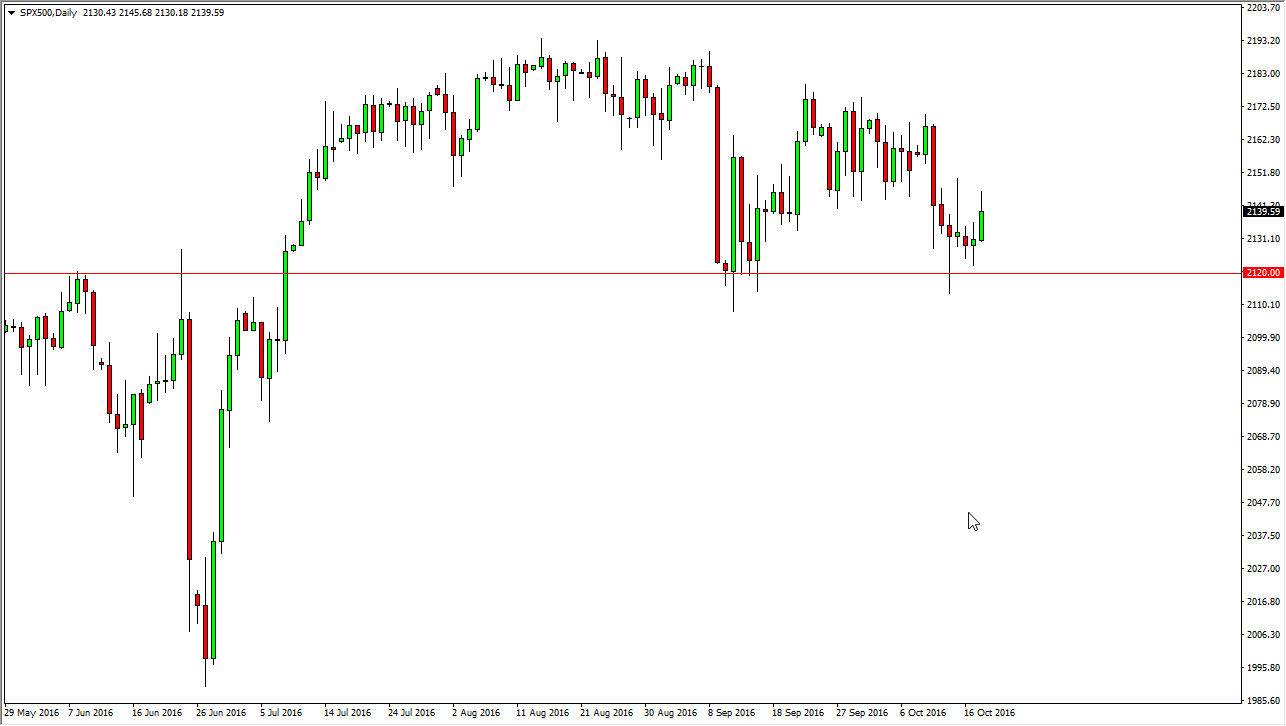

S&P 500

The S&P 500 rallied during the course of the session on Tuesday, showing signs of bullish pressure during the day. Ultimately, looks as if the market continues to rally in the consolidation area that we have been in for some time, and I currently have the 2120 level below as support, while the 2180 handle is massively resistive. Because of this, I feel that the market will continue to try to reach towards the top of this consolidation area, so makes sense of the buyers will return. We will probably continue to stay in this consolidation, and with that being the case I think that we are simply trying to build up enough pressure to go to the upside. I also recognize that the 2120 level below is probably extends all the way down to the 2100 level as far as the “floor” is concerned.

NASDAQ 100

The NASDAQ 100 rallied during the course of the session as well, but gave back some of the gains during the day. I believe that at this point in time we will more than likely try to reach towards the 4900 level, which is massively resistive. There is a very good chance that we will not only reach towards the 4900 level, but we may continue to go higher than that and extend all the way up to the 5000 handle which is my longer-term target.

Pullbacks at this point time will more than likely be buying opportunities based upon value, as the 4750 level below looks to be the absolute floor in this market at the moment. Eventually, we could grind above the 5000 level as well, but I think that’s going to take us a certain amount of time to finally build up a massive amount of momentum in order to go higher than that. I have no interest in selling at all.