WTI Crude Oil

The WTI Crude Oil market initially fell during the course of the session on Tuesday, testing the $46 level. The level offered enough support to turn things back around and form a bit of a hammer. A break above the top the hammer will more than likely send this market much higher. The fact that we have seen such bullish pressure over the last several sessions suggests that there is a bit of a change in sentiment. Now that we have formed a hammer at the $46 level, it’s likely that the market will continue to go much higher. There is a small problem above, as there is a lot of noise. However, I think that the market will probably try to reach the $50 level. If we break down below the bottom of the range for the Tuesday session, I feel that the market will probably fall.

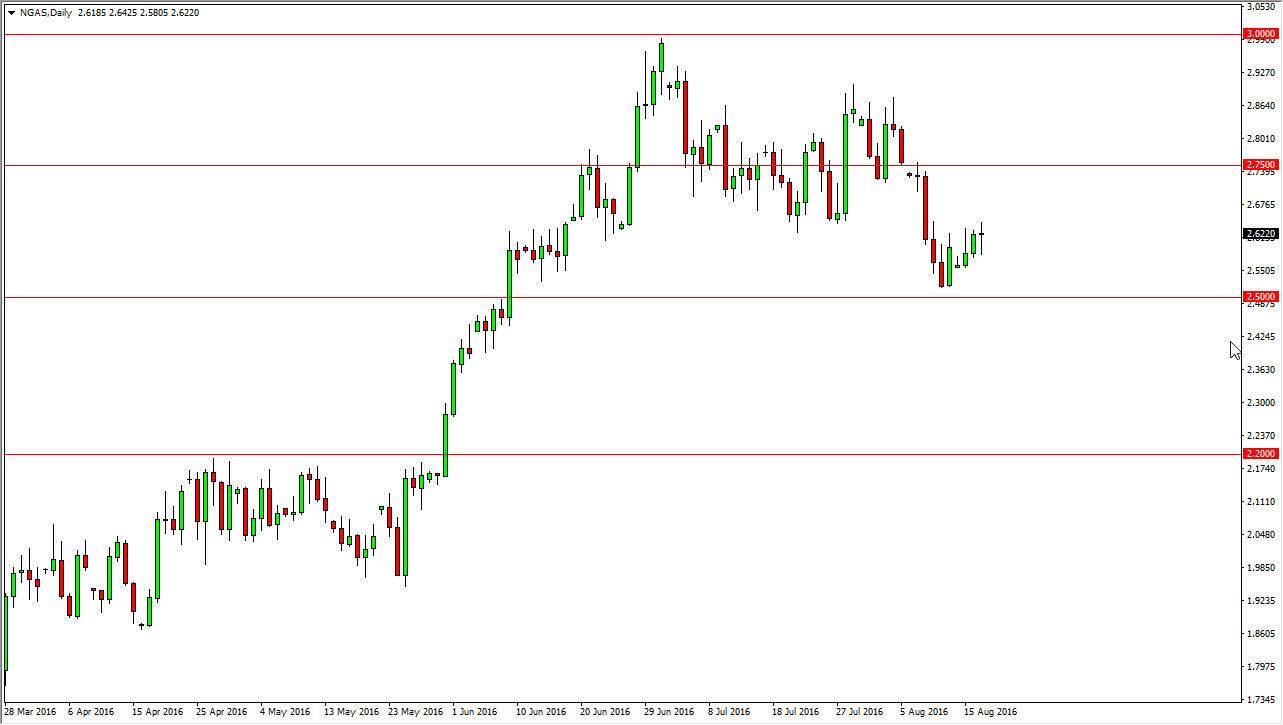

Natural Gas

The natural gas markets went back and forth during the course of the session, as we have formed quite a bit of a neutral candle. Having said that, there is quite a bit of noise just above that could cause problems for the buyers. At this point, natural gas seems to be in a bit of an inflection point, but I think the easiest trade to take would be some type of exhaustive candle above that we could start selling.

Ultimately, I think that the $2.50 level below will continue to be very supportive. With this, I feel that the market will continue to see quite a bit of pressure in both directions, thereby making it very difficult to deal with. At this point in time, I’m going to stand on the sidelines as the market could very well cause quite a bit of trouble going forward, and I am going to have to wait to see whether or not we can get some type of impulsive candle.