GBP/USD Signals Update

Yesterday’s signals were not triggered as the bullish price action took place just a little way below the anticipated support level at 1.2950.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trades

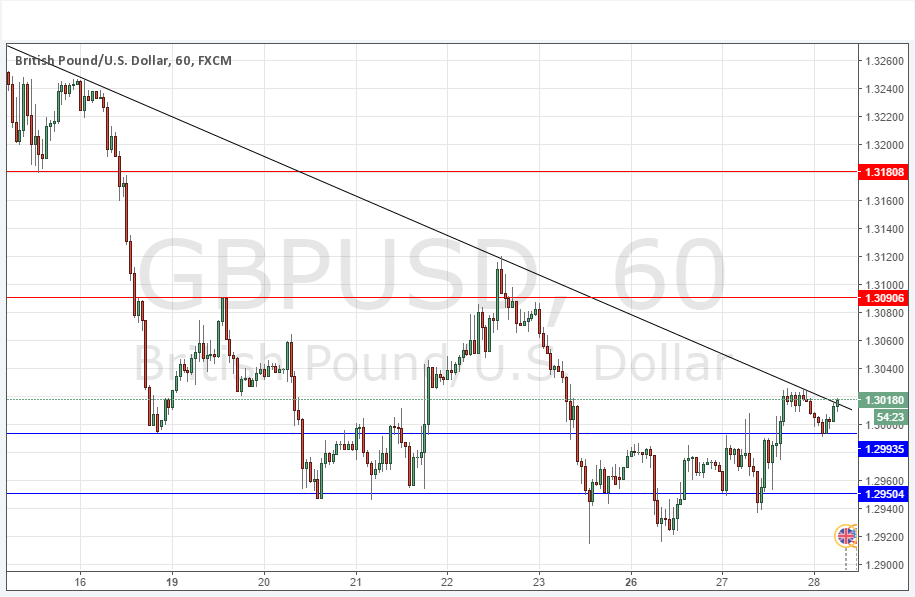

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2994 or 1.2950.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3090.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

I wrote yesterday that the picture again suggested bullishness, with a Quasimodo/over and under bullish pattern basing its final leg off a new support level at 1.2950. However, the price needed to break above 1.3000 to make this happen. We have now broken up above 1.3000 but there is a long-term bearish trend line holding down the price so far. On the way a new support level has been made just below 1.3000 at 1.2993.

It is hard to say what will happen next. My gut feeling is that there will be a break up above the trend line and another bullish day.

There is nothing due regarding the GBP. Concerning the USD, there will be a release of Core Durable Goods Orders at 1:30pm London time followed by testimony from the Chair of the Federal Reserve before Congress at 3pm and Crude Oil Inventories data at 3:30pm.