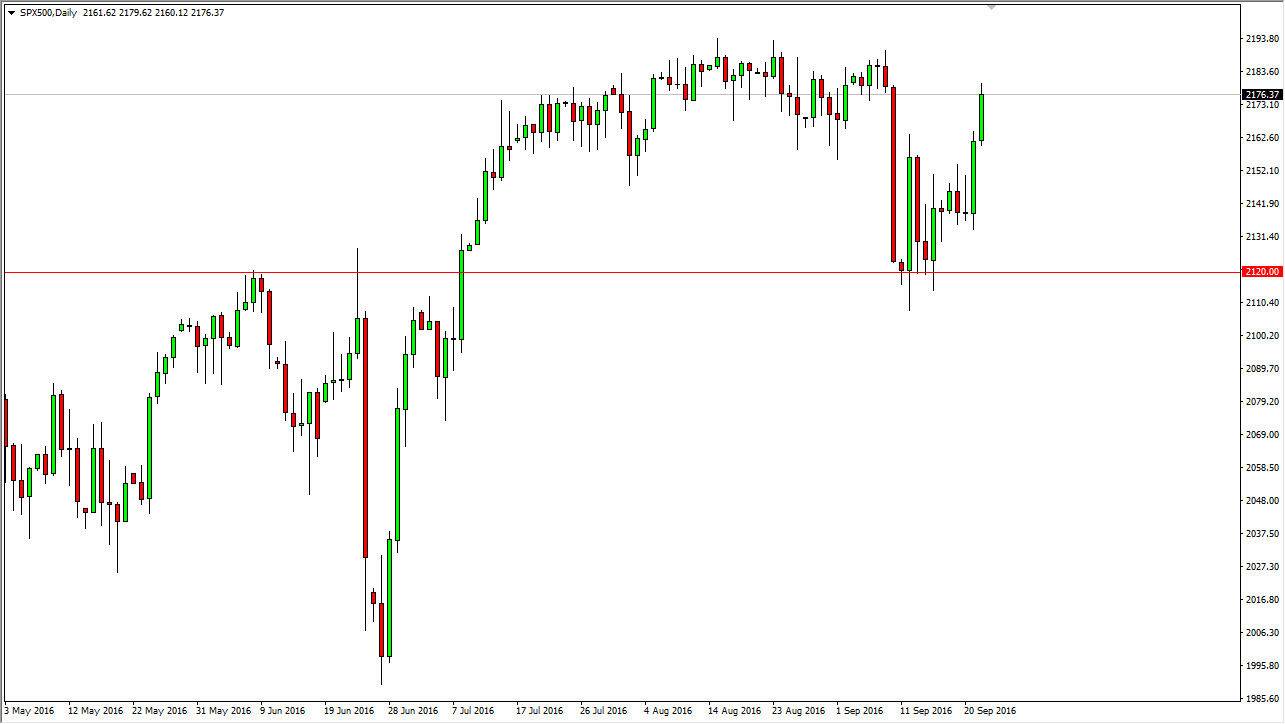

S&P 500

The S&P 500 rallied during the course of the session on Thursday, grinding its way into the resistance barrier above. I believe that there is a significant amount of resistance above, so quite frankly we could pullback but that should be a bit of a “value” type of trade in my estimation. After all, we are starting to see that the low interest-rate environment should continue to go much farther into the future. With this being the case, I feel that there is plenty of bullish pressure underneath because the bond markets simply are not going to offer any type of return at this point as far as interest is concerned.

NASDAQ 100

The NASDAQ 100 broke higher during the course of the session on Thursday, making fresh, new highs. This is a market that I believe has broken out obviously, but I also believe that we are going to go to the 5000 level. Ultimately, I believe that the NASDAQ 100 will be the strongest performer of the indices that we follow here, and as a result I think buyers will return again and again when we pullback. The 5000 level has been a target for me in this market for quite some time. I believe that we will not only reach that level, but could very well break above there.

It looks as if the market has so much support below that it can be difficult to imagine a scenario in which we start selling. Most certainly, I feel that the 4800 level continues to be massively supportive, and as a result I think you can more or less use it as the “floor” in this market. Keep in mind that the volatility could pick up, but quite frankly stocks are essentially the only game in town.