Gold prices rose $10.79 on Tuesday as a softer dollar and uncertainty surrounding the U.S. presidential election bolstered demand for the precious metal. The broad sell-off in the equity markets was also behind gold’s 0.85% jump yesterday. The XAU/USD pair was able to cleanly break the anticipated resistance in the $1280/77 zone and as a result the market ended up challenging the next significant barrier at $1292.

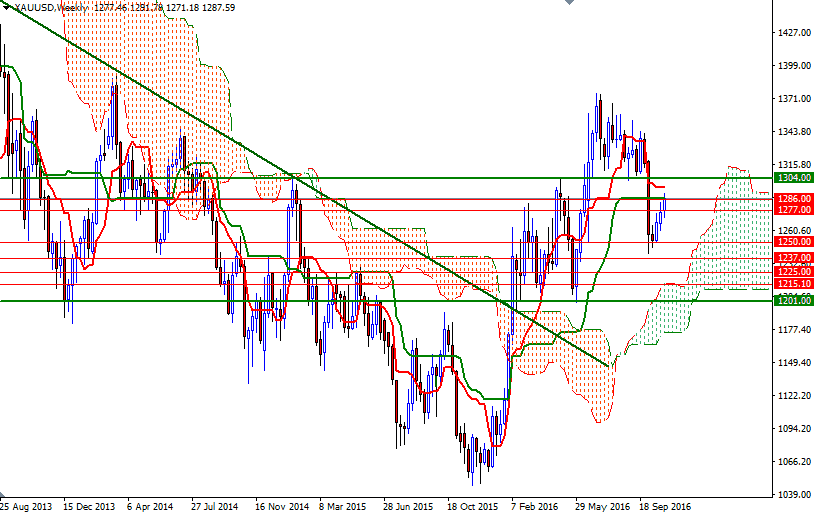

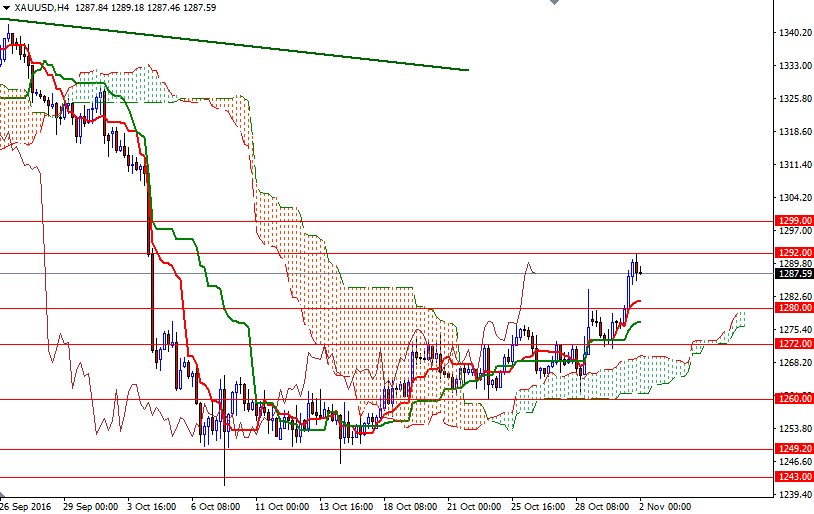

The market will be waiting for the Fed’s decision today. The consensus is that the Fed will leave interest rates unchanged at the end of its two-day meeting. The precious metal is trading at $1287.59, slightly lower than the opening price of $1287.87. The short-term charts are bullish at the moment, with the market trading above the Ichimoku clouds on the 4-hour chart, plus we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. However, the daily cloud still stand on our way.

The bulls will need to push prices beyond the 1294/2 area, if they intend to march towards the 1300-1299 region. Breaking through this barrier could trigger a reaction targeting the 1307/4 area, which played a crucial role in the past. To the downside, keep an eye on the 1286 level. If this support is broken, then we are likely to pull back to 1280/77. The next critical support below that level is located in the 1272/0 zone.