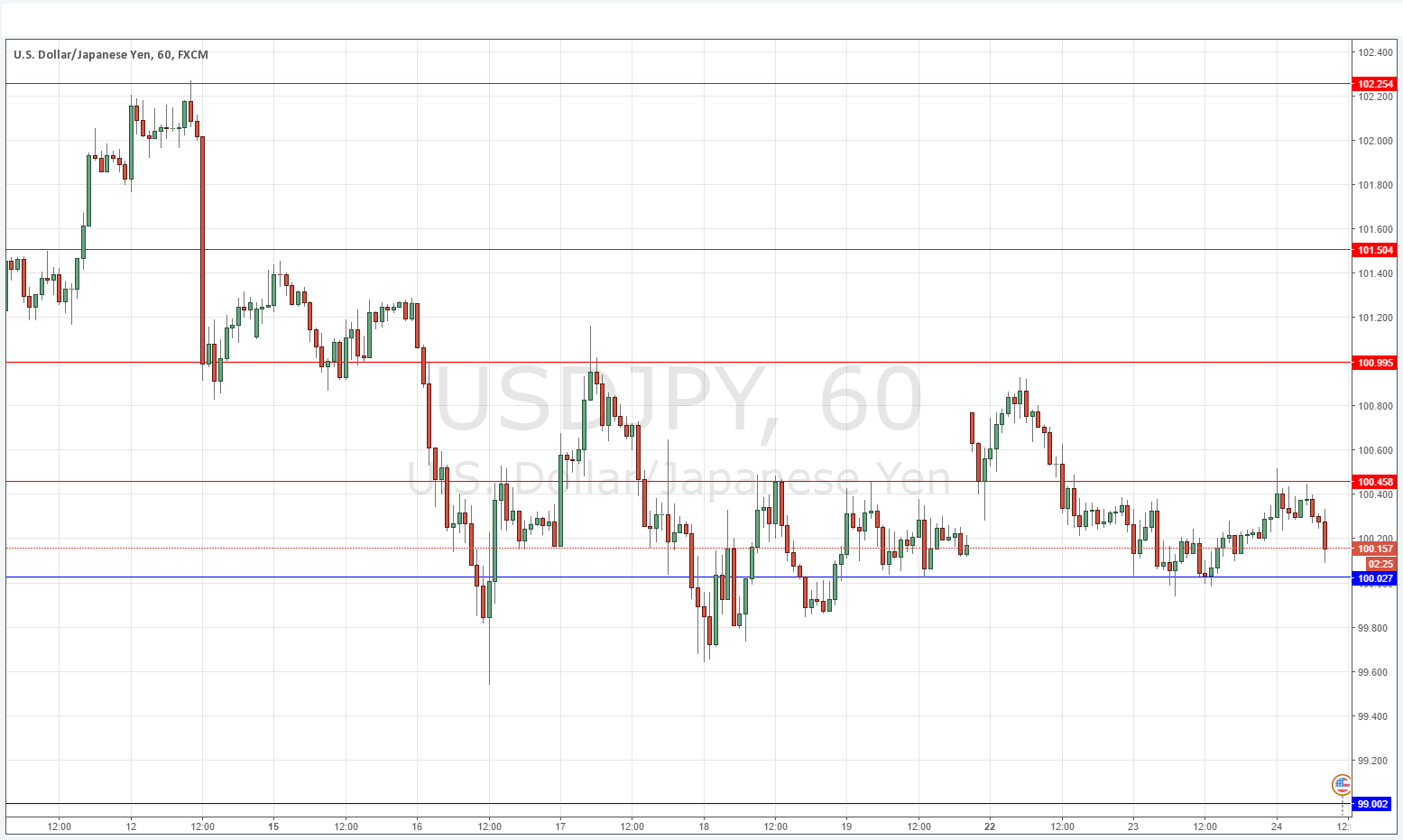

USD/JPY Signal Update

Yesterday’s signals gave both a profitable long trade off the support level at 100.00 and also a possible profitable short trade off the resistance level at 100.44. It would be a good idea to exit any open trade and book profit as the pair is presently right in the middle of a choppy congestion zone.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be entered between 8am New York time and 5pm Tokyo time, over the next 24 hours only.

Short Trades

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 101.00 or 101.50.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 99.00.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

The action has remained choppy although there are clear but very small swings. Essentially the price is stuck in between 100.46 and 100.02 and it will eventually break out. As we already had some good trades off these levels, although these levels are still valid, I would look to the levels beyond these for the next trades, as at the moment the price has gone nowhere for too long and there is bound to be a sudden jump in volatility which makes trading off levels unpredictable.

There is still a strong, long-term downwards trend in force.

There is nothing due today concerning the JPY. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.