USD/JPY

The USD/JPY pair did very little during the day on Friday as we continue to consolidate near the 102.50 region. At this point in time, I don’t necessarily want to put any real money into this marketplace most certainly have an upward bias. I believe that there is more than enough support all the way down to the 100 level to have buyers entering this market on signs of support or just simple value. I believe that the Bank of Japan will continue to work against the value of the Japanese yen, so therefore don’t have any real interest in selling this pair. Having said that, most of the time we need a trend change like this, things get very choppy so expect quite a bit of volatility.

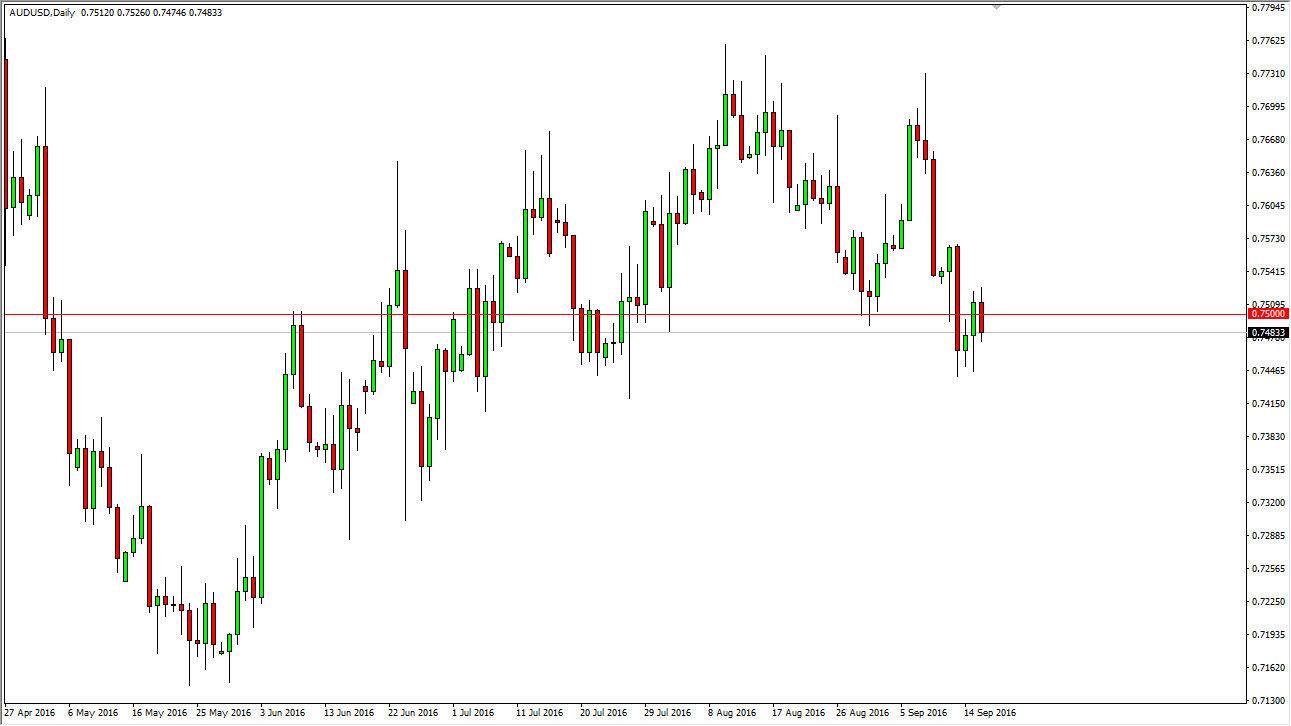

AUD/USD

The Australian dollar fell initially during the course of the session on Friday, but as you can see found a little bit of support below. I think there is still quite a bit of support all the way down to the 0.74 level, so at this point in time not ready to quite press the button on a sell order. However, I do think that rallies and show signs of exhaustion might be short-term selling opportunities. If we do break down below the 0.74 level though, I think that at that point in time the market will probably try to make its way down to the 0.72 level, and then eventually the 0.70 level. This is a market that looks a bit heavy, but keep in mind that gold has quite a bit of influence on the Australian dollar as well. Because of this, if the gold markets perk up a little bit it’s likely that the Aussie dollar will as well, and perhaps and then try to reach towards the 0.77 handle, but at this point in time I don’t see any real attempt to do so.