USD/CHF Signal Update

Yesterday’s signals were not triggered as none of the key levels were ever reached.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today.

Long Trades

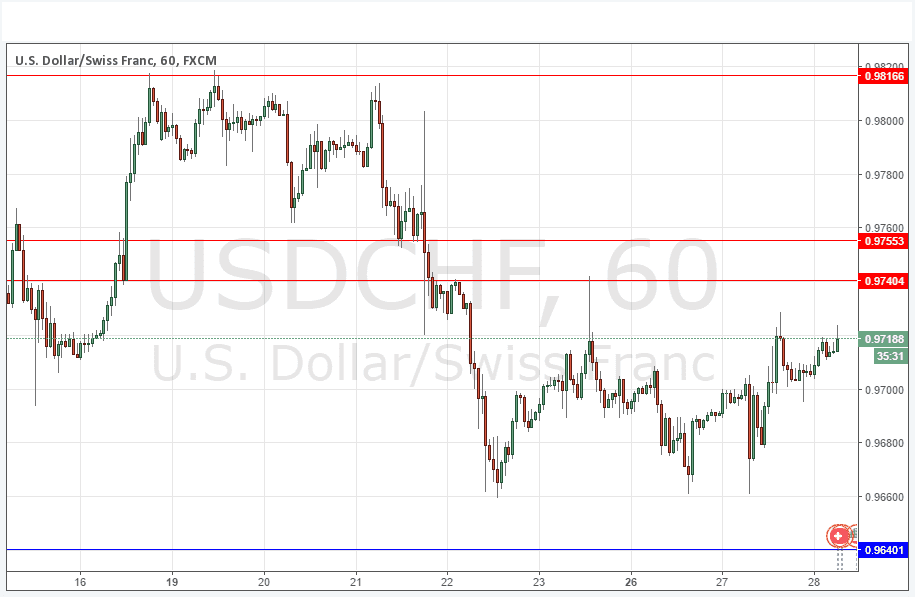

Go long after bullish price action on the H1 time frame following the next touch of 0.9640 or 0.9593.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9740/0.9755 or 0.9816.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

I wrote yesterday that we had something of a double bottom below at about 0.9760 which could become a triple bottom if the price gets down there again. This is exactly what happened. It looks now as if the price may be running into resistance starting at around 0.9725 although I would prefer to wait for 0.9740 at least.

There is nothing due regarding the CHF. Concerning the USD, there will be a release of Core Durable Goods Orders at 1:30pm London time followed by testimony from the Chair of the Federal Reserve before Congress at 3pm and Crude Oil Inventories data at 3:30pm.