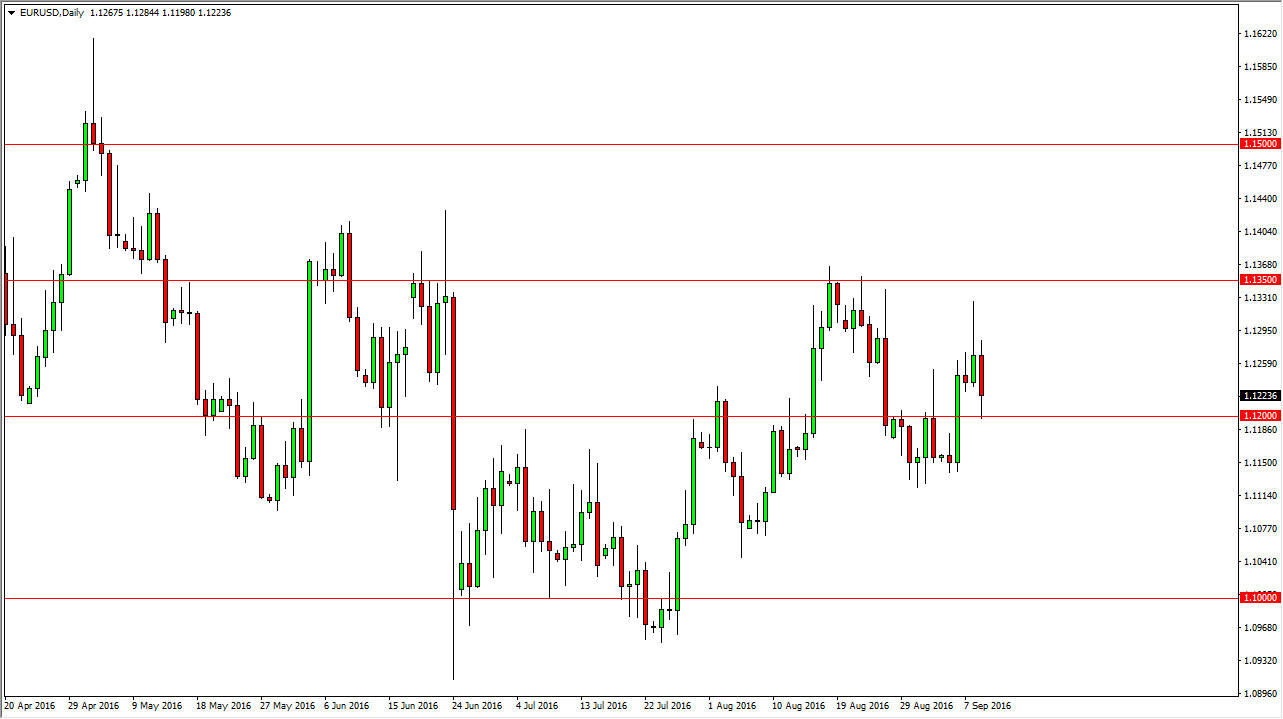

EUR/USD

The Euro fell during the course of the day on Friday, slamming into the 1.12 level. This would have been a continuation of the negativity that had popped into the market on Thursday after the ECB suggested that ultra-loose monetary policy was going to be the norm. With this, we tested the first major supportive area, and as a result it looks likely that we will continue to see quite a bit of volatility, if not some type of choppy type of situation. Ultimately, I think that we will probably try to reach towards the 1.11 handle, but it might take some time to get there due to all the noise I see just below. Ultimately, rallies at this point in time should a bit untrustworthy, so signs of exhaustion would have me selling but I do recognize that this is going to be a lot of back and forth trading.

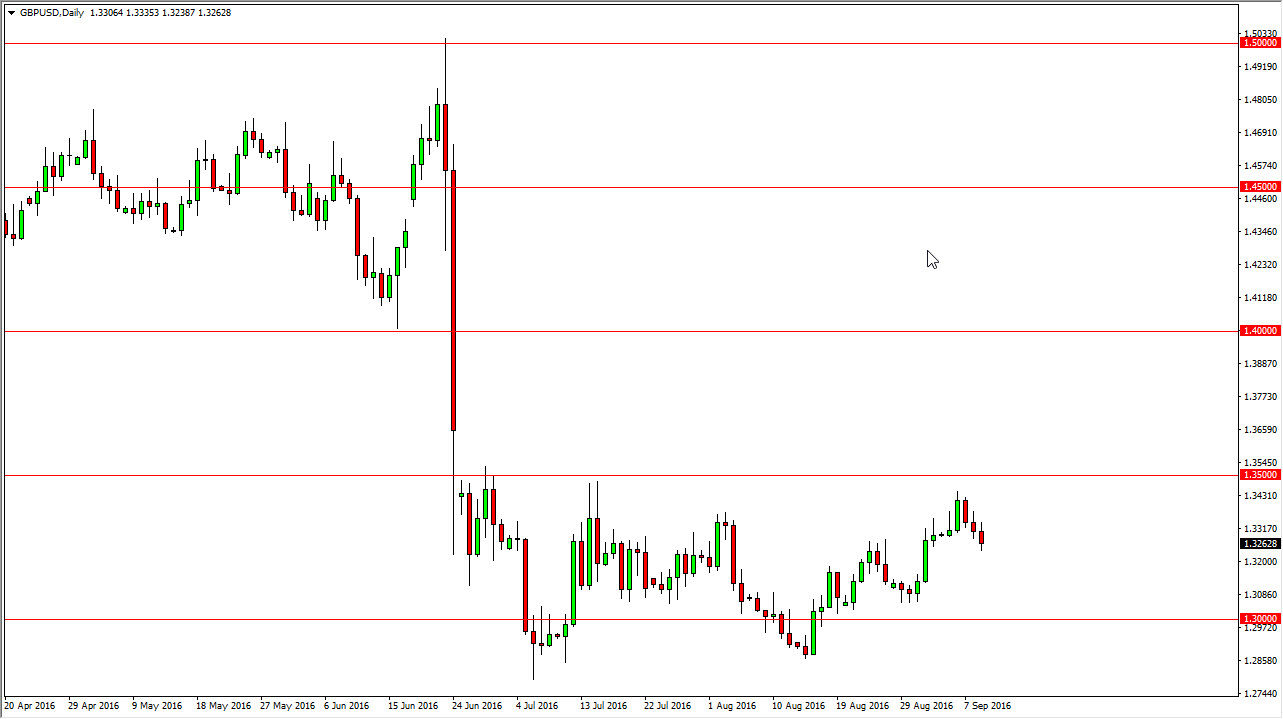

GBP/USD

The British pound of course fell a bit during the course of the day on Friday, as we continue to see negative pressure. The weekly chart ended up forming a shooting star which I believe is very negative as well, so at this point in time I think we’re going to try to reach down towards the 1.30 level below, and then possibly the 1.2850 level after that. We still have the gap above the 1.35 level will continue to put pressure on this market to the downside, so with all of this means that I have no interest in selling and I am simply looking for selling opportunities. For example, a break down below the bottom of the range during the session on Friday would send this market into a selling motor as far as I can see.

I think that eventually we will break down below the 1.2850 level and reach towards the 1.25 level, but this could be more of a process rather than a move, because we are just now starting to see volume pick up after the summer break.