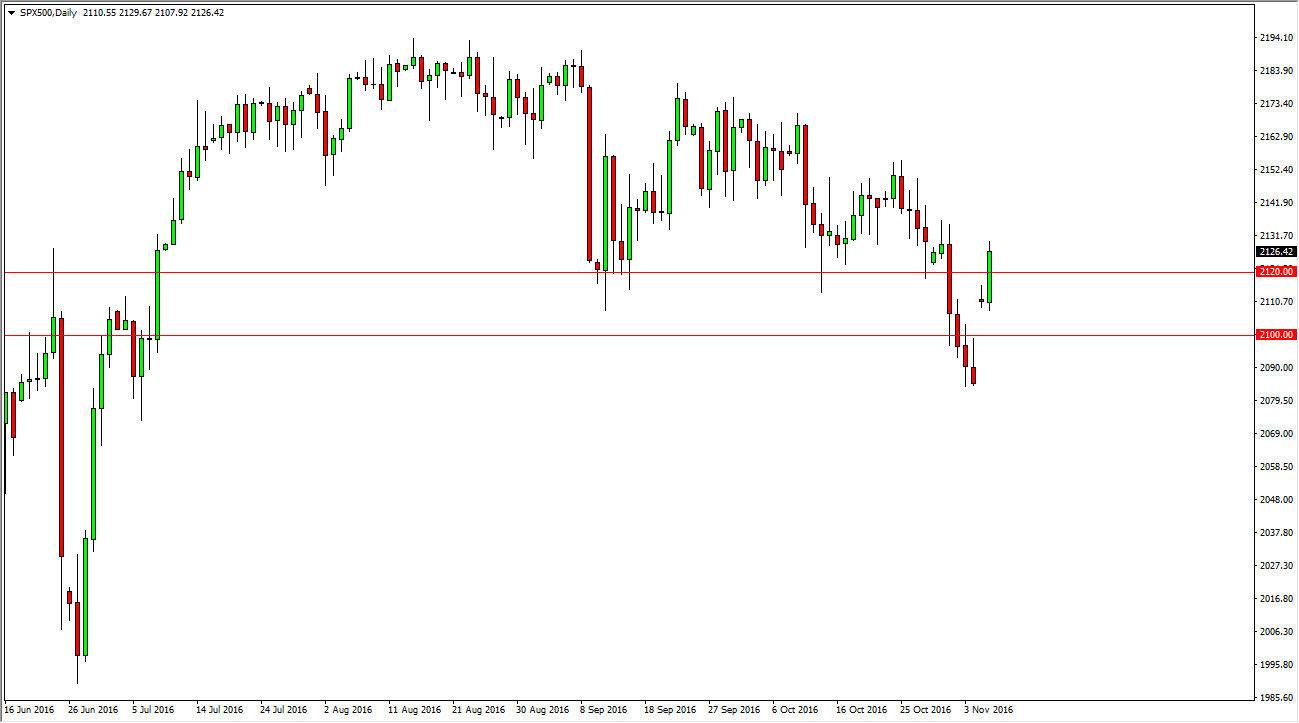

S&P 500

The S&P 500 gapped higher at the open on Monday, as we continue to see quite a bit of volatility in this market. By breaking above the 2120 handle, it suggests that we are going to go even higher but keep in mind that today is the presidential election in the United States. The gap of course was since Hillary Clinton will not be indicted by the FBI in the email case, at least not now. Because of this, it appears that the market prefers the “status quo”, but we will not get answers as to what the election results are until late in the day, so it is probably almost impossible to trade this market.

NASDAQ 100

The NASDAQ 100 also gapped higher, reaching towards the 4760 level, and even above there at one point. The 4800 level above is massively resistive, as was previously supportive. If we can break above that level, the market should then reach towards the 4900 level. However, with the election today is difficult to imagine putting money to work, because the results will not come until after 5 o’clock, which of course means that the stockbrokers will all be home. There is a massive “floor” at the 4650 level, so I do believe that the easier route is to the upside, but I would not expect much in the way of volatility or even strength for that matter today.

There of course could be some kind headline shock over the next 24 hours, which could move the market one direction or the other. However, at this point it looks as if everything but the voting is done, so results will be the only thing that matter. Yes, there are various other things going on, but today it’s all about the election and not much else.