Gold prices fell $9.01 on Thursday as the dollar strengthened after comments by Federal Reserve Chair Janet Yellen bolstered the case for raising interest rates in December. Yellen said interest-rate increase could come "relatively soon". The greenback was also supported by better than expected U.S. economic data. The Labor Department said its Consumer Price Index increased 0.4% last month. A separate report showed that the number of people filing new claims for unemployment benefits last week dropped 19K to 235K, the lowest level since November 1973. The XAU/USD pair is currently trading at $1215.27, slightly lower than the opening price of $1216.

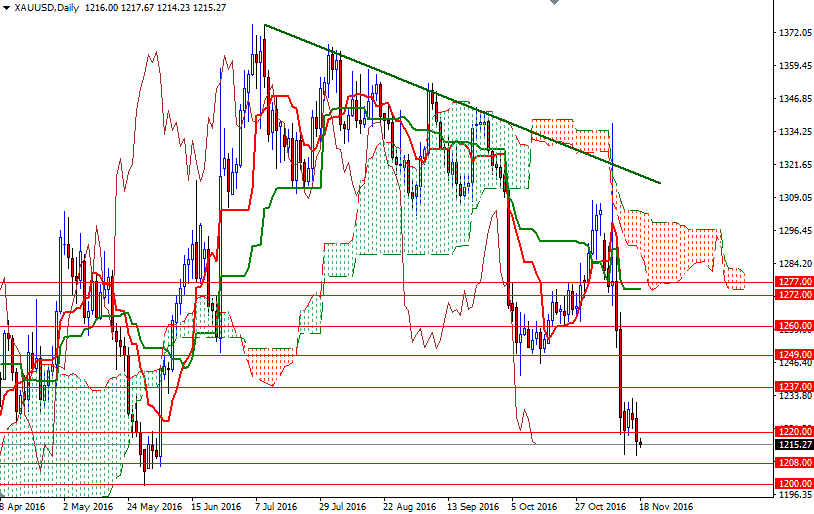

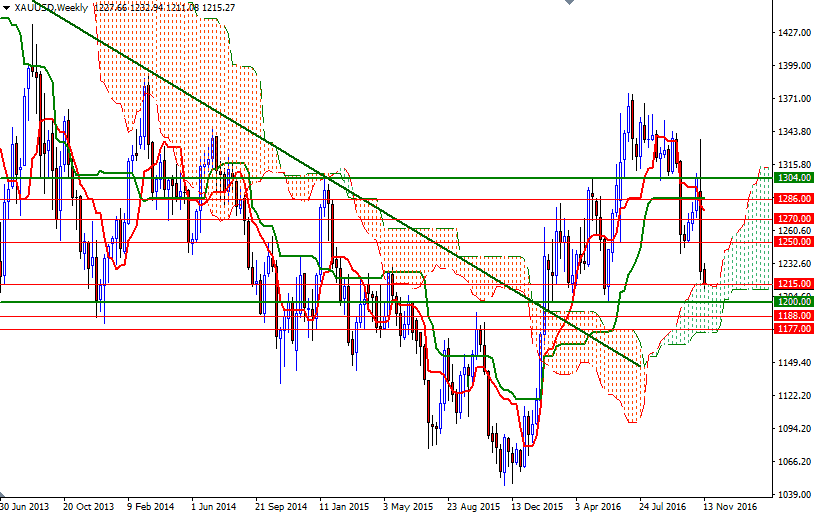

Currently the XAU/USD pair is trading below the Ichimoku clouds on the daily and 4-hour time frames and that gives the bears an advantage. Adding to the beaish outlook is the daily close below the 1220 level. The short-term charts suggest that the XAU/USD pair may extend its losses. In that case, the 1208 level will be the first stop. Breaking down below the 1208 level could put more pressure on the market and increase the possibility of an attempt to revisit the 1200-1197 zone. If the market successfully drop through 1200-1197, then look for further downside with 1189/6 and 1180/77 as targets.

However, if prices turn bullish from here and climb back above 1220, the market may grind higher towards 1228/6 - where the hourly cloud reside. The bulls will have to pass through 1228, so that they can proceed to the next barrier standing at around the 1237 level. A daily close above 1237 could provide the bulls the momentum they need to revisit the 1243/0 zone.