USD/JPY Signal Update

Yesterday’s signals may possibly have given a long trade off 102.08 during the Asian session. It would probably be wisest to take some fast profits there if possible.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time, during the next 24-hour period only.

Long Trades

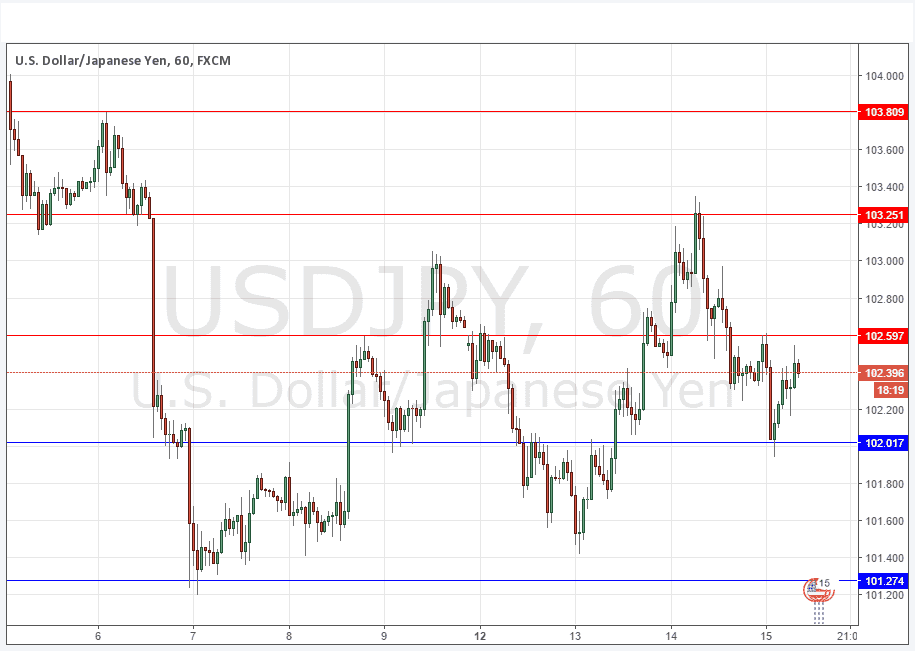

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 102.02 or 101.27.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 103.81 or 102.60.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

This pair is interesting, in that although the price is getting somewhat congested, without any real key long-term highs or lows being made, it moves in a fairly orderly way which has been giving trading opportunities. This means that we are printing quite a few support and resistance levels close by. I have some confidence in 102.00 and 103.81, and a lot of confidence in 101.27, but I am dubious about 102.60 though it is definitely a level to be aware of.

There is still a long-term bearish trend and I think that any bearish reversals above 103.25 can be sold for 100 pips or so.

It would not be a big surprise if this bearish trend came to an end within the next few weeks.

There is nothing due today concerning the JPY. Regarding the USD, there will be a release of Retail Sales, PPI and Philly Fed Manufacturing Index data at 1:30pm London time.