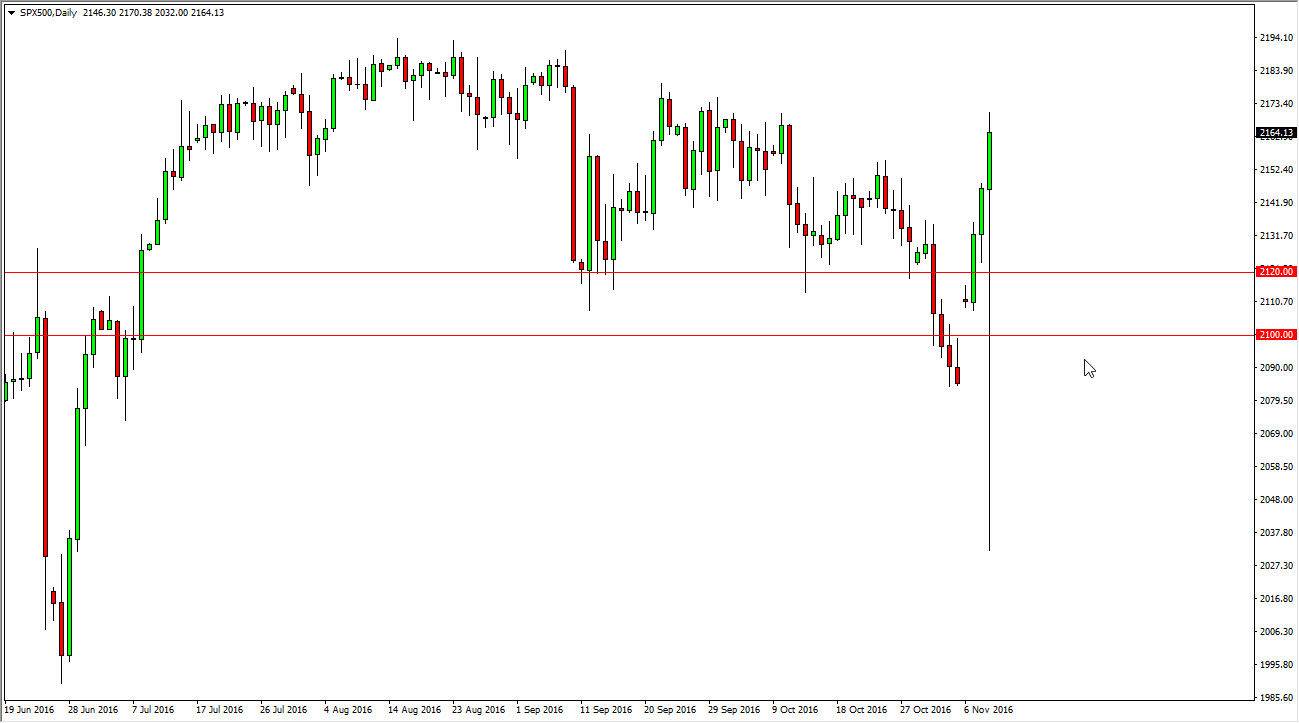

S&P 500

The S&P 500 fell initially during the day on Wednesday, reaching all the way down to the 2030 handle. With this, we ended up in a massive “oversold” condition and a reaction to the election of Donald Trump. At that point, the market then shot much higher and now has formed a very supportive candle. It looks as if the US stock markets are about to go higher due to the business friendly attitude of the next administration. Short-term pullback should be buying opportunities, and with that it’s very likely that the buyers will return again and again and that the 2120 handle is now the “floor” yet again when it comes to this particular market.

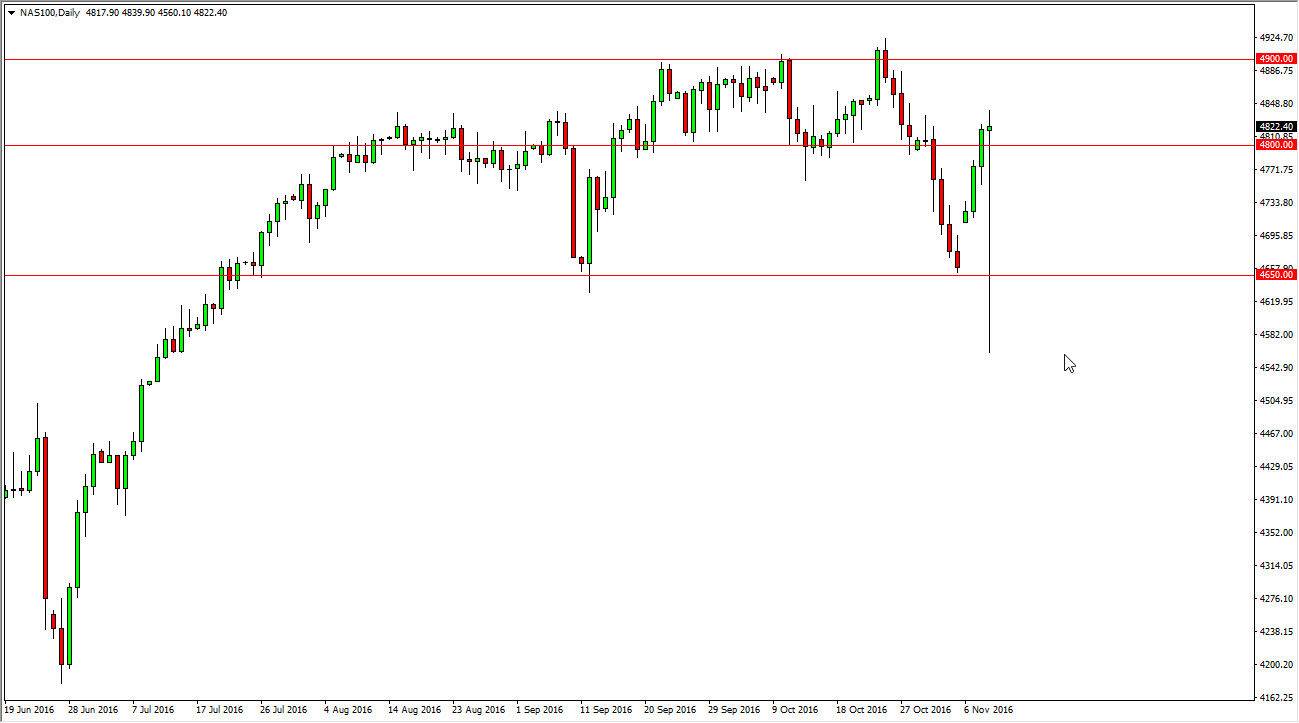

NASDAQ 100

The NASDAQ 100 fell during the session on Wednesday, for the exact same reason: Donald Trump being elected. This was something that the market had no idea what is going to happen and of course it shocked quite a few traders around the world. We turn right back around to form a massive hammer, as we broke above the 4800 level. A break above the top of the hammer would be a buying opportunity, perhaps sending this market to the 4900 level above. I think short-term pullbacks and show signs of support are also buying opportunities, and with that I have no interest in shorting this market. A break above the 4900 level sends this market looking towards the 5000 level, and this means that we should continue to see buyers again and again. This looks like a continuation of what we have seen recently, and with that there is no opportunity for selling as far as I can see from not only a technical perspective, but also from the fundamental reason that the market turned around so rapidly. As far as I can see, this looks like a market that will not fall for any real length of time.