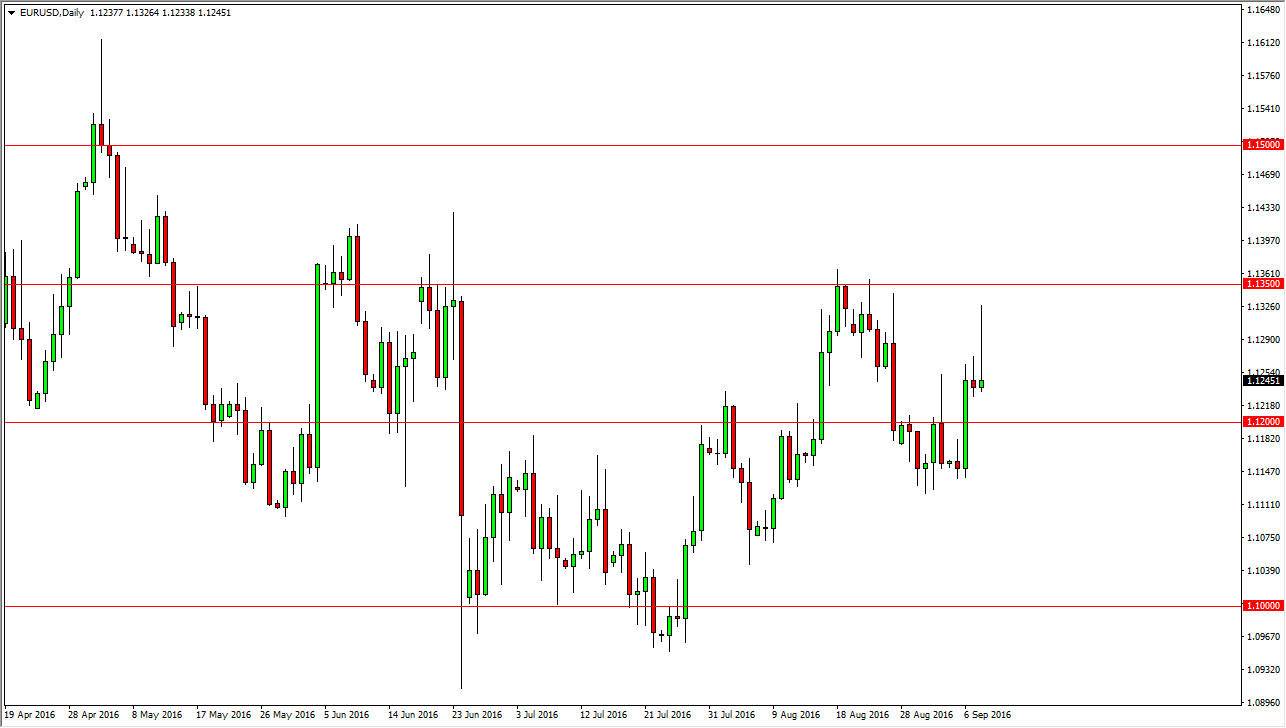

EUR/USD

The Euro climbed initially during the US dollar during the Thursday session, but after the press conference by the European Central Bank, the Euro sold off. This is mainly because it looks like the loose monetary policy coming out of the ECB is going to continue, and therefore it is showing a very dovish stance until at least March 2017. This has put a lot of pressure on the Euro in general, and it makes sense that we formed a massive shooting star. Because of the shooting star, I now feel that the sellers are back in control of this pair, and we should continue to go lower. I believe short-term rallies will end up being selling opportunities as well, on initial signs of exhaustion.

GBP/USD

The British pound fell during the day as well, after initially trying to rally. We are hunting the 1.33 level at the moment, and I believe that if we break down below the major handle for any real length of time, we will then reach towards the 1.31 handle. This is a simple continuation of the consolidation that we’ve been in all summer, and I feel that it’s only a matter of time before we reach down to the 1.31 handle, and then perhaps the 1.30 level below there. This is a market that of course is still trying to punish the British pound for the British people voting believe the European Union, and of course there is quite a bit of a safety bid due to the relative safety of the US dollar.

Ultimately, I believe that selling is the only thing you can do with any type of confidence as it would not take much to spook traders away from the British pound. I also believe that the Just above the 1.35 level is a massive barrier to overcome, one that I don’t see being broken anytime soon.