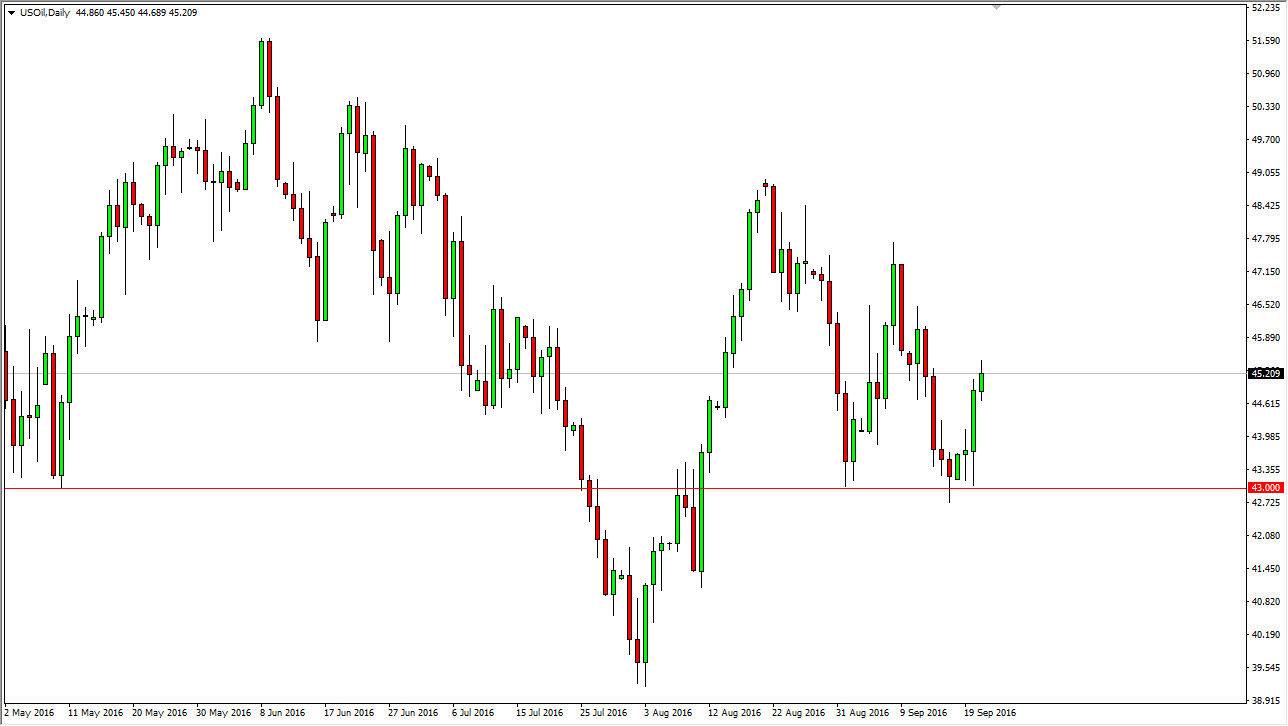

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the course of the day on Wednesday, as we continue to see quite a bit of strength. However, we have recently seen bearish pressure and on top of that the highs keep getting lower. With this being the case, I’m waiting to see whether or not I get some type of exhaustive candle that I can start selling. The $43 level below is massively supportive, and as a result I feel that if we break down below there it would be time to not only sell, but hang onto that position again. Exhaustion above would be a nice selling opportunity as well, but you may have to look to the shorter-term charts in order to take advantage of that.

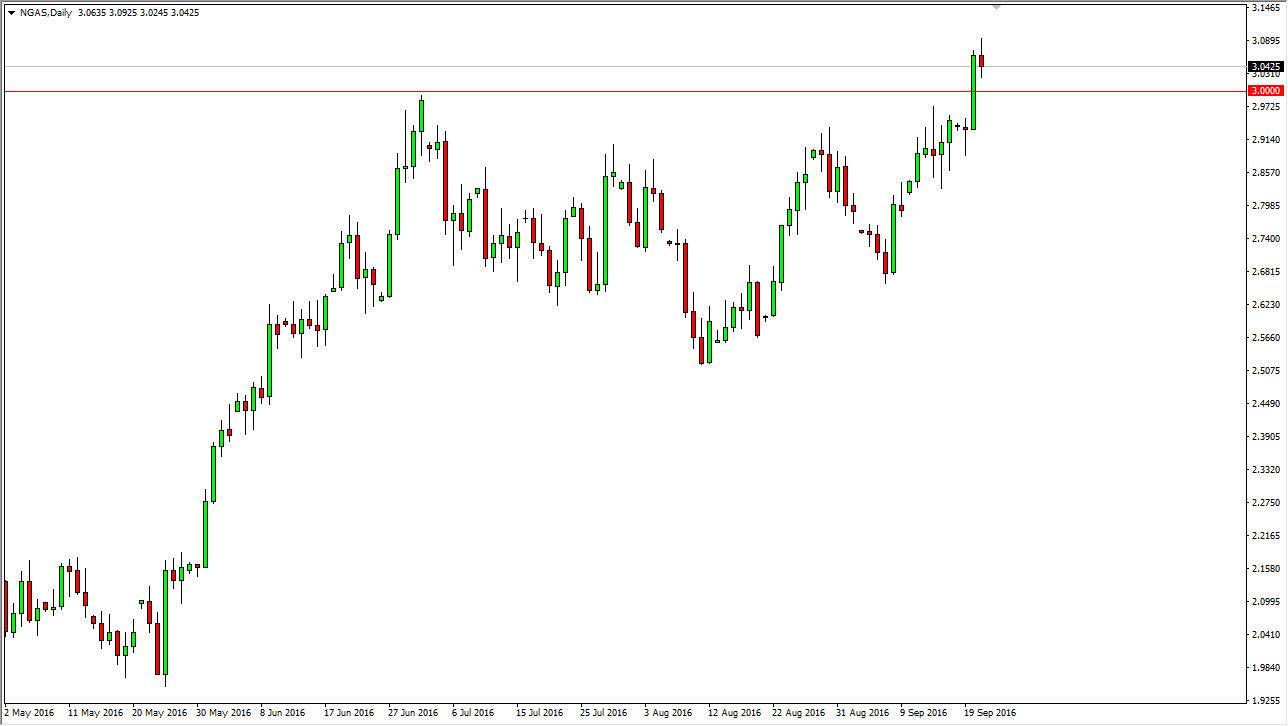

Natural Gas

The natural gas markets went back and forth during the day on Wednesday, initially trying to reach the $3.10 level. However, we turn right back around to form a bit of a neutral candle, perhaps even a shooting star. This obviously is a very negative sign, but now that we have broken above the $3.00 level, which of course is a major breakout. I think given enough time we will more than likely find buyers returning to this market on any type of pullback. I think that the support runs all the way down to at least the $2.95 level, and with that being the case I have no interest in selling. In fact, I don’t really have any interest in selling until we get well below the $2.80 level. In the meantime, I think pullbacks will continue to offer value that people take advantage of, and perhaps be an opportunity for more and more momentum to come back into play as we would then reach towards the $3.00 level above.