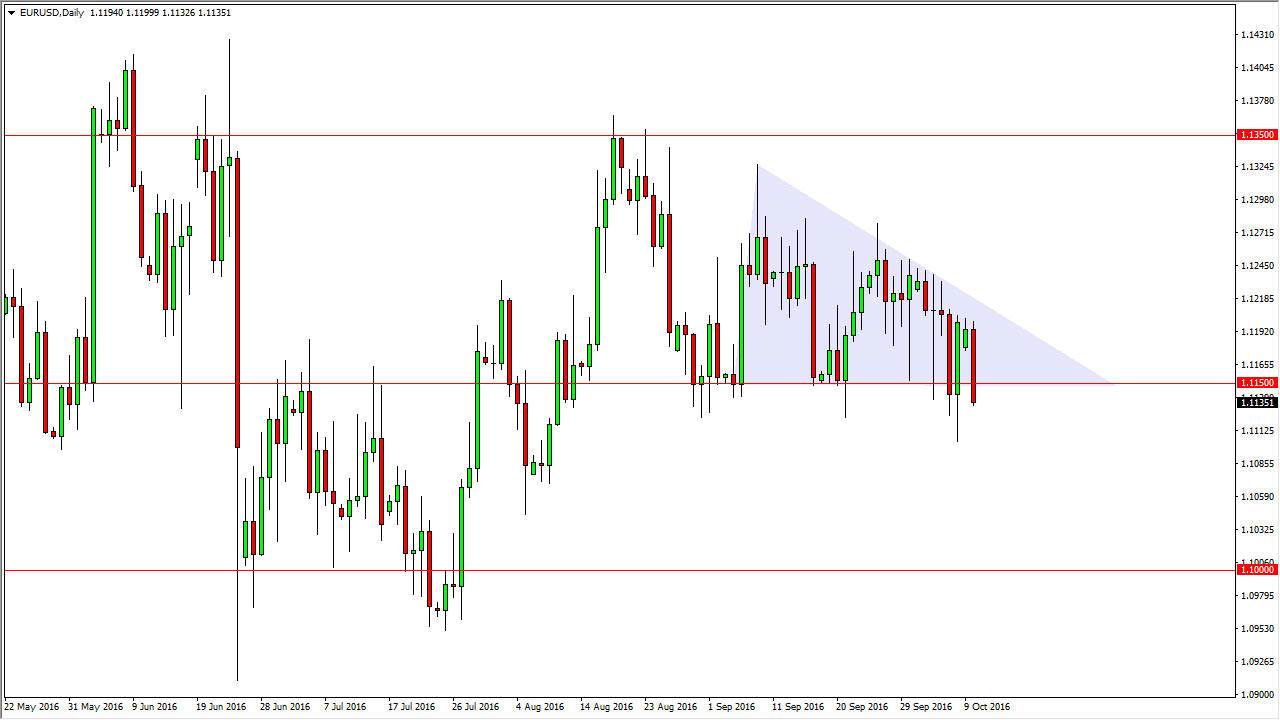

EUR/USD

The EUR/USD pair fell during the course of the day on Monday, slicing through the 1.1150 level below. Because of this, it looks as if we are going to test what I believe is the bottom of the support range, the 1.11 level below. Once we get below there, at that point in time feel that the market should then go towards the 1.10 level below. Any rally at this point in time I think will end up being a selling opportunity as soon as we see signs of exhaustion. Exhaustion of course would continue the downward pressure that we have seen for some time, as we now have a descending triangle. The fact that we are starting to break down now somewhere near the 75% part of the triangle is also very encouraging for the sellers. At this point in time, I don’t have any interest in buying this market until we get well above the top of the downtrend line of the triangle, and even then I would have to think about it.

GBP/USD

The British pound fell slightly during the course of the day on Monday, as we continue to try to grind lower. I believe that the 1.20 level below will be the target given enough time, but at this point in time it’s probably going to struggle to go straight down there. I believe that selling short-term rallies will probably be the way to go going forward, as the market will continue to find bearish pressure of the longer-term due to the boat believe the European Union. I certainly don’t have any interest fighting this trend, and I believe that the 1.2850 level above is going to end up being a bit of a “ceiling” in this market.

I don’t know if we can break down below the 1.20 level anytime soon, it was a bit of an impulsive move lower, so I think there is still plenty of support just below. However, I do think that we are going to at least try to test that level again.