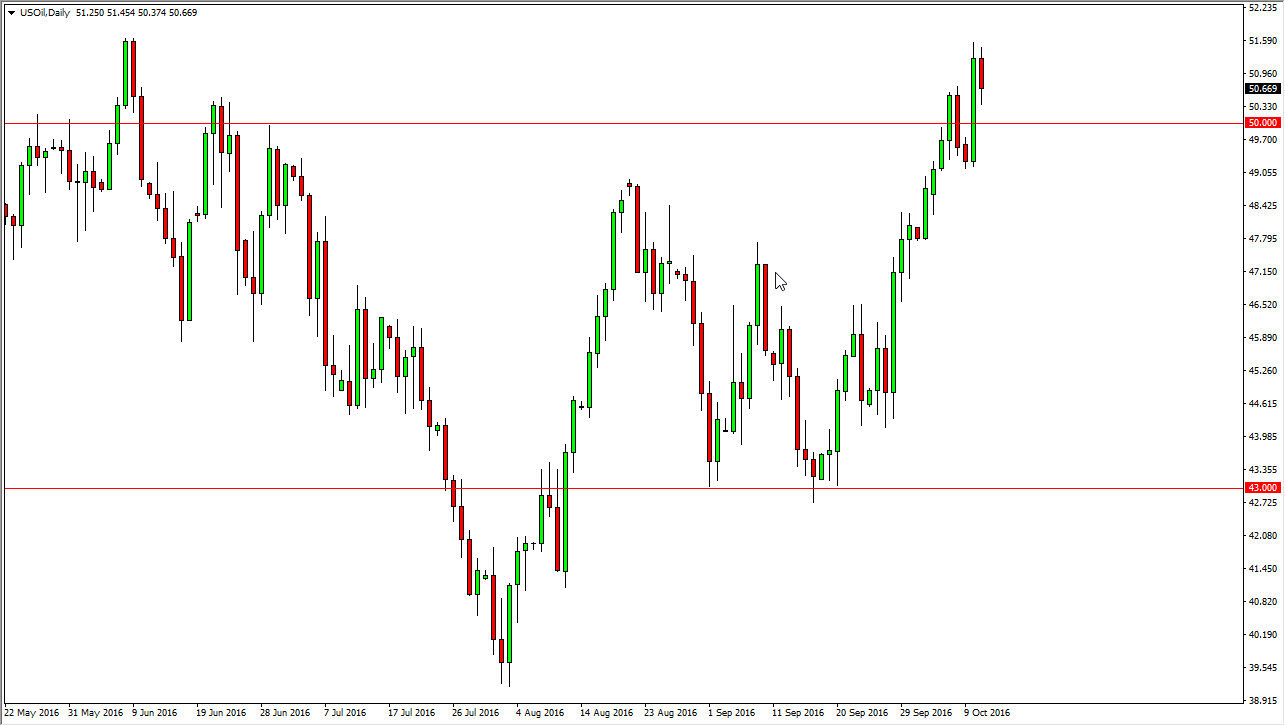

WTI Crude Oil

The WTI Crude Oil market try to rally initially, but turn right back around to fall towards the $50 level. Because of this, we are testing what should be rather supportive action, as it is a large, round, psychologically significant number. I think as soon as we see some type of supportive candle, it’s time to start buying again as we are most certainly overbought at this point in time.

Recently, Vladimir Putin has suggested that perhaps Russia would be willing to cut oil production right along with OPEC. Because of this, that throws even more bullish pressure into this marketplace and it makes sense that eventually we will probably try to grind higher. However, we are bit overextended so it makes sense that we also need a pullback in order to find more buyers. At this point in time, this market continues to be one that you can’t sell, at least not until you see some type of massive bearish candle.

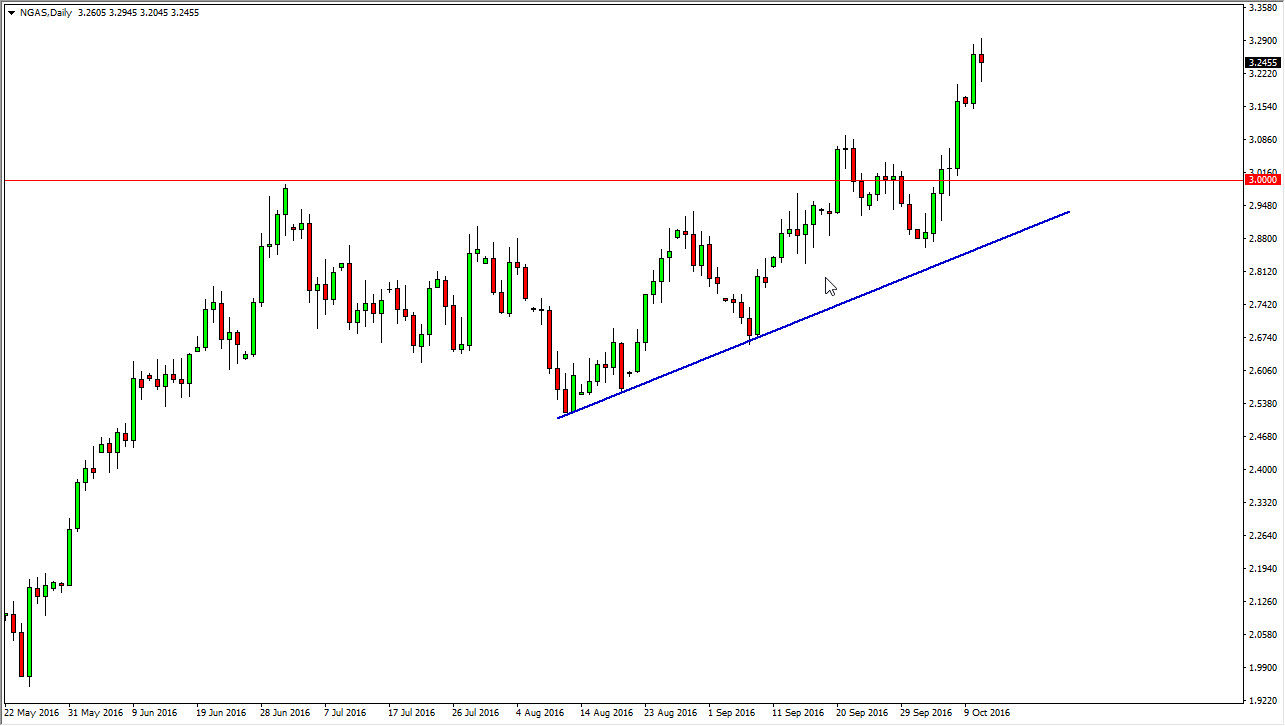

Natural Gas

Natural gas markets went back and forth during the course of the day on Tuesday, showing real signs of strength. Ultimately, I believe that we will eventually try to reach towards the $3.40 level above, which I see as the next major resistance barrier on the longer-term charts. I also recognize that the $3.00 level below is massively supportive after being massively resistive in the past. With that being the case, I think that every time we pullback it offers value that you have to take advantage of as not only will Russia cut back on oil potentially, but they are also one of the biggest producers of natural gas for the European Union. Because of that, I think that energy markets in general are getting continue to see buyers step in as for the short-term, it’s likely that you will continue to see bullish fundamentals. However, longer-term we are still going to suffer with the oversupply.