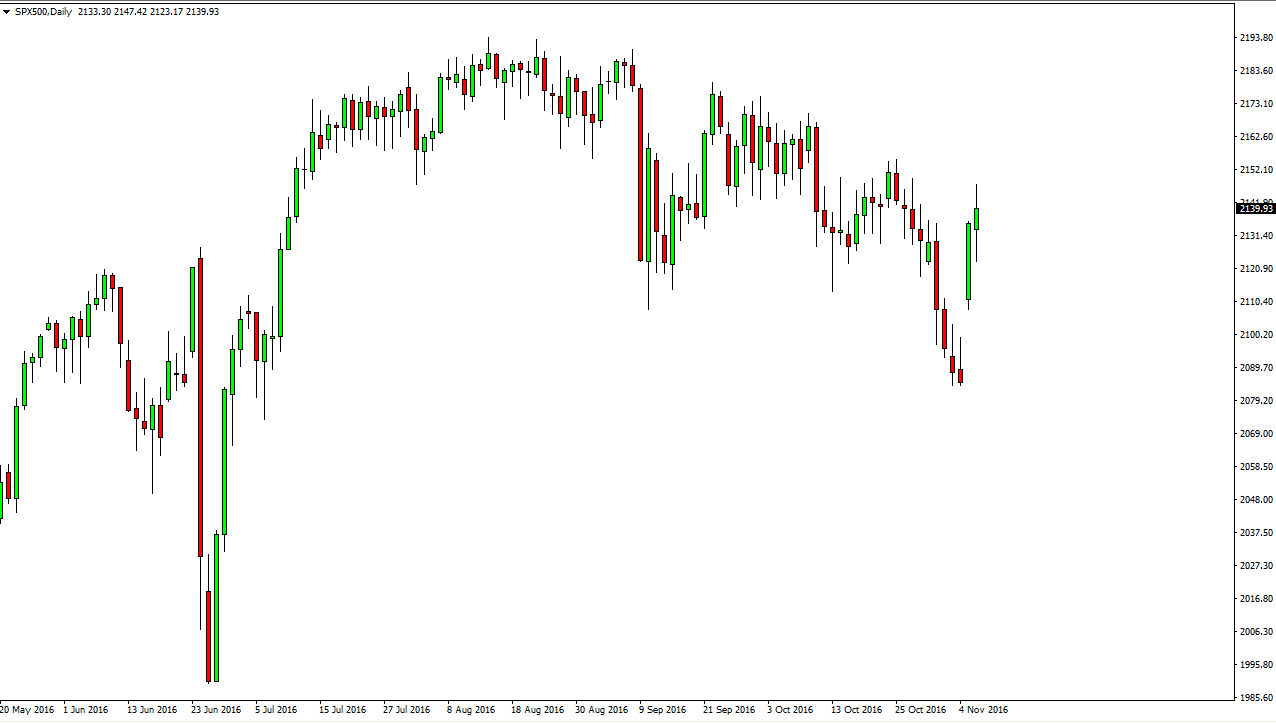

S&P 500

The S&P 500 had a very volatile session during the day on Tuesday, as the presidential elections obviously took center stage. At this point, one would have to believe that the markets favor Hillary Clinton, but there is a lot of noise above anyway. Because of this, it’s likely that the market will be volatile regardless of what happens, because as soon as the market stops looking at the election, and then must look at the fact that the US government will be stuck in gridlock going forward. Even if Donald Trump were to win, that would more than likely be the case as well.

At this point, it looks as if a pullback could be exactly what the market needs in order to build up enough momentum to continue going higher. A breakdown below the gap underneath would be a nice signal start selling, because it would show a collapse of bullish pressure.

NASDAQ 100

The NASDAQ 100 had a slightly positive session on Tuesday, but again, just as with the S&P 500 I feel that it’s almost impossible to place any type of trade until we get the election results. At this point, it looks as if the market is getting ready to go higher and reach towards the 4900 level. A pullback at this point must deal with the gap below that should be very supportive. Because of this, I believe that a supportive candle in that area would be a nice buying opportunity. However, the breakdown below the 4650 level would be very negative and puts in this market much lower. Just as in the S&P 500, I think that volatility will certainly be a huge part of this market regardless of what happens in the election as there is so much choppy trading overall. From the longer-term perspective, though, it looks as if the buyers are still in control.