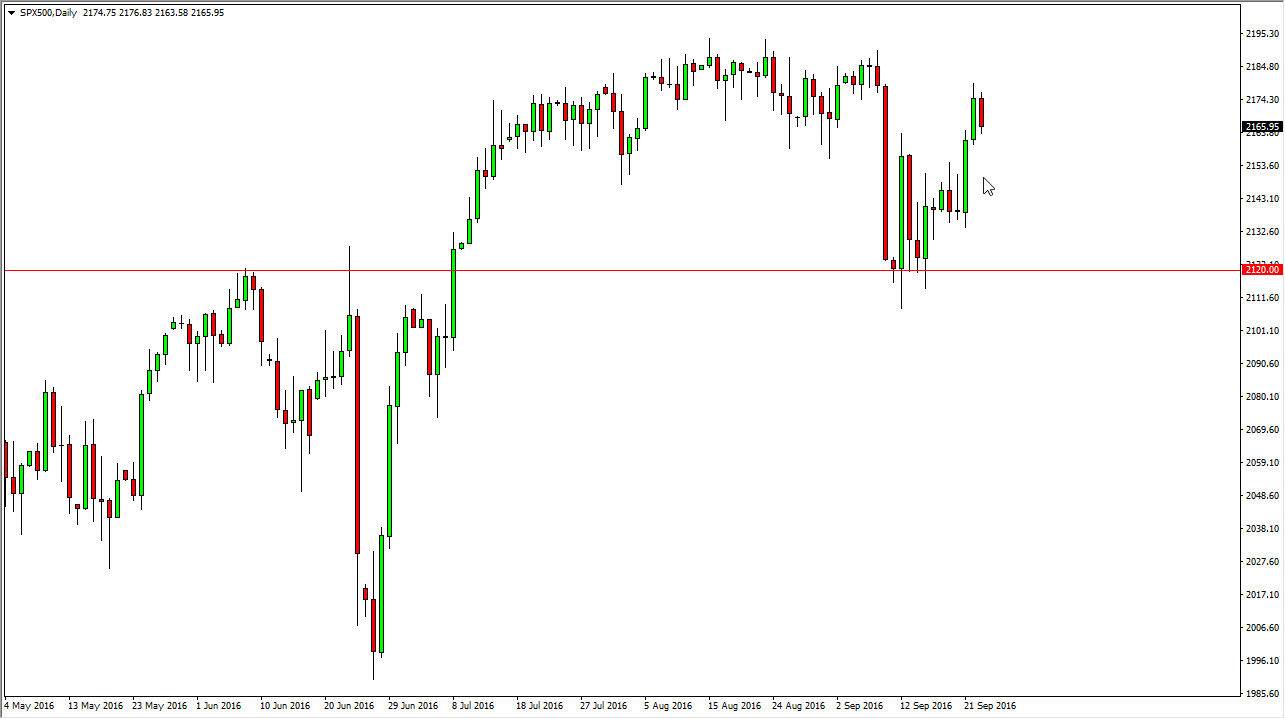

S&P 500

During the day on Friday, the S&P 500 fell a bit as we tested the 21.65 level for support. Quite frankly, I believe there is plenty support below, and that the buyers will return sooner or later. I think that supportive candles on pullbacks offer value that people will continue to take advantage of, because quite frankly the interest-rate environment should remain very below for the foreseeable future. I believe that we will eventually reach back towards the 2200 level, which was the most recent highs. With that being the case, I have no interest in selling this market and believe that the 2120 level below is the “floor” and as a result I think as long as we can stay above there we should be a lot of find buyers given enough time. I have no interest in selling until we break down at least below that level, and then perhaps even lower than that.

NASDAQ 100

The NASDAQ 100 fell during the course of the session on Friday, but we are still well above the breakout point, and as a result I feel it’s only a matter of time for the buyers return. After all, we have cleared a fairly resistive area in the form of the 4850 handle, and I believe that we are now going to reach towards the 5000 level given enough time. I also believe that the market will continue to enjoy the interest-rate environment being so low, and as a result money will be forced into the stock markets rather than wasting its time in the bond markets. As long as there’s cheap money, we are likely to see the NASDAQ 100 continue to climb.

I don’t really have a scenario in which a willing to sell this market, and I believe that every time we pullback and formed a supportive candle we should continue to find buyers again and again. I do believe the 5000 will offer some significant resistance, but at this point in time I would also assume that we will break above there.