S&P 500

The S&P 500 initially fell during the day on Thursday, but turned around to form a bit of a hammer. The hammer of course is a bullish sign and as a result I feel that if we can break above the 2180 handle, the market could very well continue to grind higher. This is obviously going to be a very volatile day, as we get the Nonfarm Payroll Numbers. With this being the case, I feel that any pullback at this point in time will more than likely offer a buying opportunity on a supportive candle. I think that the “floor” in this market is somewhere near the 2120 handle. With that being the case, I’m going to ignore any bearishness today unless of course we get some type of massive meltdown.

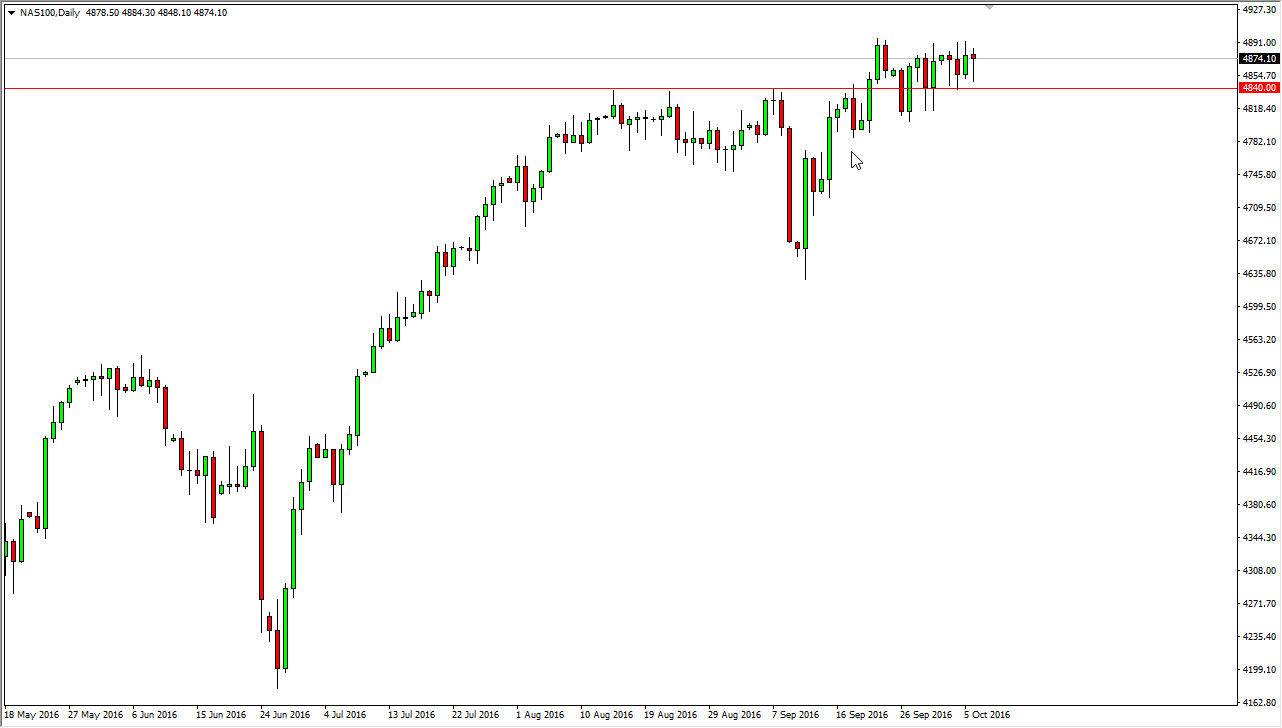

NASDAQ 100

The NASDAQ 100 initially fell during the course of the session on Thursday, but found support yet again at the 4840 handle. Because of this, we did up forming a bit of a hammer and that suggests that we are going to go higher, and that pullbacks will more than likely offer buying opportunities. I think that the market will then go to the 5000 handle, which is my longer-term target anyway. I don’t have any interest in selling the NASDAQ 100 because quite frankly it has been one of the better performers that I follow. The market has been fairly quiet over the last several sessions, because we have been consolidating. However, I feel that it is time to get going, and this announcement could be exactly what happens to move this market.

I don’t have any interest in selling until we get below the 4780 handle, which I don’t things can happen today. So having said that, it’s likely that any selling opportunities will be more of the longer term variety and several sessions down the road.