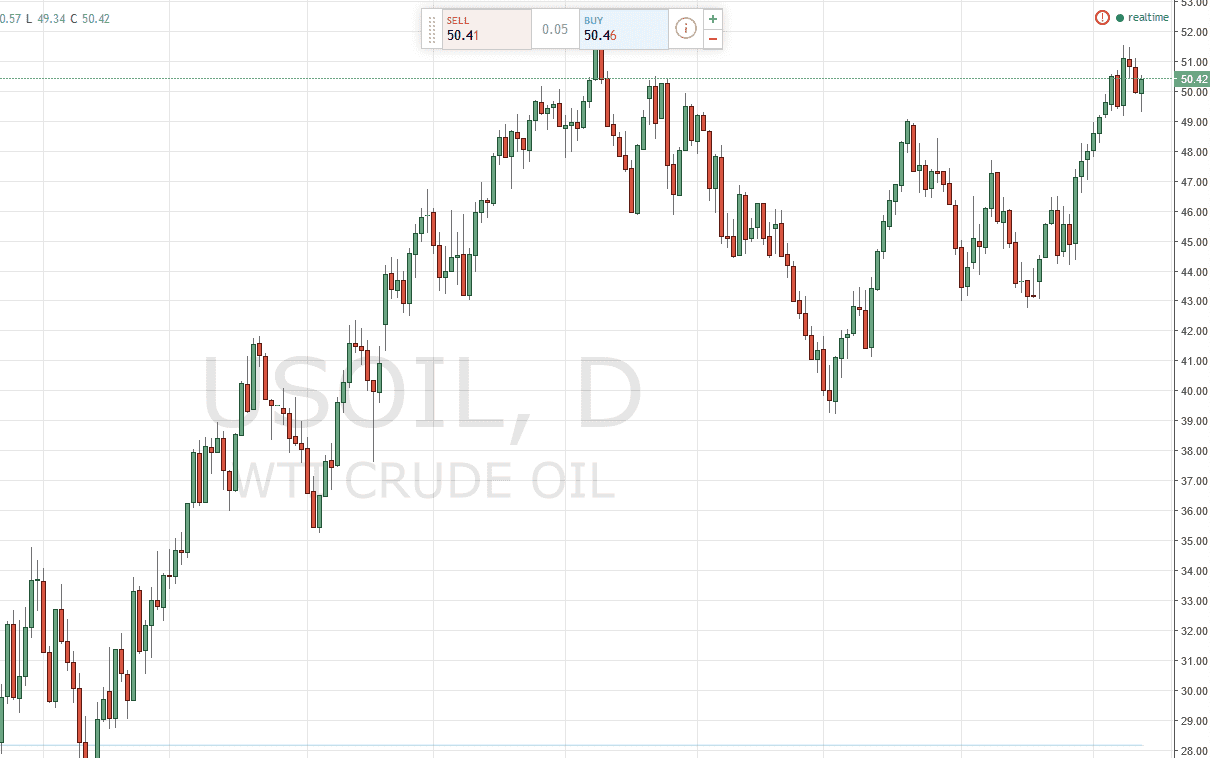

WTI Crude Oil

The WTI Crude Oil market initially fell on Thursday, dropping near the $49.25 level. However, we found enough support to true things back around and form a hammer, which of course is one of the more bullish candlesticks you can form. Because of this, I feel that the market will continue to find buyers as we grind away in order to try to find enough momentum to break out to the upside. A move above the $52 level would be a breakout, and I believe at that point in time the market would probably try to get to the $55 level. Alternately, if we break down below the $49 level, I feel that the market will probably drop down to the $47 level in the short term. Although I am not bullish longer term, I have no interest whatsoever in trying to sell at this point in time.

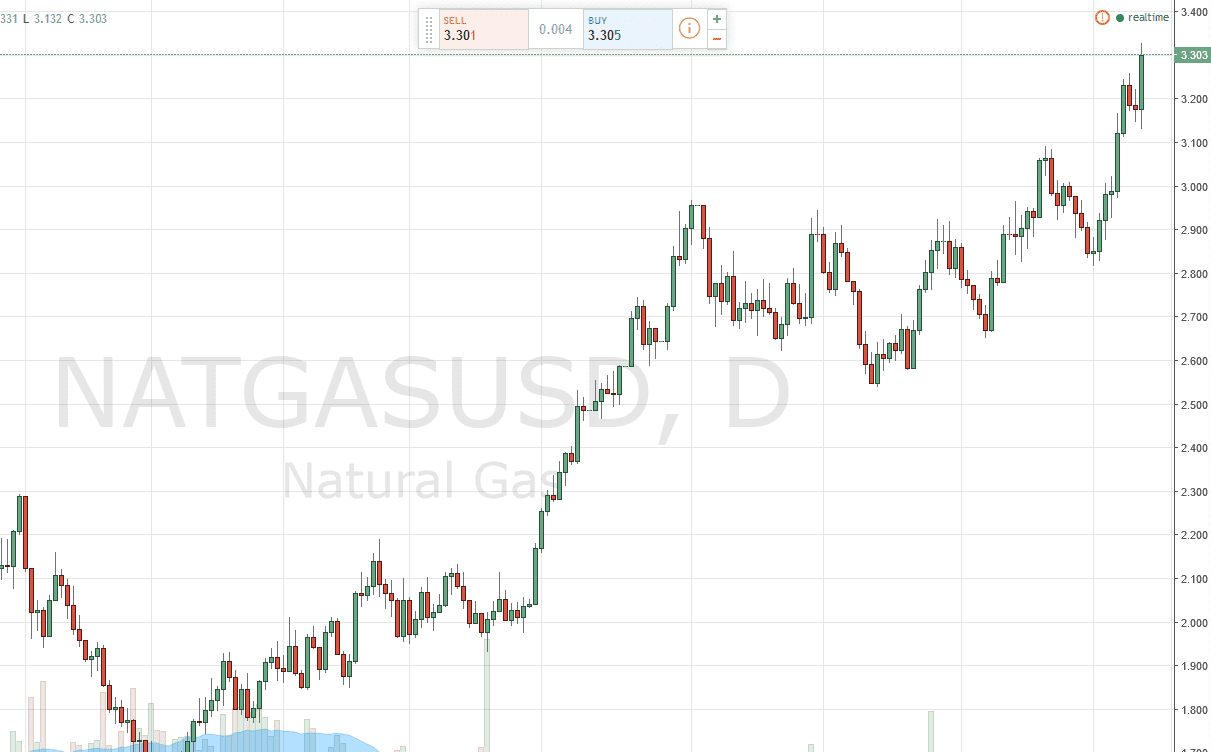

Natural Gas

The natural gas markets initially fell on Thursday as well, but found enough support near the $3.12 handled the turn things back rent shoot straight up into the air. I have had a target of $3.40 recently, and it seems to me like we are most certainly going to get there soon. Because of this, I think that anytime you get a short-term pullback, you have to be thinking about buying. At the $3.40 level I see much more significance to that level on the longer-term charts than current levels, so I feel that point time will probably run into quite a bit of resistance.

With this being the case, I think that you cannot sell this market and I do believe that there will be a certain amount of psychological support near the $3.10 level, and most certainly near the $3.00 level. Because of that, this is essentially a “buy only” type of market right now.