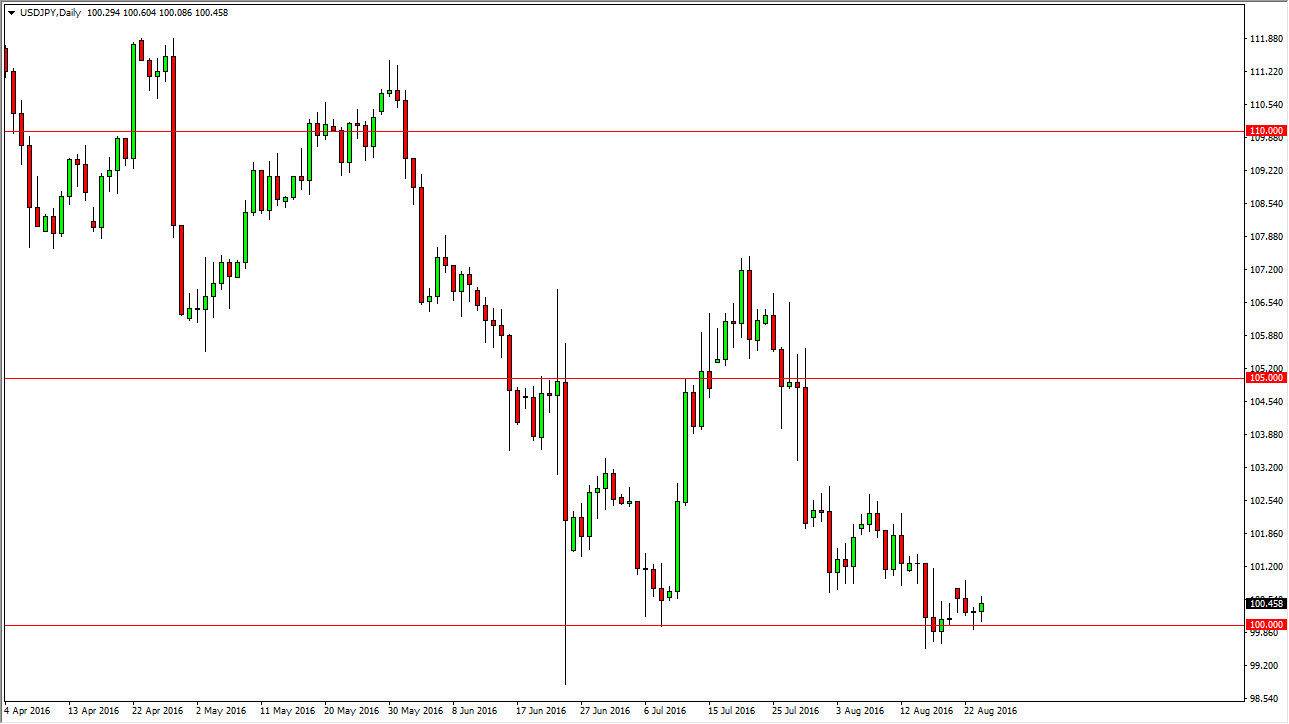

USD/JPY

The USD/JPY pair went back and forth during the course of the session on Wednesday, testing the 100 level at one point. This is an area that I believe is a “line in the sand” when it comes to the Bank of Japan. With that being the case, it makes sense that the market will continue to bounce off of this region. After all, this is a market that has to worry about central bank intervention, quantitative easing, and of course possible jawboning of the Japanese yen. With this being the case, I think we could get short-term bounces from time to time, and that’s exactly how I’m plane this market, short-term gains.

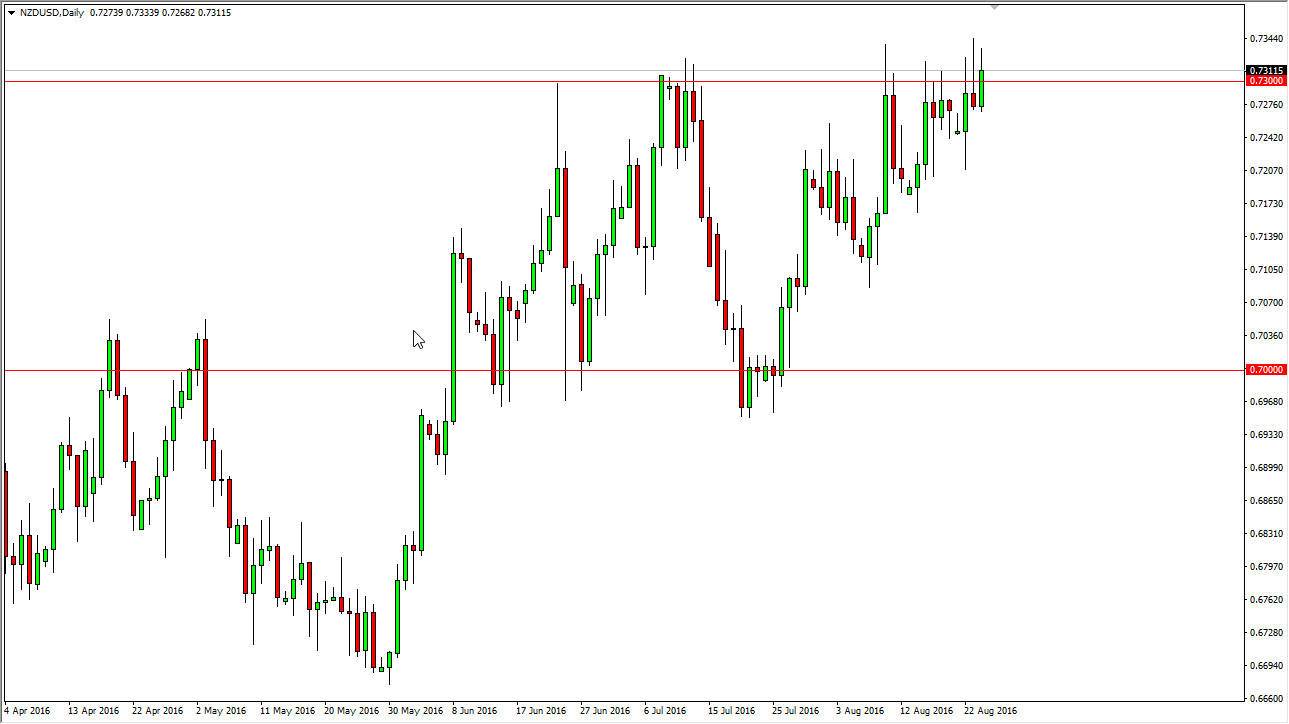

NZD/USD

The New Zealand dollar broke out and above the 0.73 level at one point during the course of the session on Wednesday, as we continue to trying to break higher. Ultimately, this is a market that I think eventually will break out to the upside but there is obviously quite a bit of resistance in this general vicinity. Pullbacks at this point in time should be thought of as value in the Kiwi dollar, and therefore I’m willing to buy short-term pullbacks to show signs of support or perhaps a bounce. I believe that the interest-rate situation around the world is so poor that people are simply buying the New Zealand dollar in order to pick up a little bit of swap.

I think that we will be fairly quiet over the next several weeks, but eventually we should break out to the upside. Given enough time, and of course the volume coming back into the market after holiday season should give us a bit of a boost in this marketplace and give us the opportunity to go long again for a little bit more of a substantial move. In the meantime, it will probably be a lot of short-term long positions over and over.