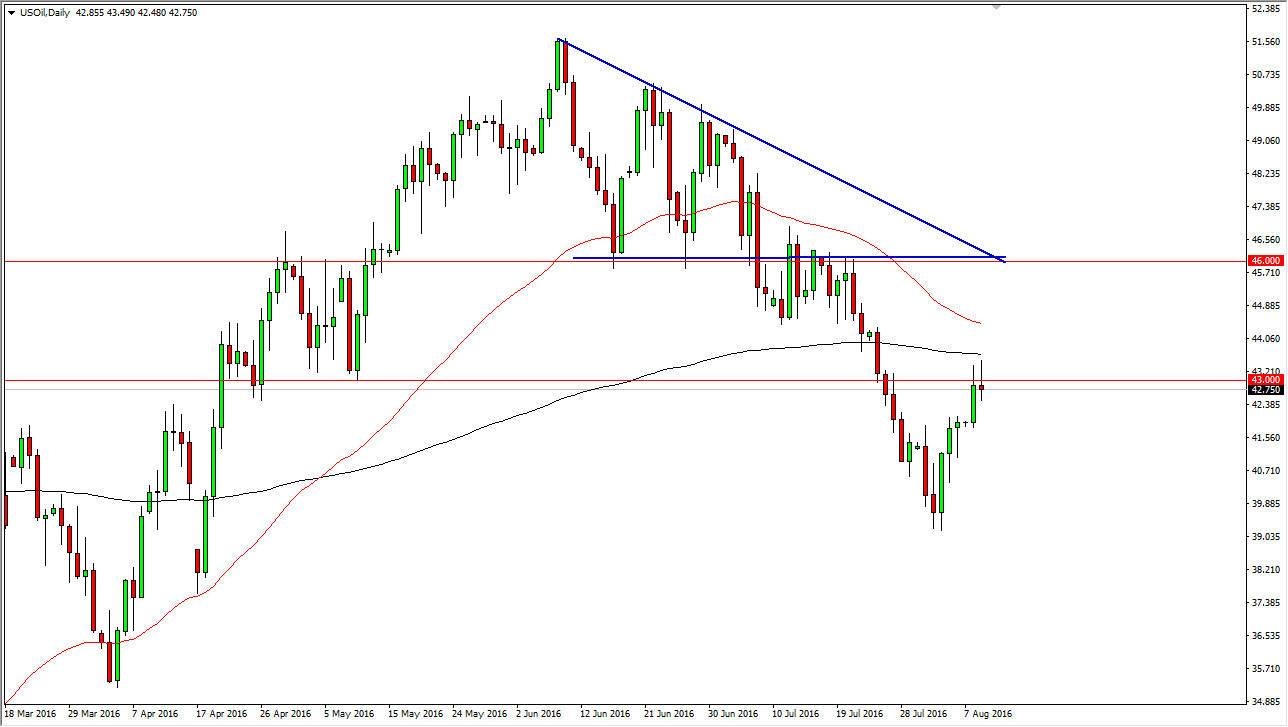

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Tuesday but found enough resistance above the $43 level to turn things around and form a shooting star. The shooting star of course is a very negative candle and at this point in time I believe it’s only a matter time before we start selling off again. The 200-day exponential moving average, pictured in black, gives us an opportunity to take advantage of what longer-term traders may be doing. With this being the case, I believe that the oil markets are ready to roll over, and that the market may possibly be expecting a bearish crude oil inventory number during the day today. Given enough time, I believe that the market will reach down towards the $39 level which was the most recent lows.

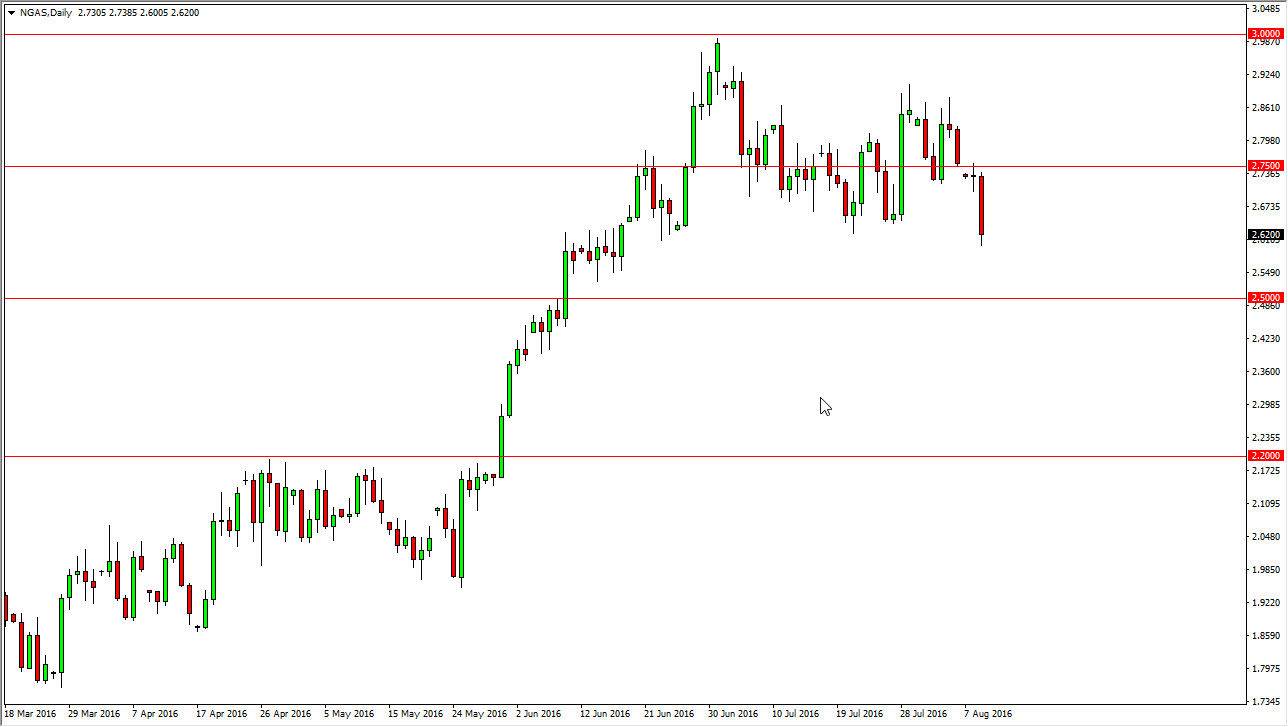

Natural Gas

Natural gas markets had a very bearish session during the day on Tuesday, breaking through some support but I have been seen for some time that I do not believe that the actual trend changes until we get well below the $2.50 level. Having said that, I am very weary of buying at this point in time, and it appears that the inventory numbers are not very bullish at all. I figure it is probably best to stand on the sidelines at this point in time because of the lack of clarity, mainly because we are sitting just above a significant amount of support, but also are at the very bottom of the candle for the day. In other words, this is a very negative looking market but at this point in time is likely that the buyers could return, but it’s going to be very noisy and with that being the case it’s probably going to be one of the situations where you need to wait to see whether or not we get an impulsive candle that we can follow.