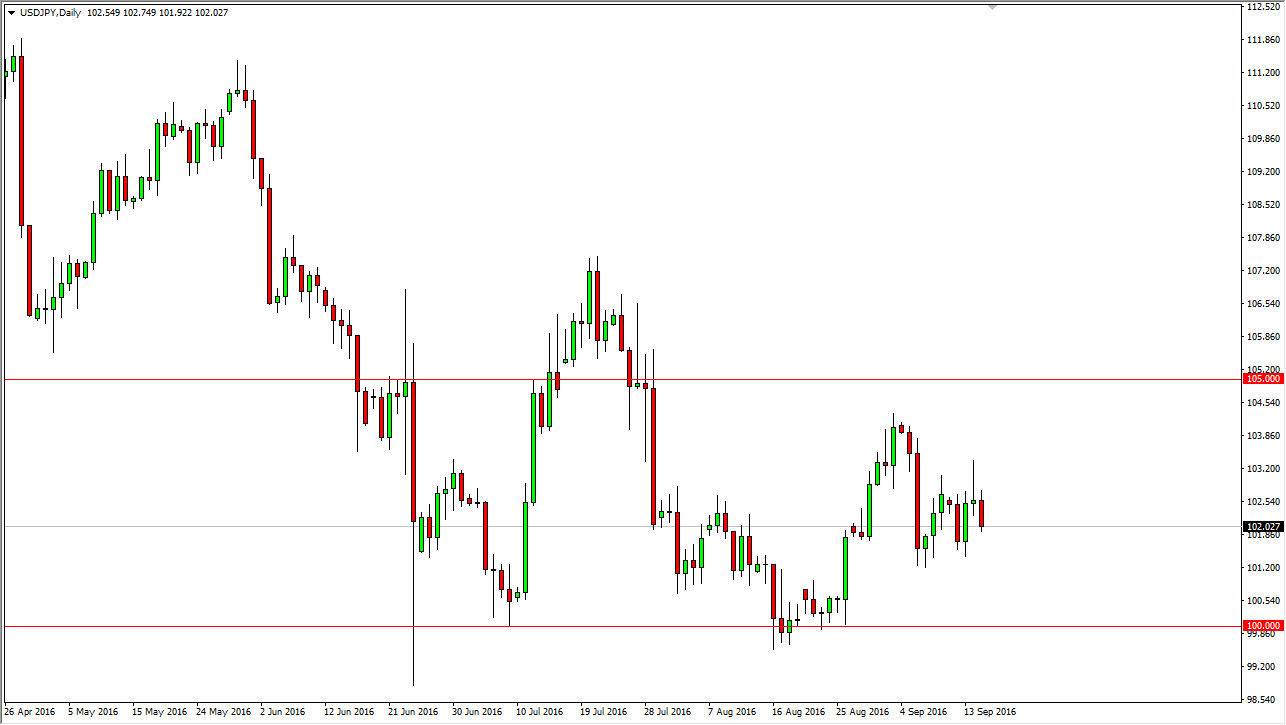

USD/JPY

The USD/JPY pair fell during the day on Thursday, breaking the bottom of the shooting star from the Wednesday session. This of course is a negative sign, but at this point in time it looks as if the 101 level is going to offer a little bit of support. If we can break down below there, the market should then reach to the 100 handle, which I believe is essentially the “floor” in this market right now. Ultimately, if we see some type of supportive candle just below would more than likely send buyers back into this marketplace and we could grind our way towards the 105 handle. With the Bank of Japan underneath looking to keep this pair going higher, I have noticed whatsoever in selling and realize that sooner or later the buyers will return.

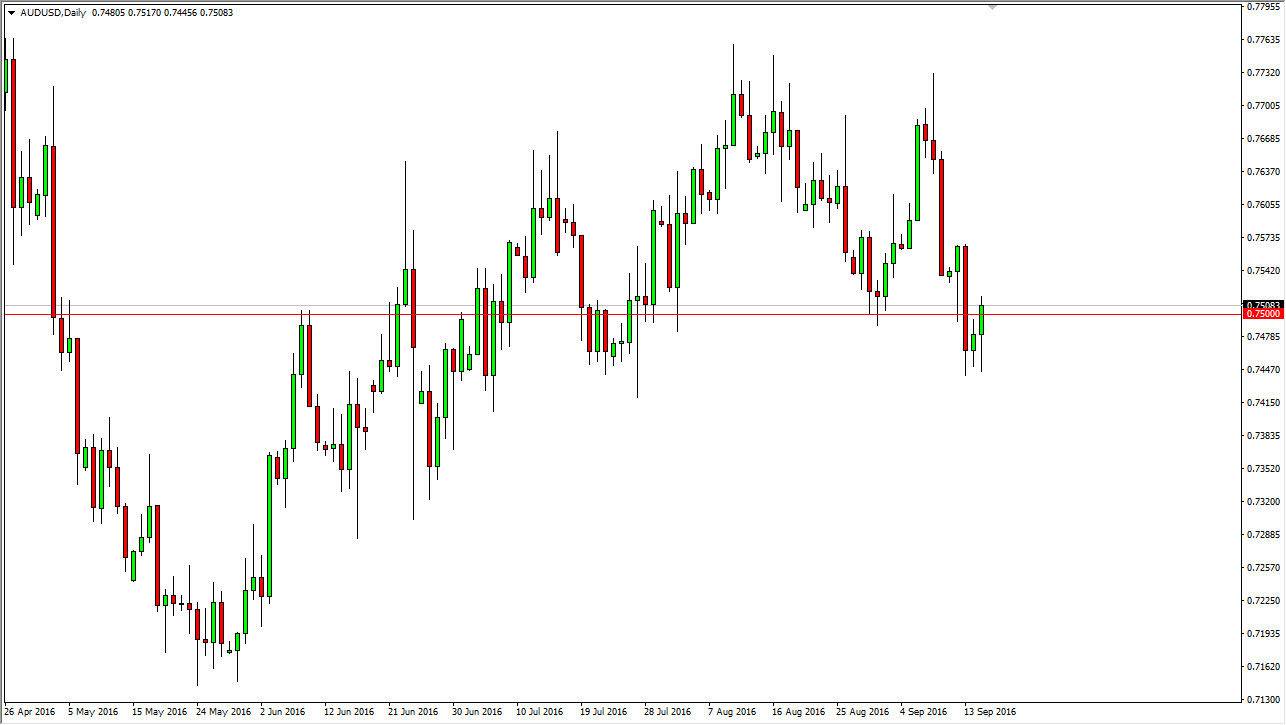

AUD/USD

The Australian dollar initially fell during the course of the session on Thursday, but turned back around to form a positive candle. By doing so, looks as if the market is trying to continue the overall uptrend that we have seen. I believe that the massive support that we’ve seen recently at the 0.74 level should continue to keep this market going higher, but I’m not going to be completely convinced to start buying into we break above the top of the massive red candle from the Wednesday session. Once we do, I think that we would more than likely reach to be 0.77 handle after that.

On the other hand, if we do break down below the 0.74 level, I think that would be very negative for the Australian dollar. That would more than likely send this market down to the 0.72 level, which is very important on the longer-term charts. With that being the case, I think it will be a target the people would pay attention to but of course we have to break down before we even think about that particular move.