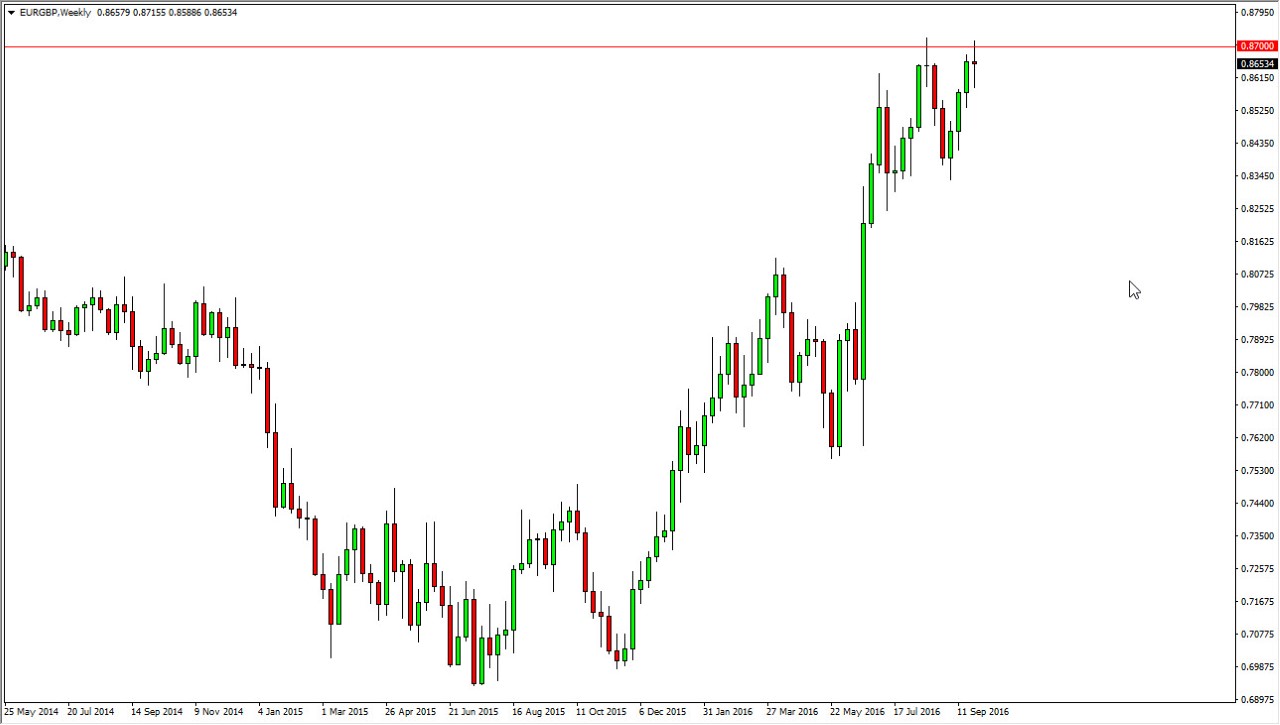

The EUR/GBP pair has been very bullish for the last several months, mainly in reaction to the vote held in the United Kingdom to leave the European Union. With this being the case, it makes a lot of sense that although the Euro itself hasn’t exactly been stellar, this pair probably has more to do with the British pound than anything else. After all, people are punishing that currency for leaving the continent, but at the end of the day I don’t think that we are done punishing the British pound.

I believe that if we can break above the 0.87 level and close above there on at least a daily chart, the market will continue to grind its way towards my longer-term target the 0.90 handle. This pair does and tend to move very quickly though, so will be a bit of a grind, but you have to remember that the tick value is almost twice what most other major pairs offer. In other words, it doesn’t need to move as quickly or as far to be profitable.

If we break down below the bottom of the weekly candle on the chart, we will probably pullback to somewhere near the 0.84 handle. That I believe is going to be the “floor” of this market, so this point in time looking at the chart I think we are essentially waiting for a breakout. I do believe that there is enough momentum to finally get that, but I don’t know exactly when it’s going to happen. In other words, I believe in buying pullbacks, and I also believe that a break out above the 0.87 level will mean something. Both of those are nice trade signals as far as I can see, and at this point time I don’t have any interest in shorting this pair even though we very well could pull back. I like the trend overall, and will continue to follow it.