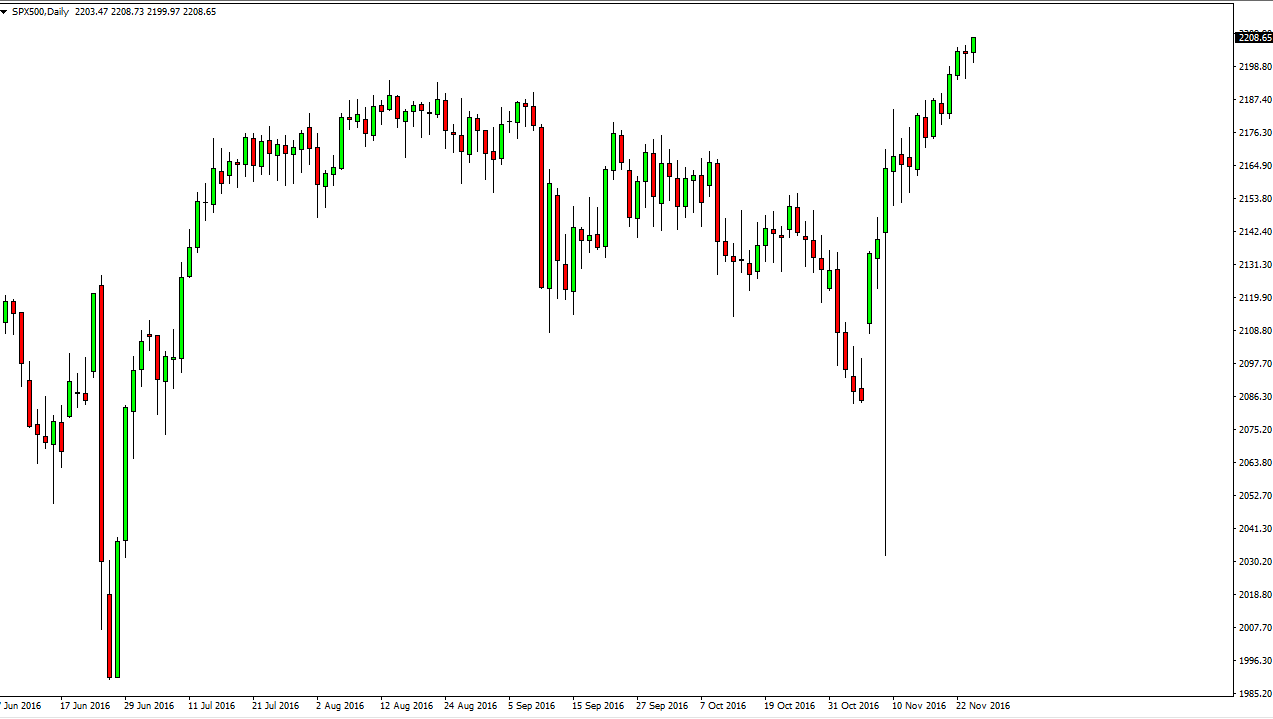

S&P 500

The S&P 500 was of course closed during the session on Thursday, but the CFD markets were open. On the attached chart, you can see that the market initially pulled back a little bit on Thursday and then went higher. We continue to see this market hang above the 2200 level, so therefore it feels only matter of time before we continue the uptrend. The fact is that traders expected on Thursday that the market would continue to go higher, and I believe that’s a little bit of foreshadowing. Even if we did pull back from here, there is quite a bit of noise just below the should serve as support, so having said that I have no interest in shorting this market. Given enough time, I believe that we reach towards the 2300 level above.

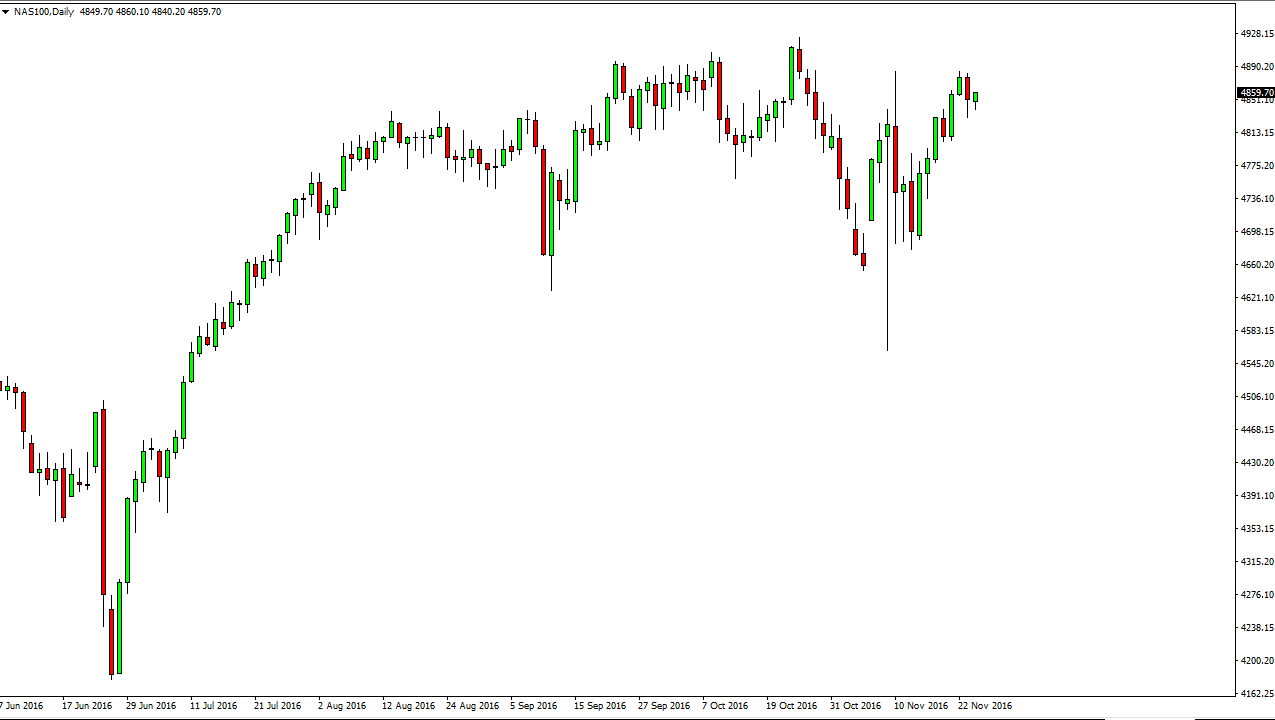

NASDAQ 100

The NASDAQ 100 fell slightly at the open in the CFD markets as well, but just as we saw in the S&P 500, we rallied. The market of course was close but it looks as if we are going to reach towards the 4900 level above. That is a serious amount of resistance, and I believe that we may have to grind through that level and perhaps try several times to break out. I do not expect this market the slice through there like it is and even a problem. I believe that pullbacks will continue to be buying opportunities and I also recognize that the 4800 level below should be supported. Once we do break above the 4900 level, the market should then reach towards the 5000 level.

Ultimately, I am a “buy only” type of trader when it comes to the NASDAQ 100 and don’t even have a scenario in which a willing to sell this market. I believe the US indices in general continue to go higher, and therefore there’s no point in fighting the trend.