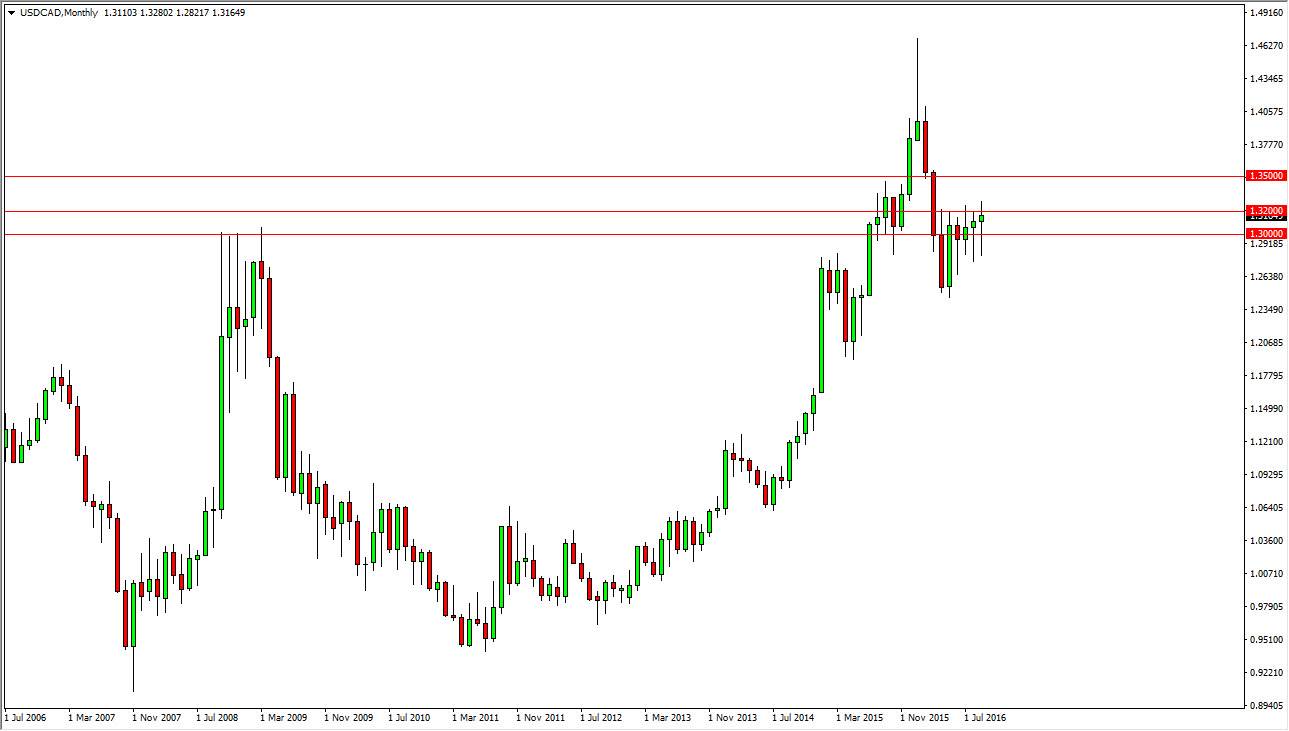

The USD/CAD pair has had a couple of rather unimpressive months, as we continue to go back and forth. However, as you can see on the monthly chart we formed a couple of hammers over the last couple of months, so I believe that it’s only a matter time before we break out to the upside. If we can break above the top of the candle, it’s very likely that this market will then reach towards the 1.35 level which I believe is very possible this quarter.

Ultimately though, I think that we will eventually break above the 1.35 level, probably closer towards the end of the year as we challenge the 1.40 level over the longer term. I do not think that we will get the 1.40 by the end of the year, but do recognize that the upside still seems to be the only way you can trade this market as the oil markets have quite a few fundamental issues going on, not the least of which is far too much output.

With this, it works against the value the Canadian dollar and I believe that will be the ongoing thesis. We simply do not have enough demand at this point in time, to take out the massive amount of crude oil being produced. Saudi Arabia and Iran came to an agreement to cut output, but it was only 700,000 barrels of oil a day. Currently, oil producers are overshooting demand by at least 2 million barrels a day. In other words, the cut was nice, but not enough to change the overall outlook for the crude oil markets.

On top of all of that, Canadian economic numbers have not been that impressive recently. That of course works against the Canadian dollars well, plus the other currency involved in this equation is the US dollar, which has the distinction of the central bank talking about a possible interest-rate hike. With this being the case, I remain positive and constructive of this pair, but realize it can be choppy from time to time.