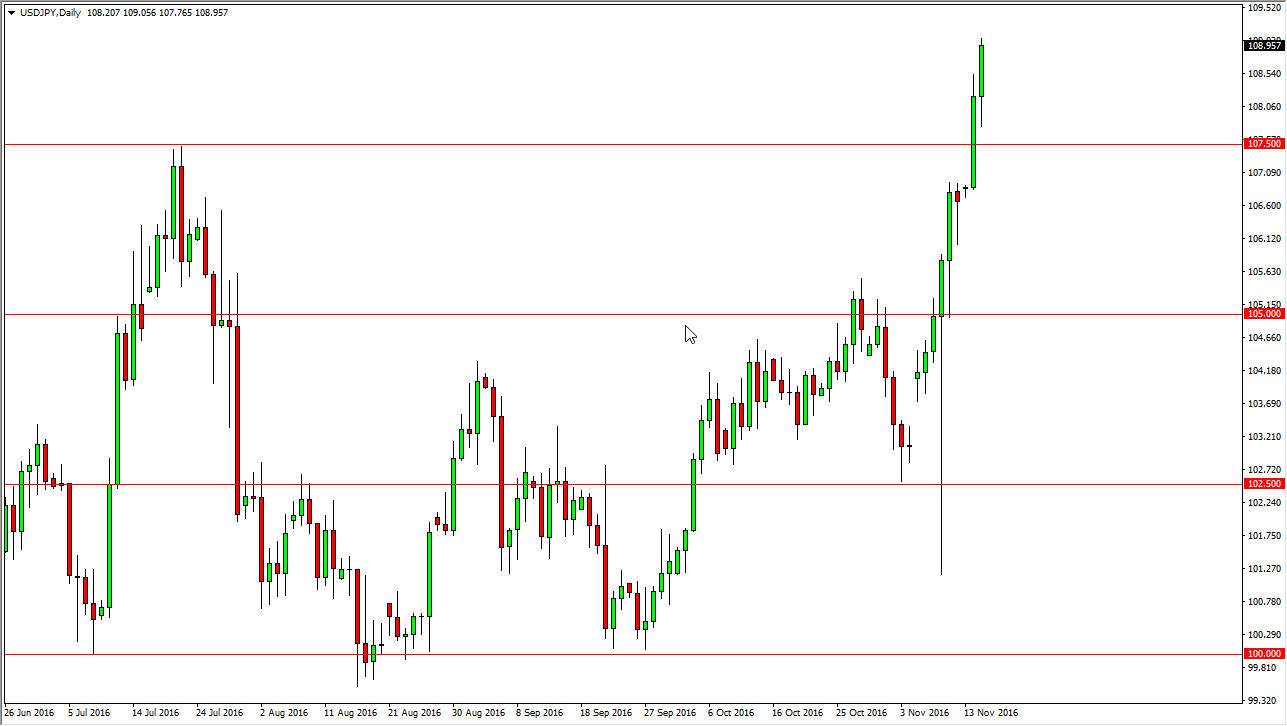

USD/JPY

The USD/JPY pair initially fell during the session on Tuesday, as the 107.50 level offered quite a bit of support. I believe that this market should continue to find buyers even though we are bit overextended. With this in mind, I think you may have to look for short-term pullbacks for buying opportunities going forward, as we continue to not only see bullish pressure, but at this point it’s very likely that we will continue to see quite a bit of volatility. I think the pullbacks will be necessary, as we have gone so far to the upside. I have no interest in selling, I believe the US dollar continues to be the favored currency around the world, and of course the Japanese yen has been selling off. As the stock markets go higher, we could see this market rise as well.

AUD/USD

The Australian dollar fell initially during the day on Tuesday, testing the previous uptrend line. The uptrend line of course was very bullish and very important, so the fact that we tested that area and then bounced is of course a very strong sign for the Aussie dollar. We also ended up forming a bit of a hammer, so that is a good sign as well but we also had formed a hammer during the previous session. The uptrend line sits just above the 0.75 level which of course is very important, so that area continues to be an area that we are trying to pay the most attention to.

We can break down below the 0.75 level, the market then could fall apart from there. I think though that you have to pay attention to the gold markets more than anything else, and if they rally, it’s probably going to send the Aussie higher and perhaps reaching all the way to the 0.7750 level above which is the top of the recent consolidation area.