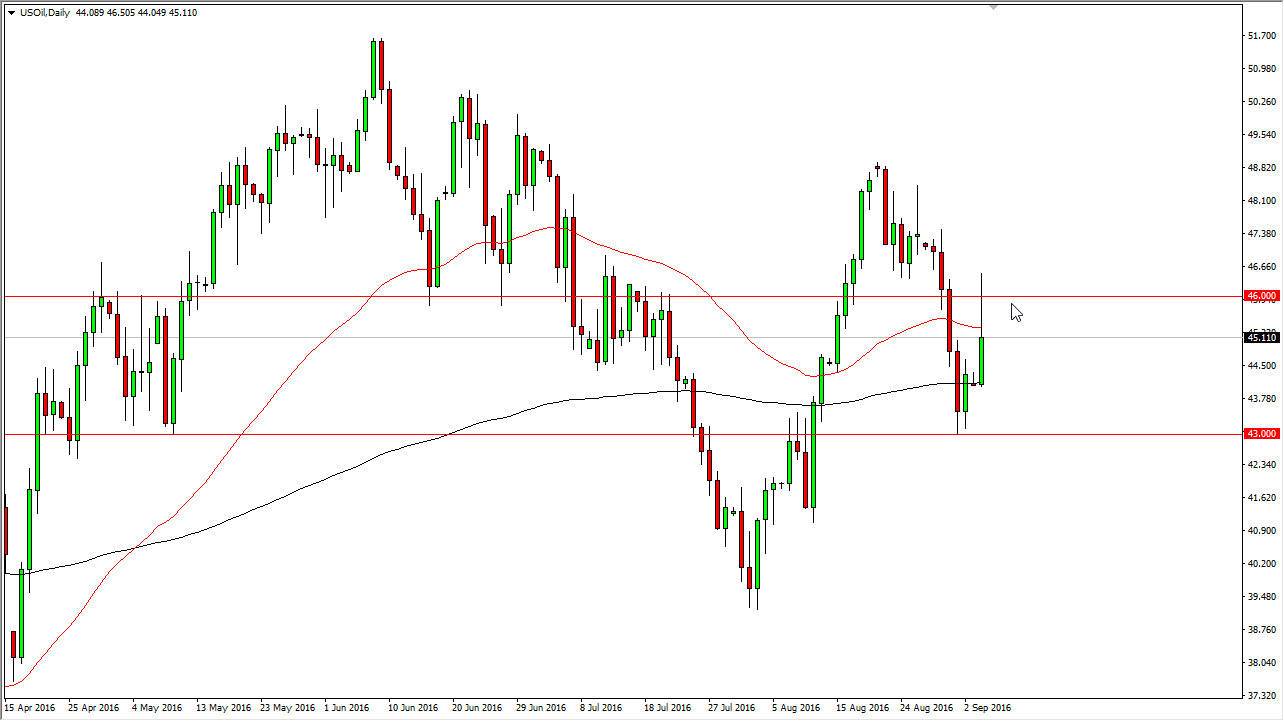

WTI Crude Oil

The WTI Crude Oil market rallied during the course of the day on Monday, breaking well above the $46 level. However, you have to keep in mind that the Americans and Canadians both were away at the Labor Day holiday, so having said that there is a serious lack of liquidity. Because of this, I believe that it is only a matter of time before the sellers return, mainly because we could not hang onto the gains. With this, I believe that we remain somewhat consolidative between the $46 level on the top and the $43 level on the bottom. Because of this, I believe that short-term trading will continue to be the way to go going forward, with a bit of a negative bias on my part.

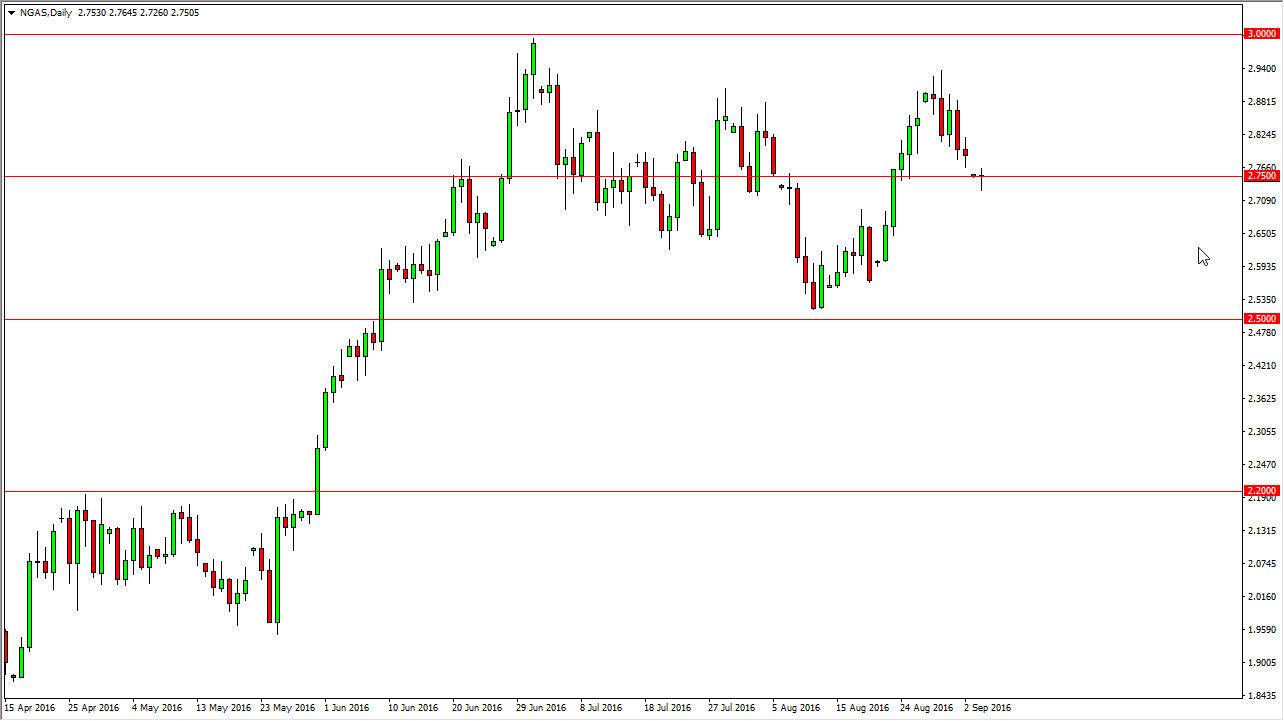

Natural Gas

The natural gas market gapped lower but as I mentioned previously, it was Labor Day in the United States so quite frankly I don’t really worry about it. The $2.75 level offered quite a bit of support, and as a result it looks very likely that the market will simply sit in this area. However, if we break down below the bottom of the candle for the session on Monday, I believe that the market grind much lower, perhaps reaching down to the $2.65 level. Also, you have to keep in mind that a lot of the previous bullish pressure had to do with the storm that was ripping through the Gulf of Mexico, which is now long gone. With that being the case, we don’t have to worry about natural gas drilling being shut down due to inclement weather.

On the other hand, if we break above the top of the gap from the open on Monday, we could grind our way back to the $2.90 level above which of course offered so much in the way of resistance previously.