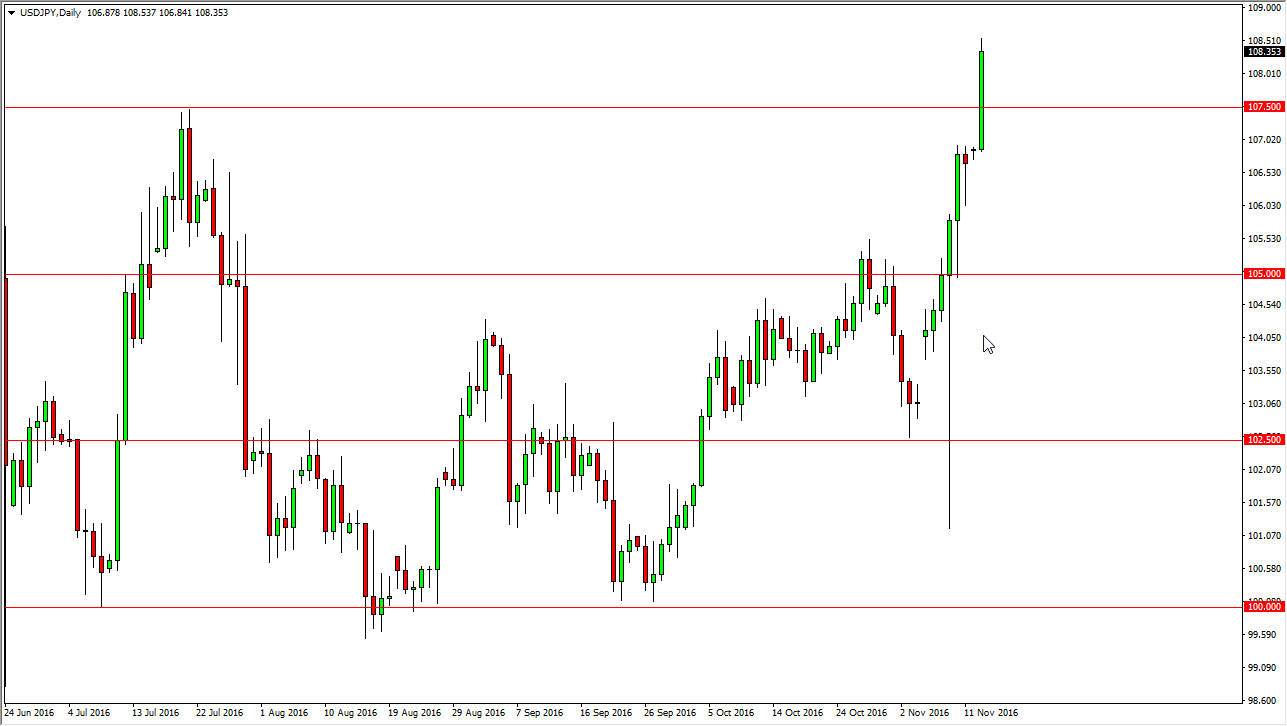

USD/JPY

The USD/JPY pair broke higher on Monday, clearing the top of the hammer from the Friday session. By doing so, it shows that we continue to see quite a bit of bullish pressure, and then when we broke above the 107.50 level, things got very interesting as the market continues to simply explode to the upside. Because of this, I believe that the market is going to reach towards the 110 level, but if you are not involved in this market at this point yet, it’s probably best to wait for pullbacks and show signs of support in order to pick up a bit of “value” going forward. After all, we are a bit overextended but I do think it’s only a matter of time before the buyers reenter the market every time we pullback.

AUD/USD

The Australian dollar went back and forth during the day on Monday, as we continue to test various levels of support. The uptrend line of course should be supportive, just as the 0.75 level below there is. Ultimately, I believe that we will have to make a decision based upon this area, and with this it’s likely that I will have to wait until we get some type of significant move in one direction or the other in order to place a trade. If we can break down below the 0.75 level on a significant move, and more importantly a daily close, then I would be interested in shorting this market. If we break above the top of the candle for the Monday session, I believe we will bounce from there and reach towards the 0.7750 level above, which has been massively resistive in the past.

Keep an eye on the gold markets, they have been falling apart and could put in quite a bit of bearish pressure when it comes to this market. Nonetheless, we have not broken down yet, so it’s almost impossible to trade based upon that.