NZD/USD Signal Update

Yesterday’s signals were not triggered as none of the key levels were reached.

Today’s NZD/USD Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time, during the next 24-hour period only.

Long Trades

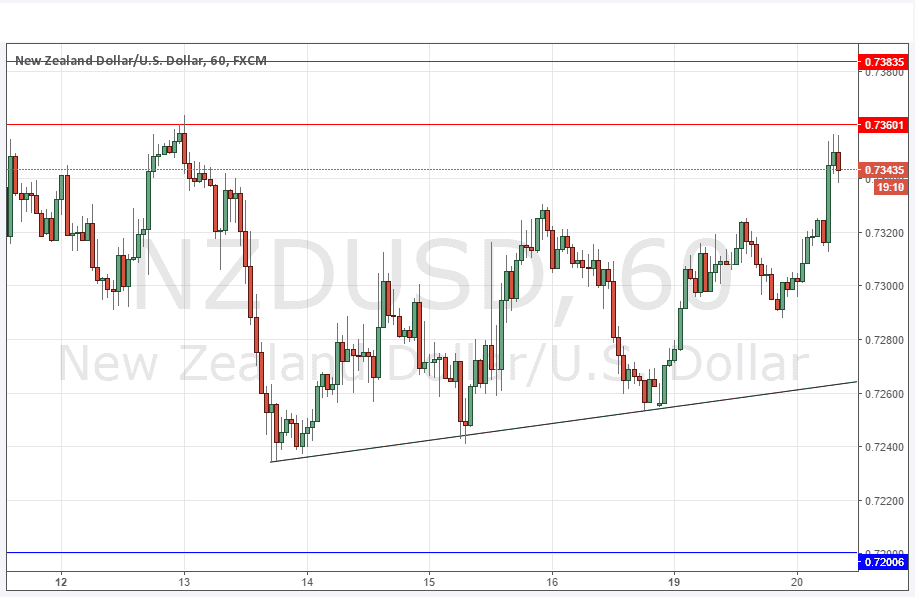

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7200 or the bullish trend line currently sitting above there at approximately 0.7265.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7360 or 0.7384.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

NZD/USD Analysis

I wrote yesterday that a move up was looking likely as the next short-term move and this is what happened, with the price reaching just a few pips short of the key resistance at 0.7360 a few minutes ago as at the time of writing.

The long-term trend is bullish and we have a bullish supportive trend line acting as a launch pad below.

There may be a bearish pull back now but the outlook still looks bullish.

Regarding the USD, there will be a release of Building Permits data at 1:30pm London time. Concerning the NZD, there will be a release of GDP Price Index data late in the New York session.