USD/JPY Signal Update

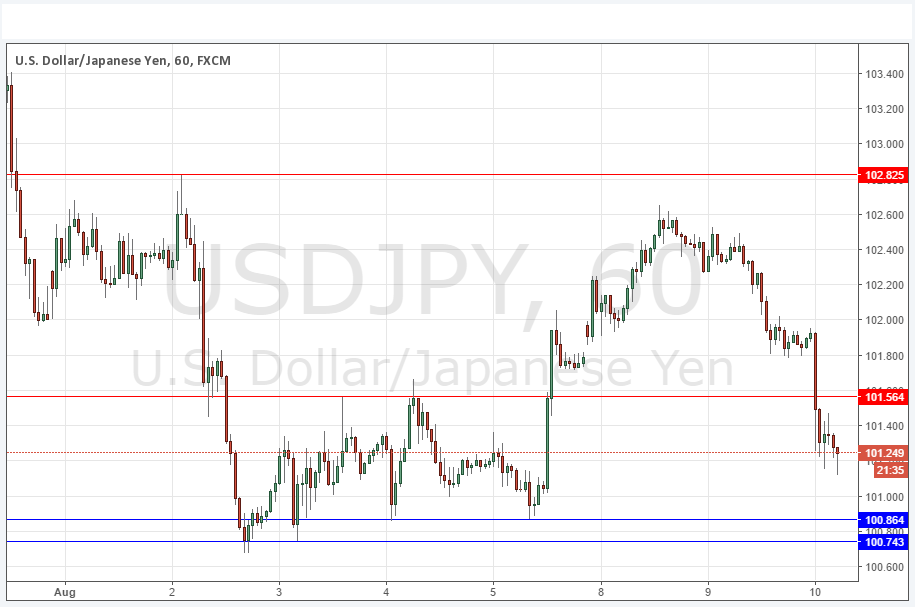

Yesterday’s signals were not triggered as there was no bullish price action at 101.56.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken from 8am New York time to 5pm Tokyo time during the next 24 hours only.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 101.56.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trades

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 100.86 or 100.74.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

The price of this pair has fallen along with the general weakening of the USD that has taken place over recent hours, cutting through a possible support level at 101.56 without any hesitation, although that does not necessarily mean that this level will not now become support.

Things get interesting below as we approach the psychologically key 100.00 level, with some support at around 100.75 that is worth watching closely. Although the long-term trend is bearish, we are beginning to get the first signs that the trend may be flattening out with a possible consolidation within a very large area between 100.00 and 107.50. Therefore, it will be really interesting to see what happens if and when the price gets down to the key support levels below.

There is nothing of high importance due today concerning the JPY as it is a public holiday in Japan. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.