GBP/USD Signal Update

Yesterday’s signals were not triggered as neither of the key levels were reached during that session.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time today.

Long Trades

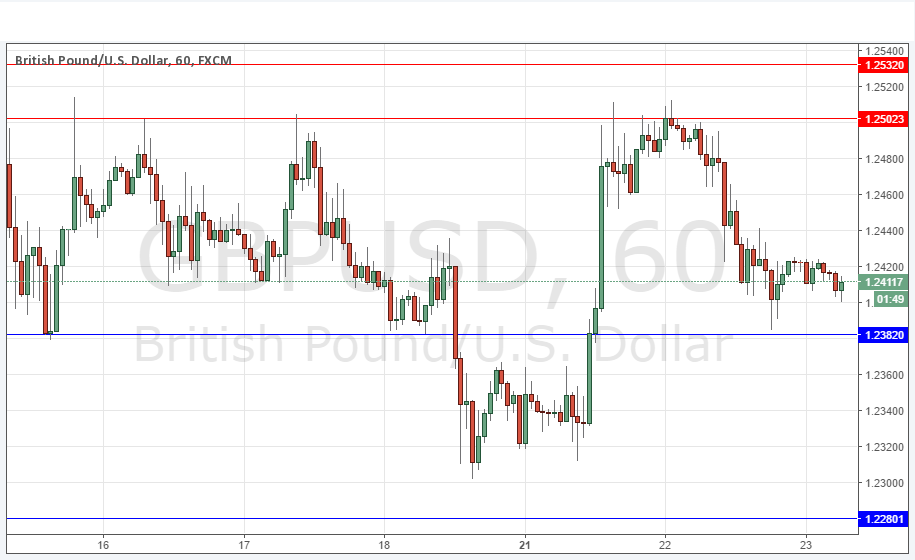

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2382 or 1.2280.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trades

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2502 or 1.2532.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

I noted yesterday that the key resistance at 1.2500 had held so far and that the price seemed to be moving down from there. This turned out to be correct and the price may not be starting to bottom out near the nearest support level at 1.2382.

The price is essentially ranging and has been doing so for the past few days, with the GBP over recent weeks showing some greater strength against the USD.

This suggests that if the price reaches support and bounces a long trade could be attractive.

There is key data due for both sides of this pair and by the end of today, the range may be broken.

Regarding the GBP, there will be a release of the Autumn Forecast Statement at 12:30pm London time. Concerning the USD, there will be releases of Core Durable Goods Orders and Unemployment Claims data at 1:30pm, followed later by Crude Oil Inventories at 3:30pm and FOMC Meeting Minutes at 7pm.