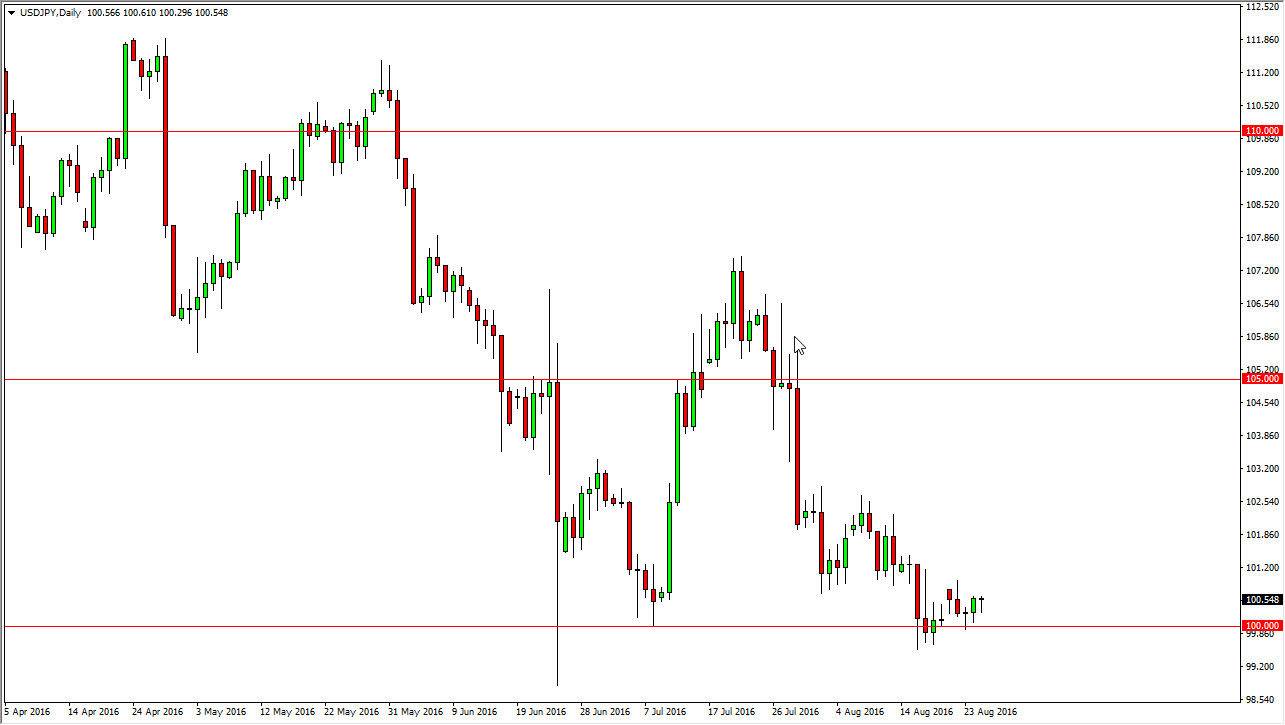

USD/JPY

Initially, the US dollar rallied against the Japanese yen but as you can see turned back around to form a bit of a shooting star on Thursday. I don’t find this particular interesting though, because we have the employment figures coming out of the United States later today. This pair tends to be very sensitive to that announcement, generally going higher as the numbers are better and of course vice versa. With that being the case, I think the fact that people may have taken a bit of profit towards the end of the session isn’t necessarily out of the question. I do believe that eventually the Bank of Japan gets involved on any significant move lower, so I believe the pullbacks should offer value that should continue to offer a nice buying opportunity.

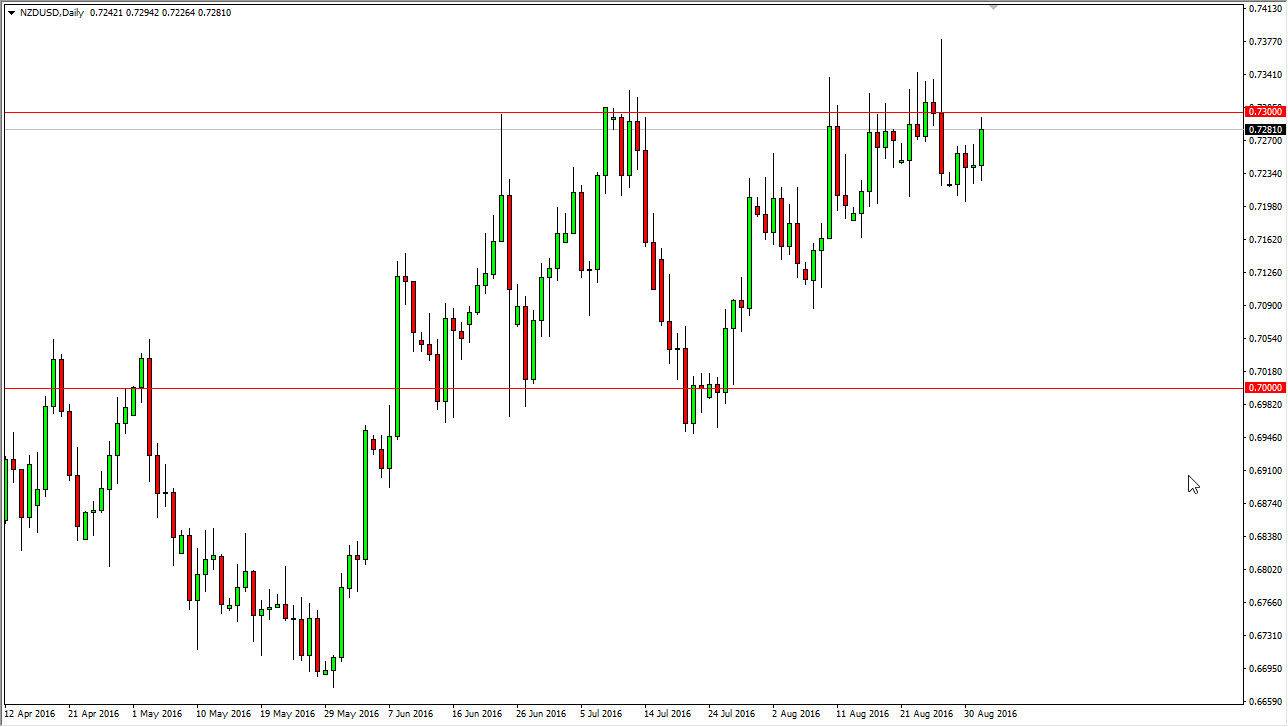

NZD/USD

The New Zealand dollar rallied during the day on Thursday, but as you can see still struggles at the 0.73 level. This is an area that has caused quite a bit of resistance previously, and continues to do so now. What have to wait to see what the jobs announcement does to this pair but I do believe eventually will probably find enough buyers to break out and cleared this region. Once we do, the market should then go to the 0.75 level where I would expect quite a bit of psychological resistance of nothing else.

Pullbacks will continue to attract value hunters, and I believe that the 0.72 level is supportive. At this point, the biggest thing that is working in favor the New Zealand dollar simply the interest-rate differential. With this being the case, I think that it’s simply a matter of traders having nothing else to do at the moment. We are in the middle of summer, so more volume will return to the market fairly soon but I believe that the writing is on the wall and we should continue to find buyers.