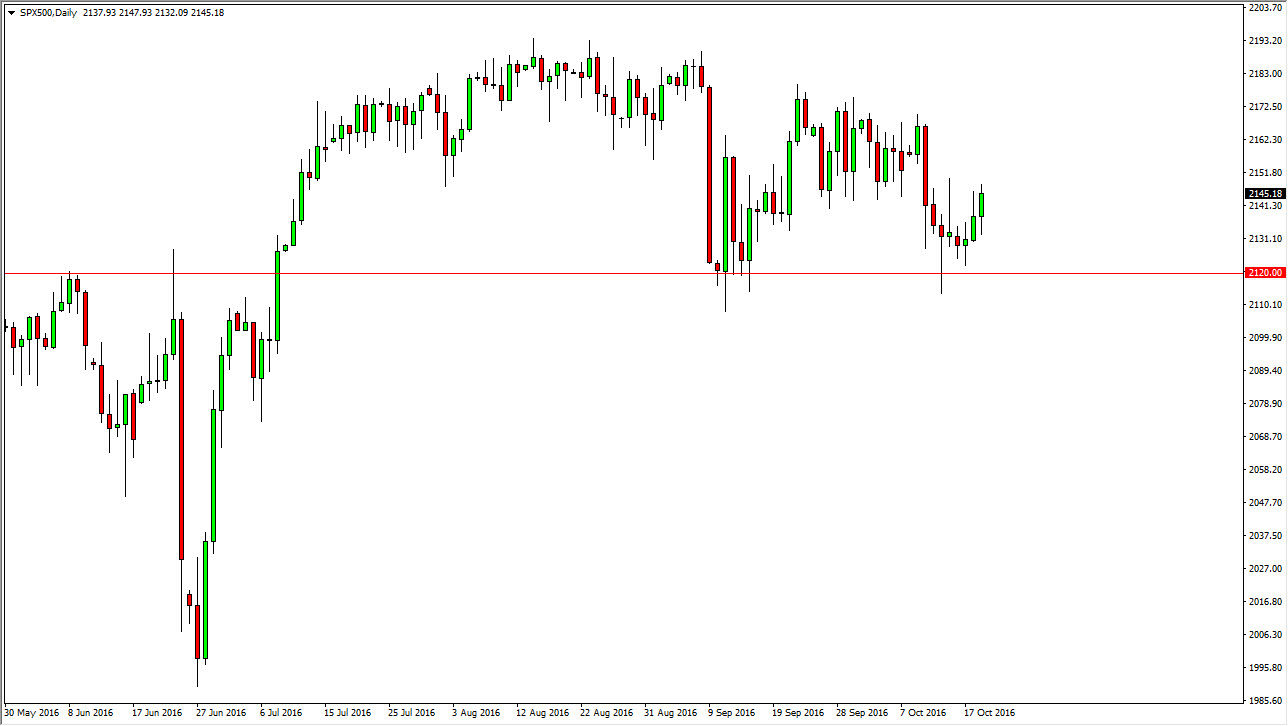

S&P 500

The S&P 500 initially fell during the course of the session on Wednesday, but turned around to form a very strong ring candle. That being the case, the market looks as if it is trying to rally from here, as the 2150 level has offered quite a bit of resistance. The 2175 level above offers quite a bit of resistance pressure, so even if we break out a little bit to the upside we still have to deal with that. I think that the 2120 level below continues to be massively supportive, so if we can break down below there it’s likely that we will see support all the way to the 2000 handle. Although I believe that longer-term we go higher, the markets will very likely be volatile and cause quite a bit of anxiety for traders who are not used to these types of markets.

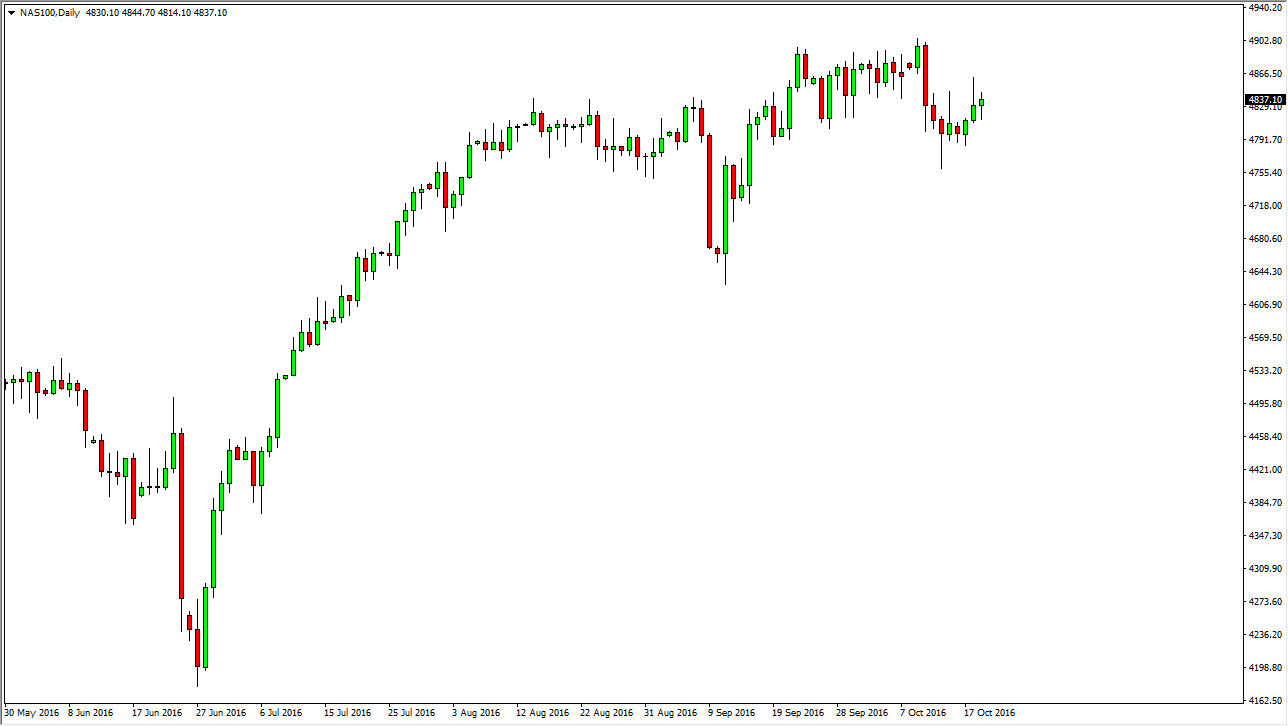

NASDAQ 100

The NASDAQ 100 initially fell during the day on Wednesday, but turned around to form a nice-looking hammer. That being the case, it looks as if the markets continue to find buyers every time we dipped. The 4900 level above will continue to be resistive, but I think sooner or later we will break above there and continue to extend all the way up to the 5000 level which is a longer-term target of mine and has been for quite some time.

Ultimately, this is a market that continues to show quite a bit of support below, so with that being the case I feel that the market is a situation where we can buy and buying again. The 4750 level below continues to be supportive, and as a result it’s likely that the buyers will return and continue to push very hard. We are still very much in an uptrend so I have no interest in selling until we break down significantly, something that doesn’t look likely to happen anytime soon.