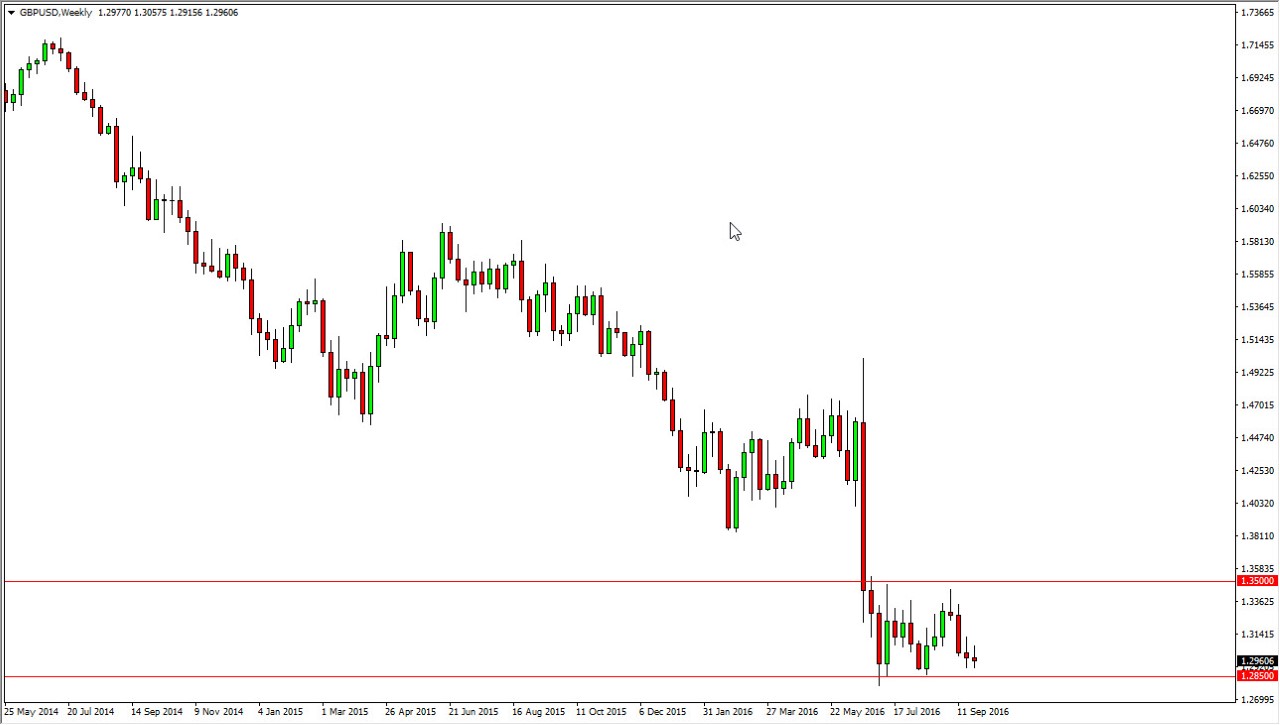

The GBP/USD pair has been bearish for quite some time, essentially since we had the vote to leave the European Union. However, when you look at the weekly chart that I have attached to this market, you can see just how dramatic the downtrend has been. With this in mind, I don’t have any interest in buying this pair although I do recognize that we are near very serious support. Right now, I believe that the longer-term consolidation area that we are paying attention to is bordered by the 1.2850 level on the bottom, and the 1.35 level on the top. Because of this, a bounce very well could come but I look at bounces as opportunities to sell this market at higher levels on signs of exhaustion.

Break down below the 1.2850 level sends this market looking to the 1.25 level in my estimation, which is the longer-term target that I have in this market. I don’t really have a scenario in which a willing to buy this pair, because quite frankly the trend has been so strong and sure. Also, there is a lot of uncertainty when it comes to what will happen with the United Kingdom, (full disclosure here: I believe that someday buying the British pound will be the trade of the century.) And of course the market absolutely hates uncertainty. With this being the case, it makes a lot of sense that we will continue to see the British pound struggle.

On top of everything else, you have to keep in mind that the Federal Reserve is the only central bank in the world that is currently thinking about raising interest rates. Conversely, you have the British economy that is struggling, but quite frankly I think that it isn’t as bad as most people make it out to be. This is a simple trade in the sense that you got where the interest-rate hikes are most likely to happen.