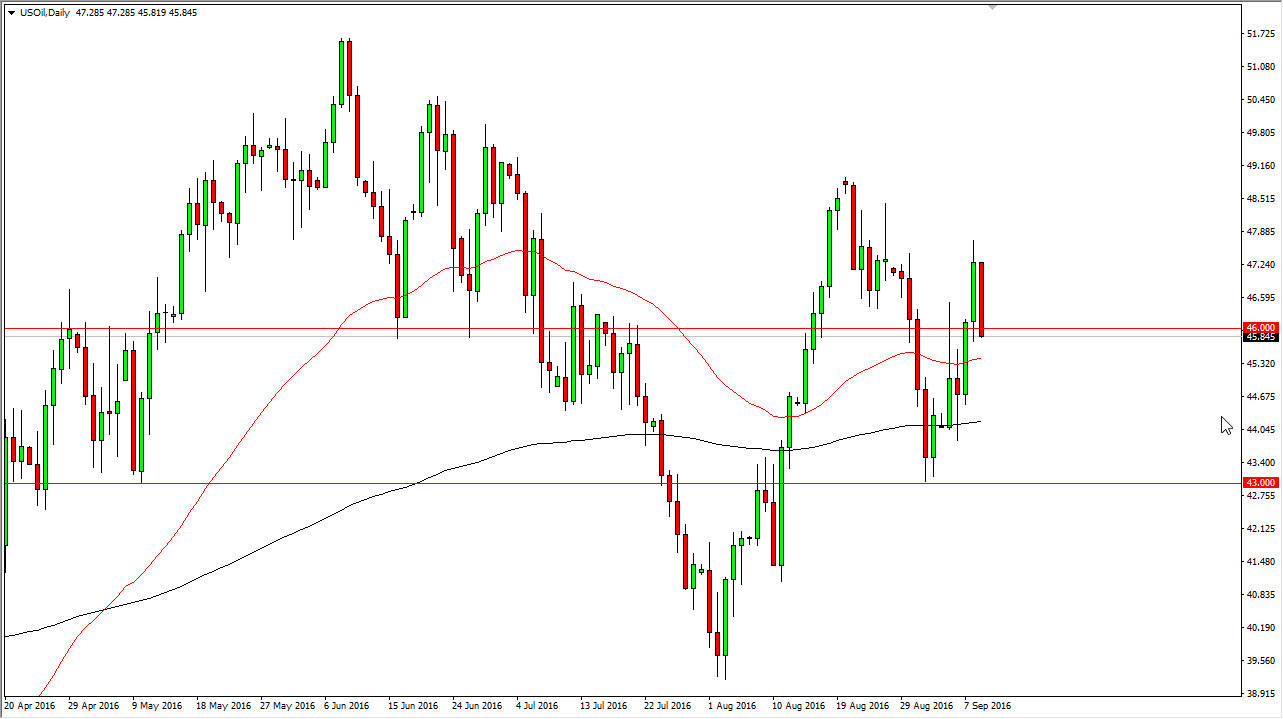

WTI Crude Oil

The WTI Crude Oil market fell during the course of the session on Friday, testing the $46 level. This being the case, looks as if we are certain see significant selling pressure, but I think we need to break down below the $45.50 level in order to feel a little bit more comfortable shorting. At that point in time, I would expect that the market would reach towards the $43 level. We could get a bounce from here, but quite frankly I think there is still quite a bit of bearish pressure overall, and longer-term I do think that oil falls. With this being the case, I’m looking to see whether or not we break down so I can get involved in starting to short this market yet again.

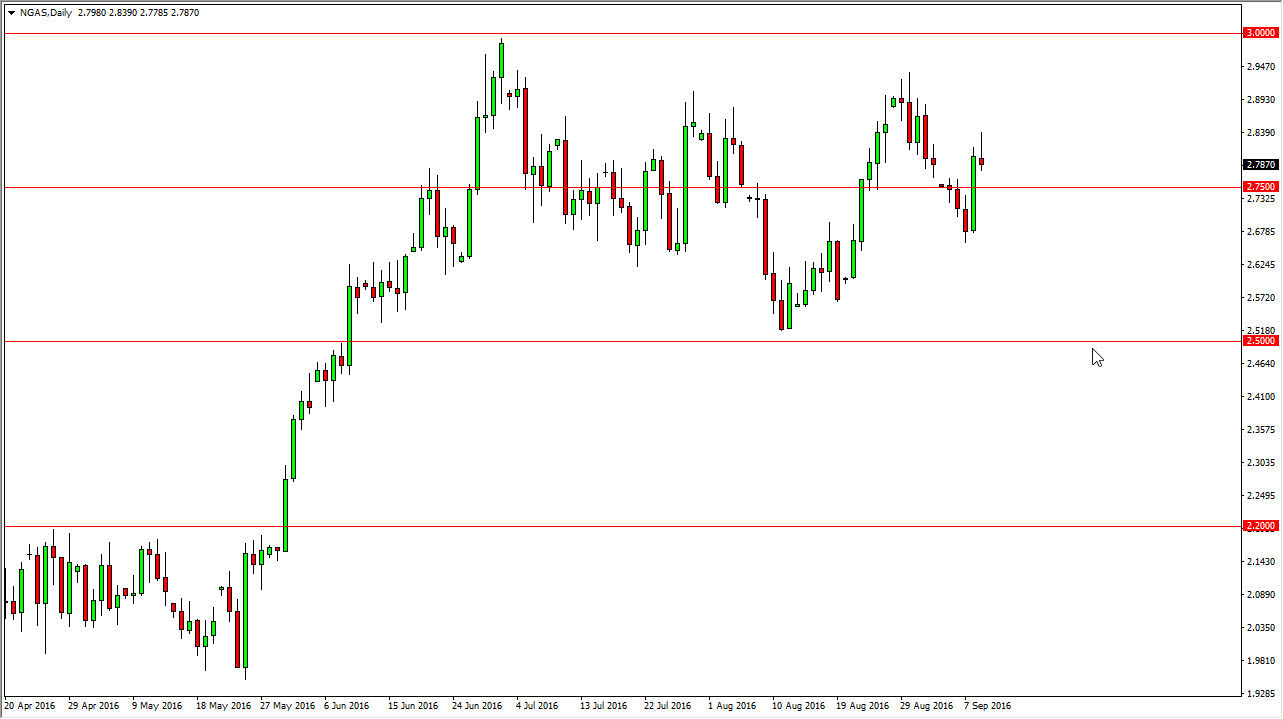

Natural Gas

Natural gas markets initially trying to rally during the course of the session on Friday, turning right back around to form a shooting star. The shooting star of course is a negative candle, and a break down below the bottom of it should send us looking back towards the bottom of the impulsive candle from the session on Thursday. However, I also recognize that there seems to be a lot of interest in the $2.75 level. The market should continue to go back and forth and chop around given enough time, and with that being the case it’s likely that the market will be very volatile and be more apt to short-term trading than anything else.

Longer-term, I have been very negative of natural gas, but we’ve had a nice bounce recently. However, a lot of the bullish pressure recently had been due to storms more than anything else. With this being the case, I think that it’s only a matter time before we see markets jump around and cause quite a bit of volatility. You have to be nimble to trade this one.