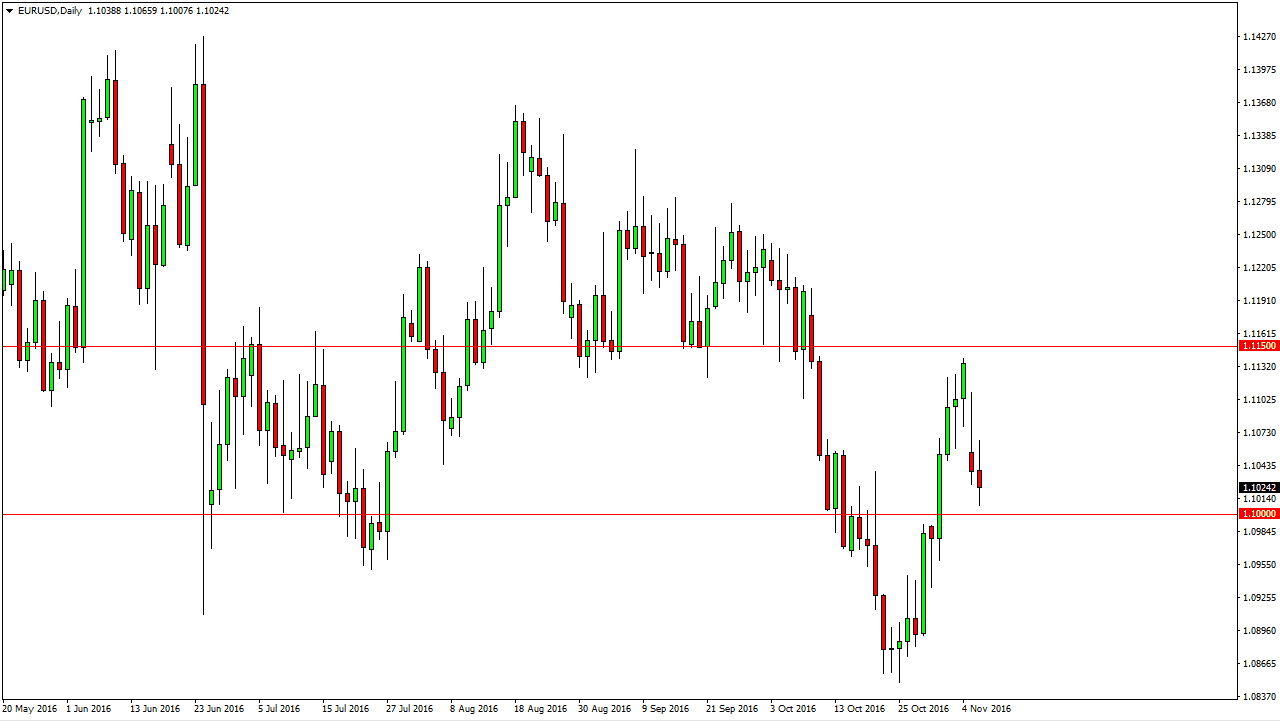

EUR/USD

The EUR/USD pair drifted a little bit lower during the day on Tuesday, but we still have to deal with the 1.10 level below as massive support. Ultimately, I think that raking down below there will be difficult, but I do think that given enough time we will as the overall downtrend is negative. Any rally now should be a nice selling opportunity, and with that I think that rallies continue to offer problems. A breakdown below the 1.10 level words in this market down to the 1.0850 level. Ultimately, this is a market that should show quite a bit of volatility, and because of this you will have to be very cautious. I feel that the market has been waiting for the US presidential election results, and at this point in time we still don’t have them.

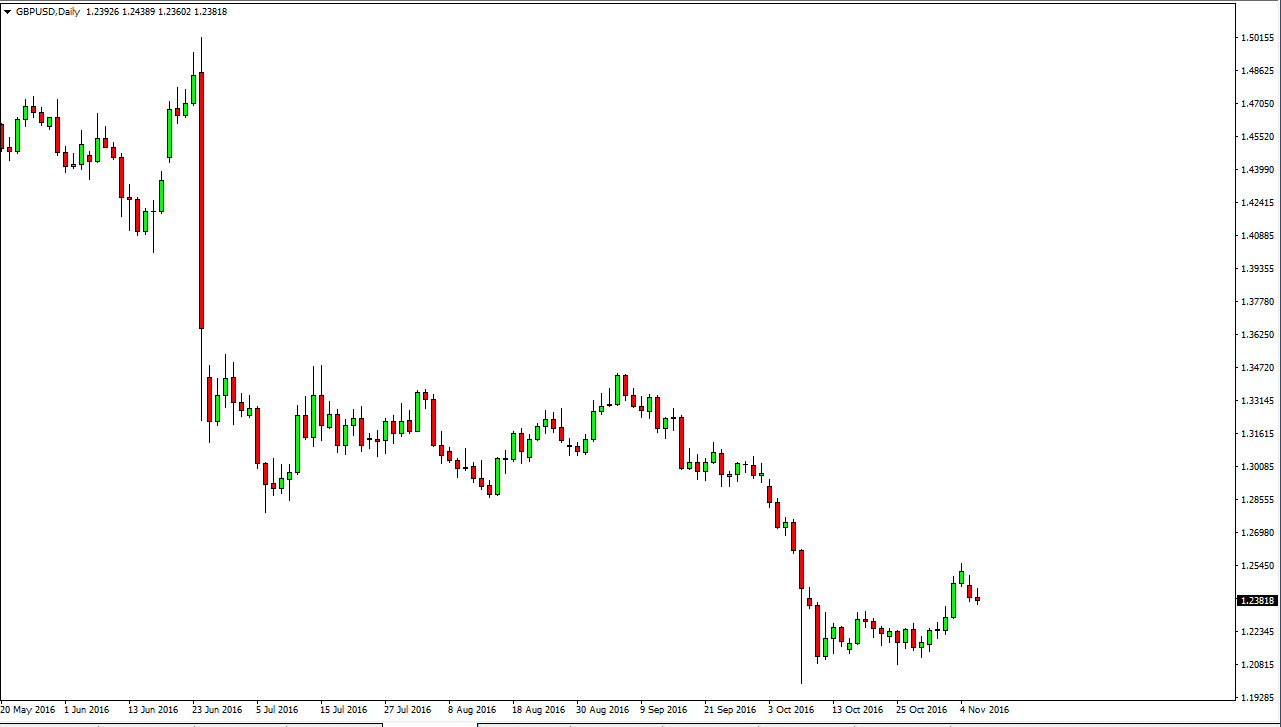

GBP/USD

The GBP/USD pair did almost nothing during the day on Tuesday as we have no interest whatsoever in moving during the election. I believe that there is a significant amount of support just below though, so given enough time it’s only a matter of time before the buyers would return in my estimation. I believe that the 1.25 level above is massively resistive, and as a result I think that any rally will probably have exhaustion above that we can continue to sell. I have no interest whatsoever and going long, as the 1.2850 level above is what I consider to be the absolute “ceiling” in this market.

The 1.20 level below is massively supportive, and because of this I think that we will have to try again and again in order to break down. If we do get below there, it’s likely that the market will probably go down to the 1.15 level based upon monthly charge. I think longer term that happens, but it will take several times.