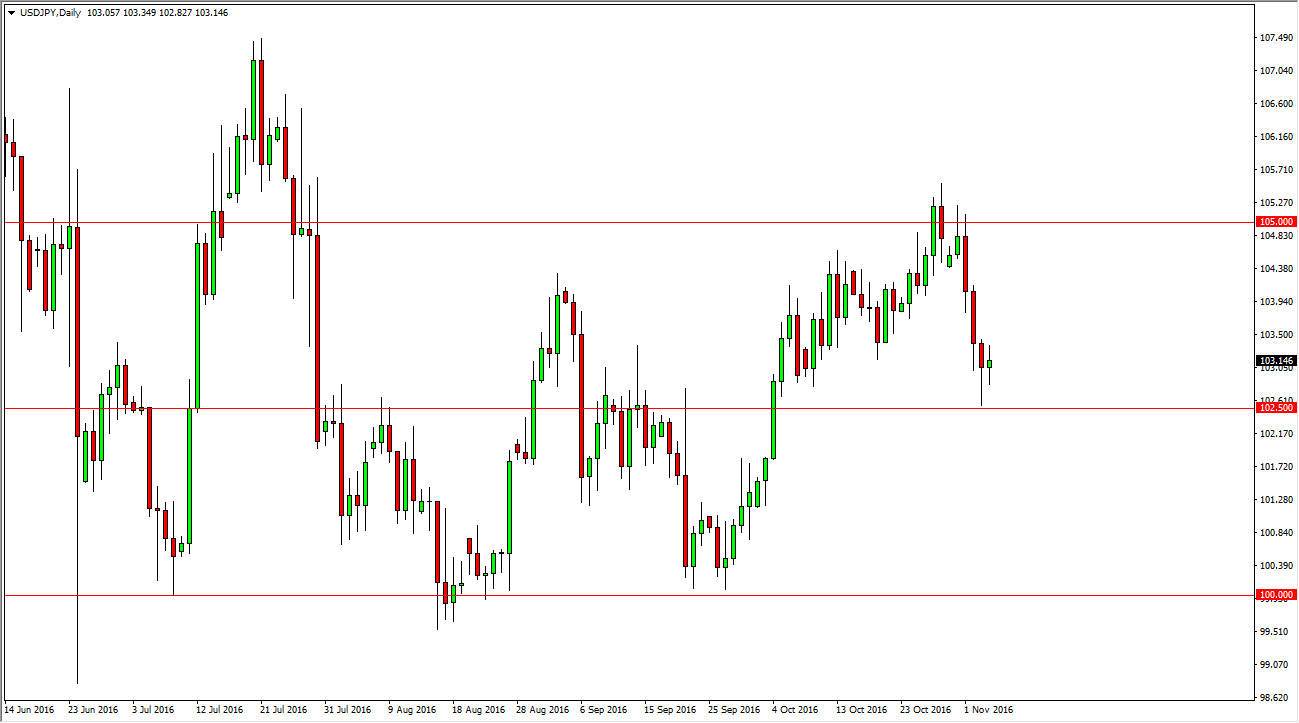

USD/JPY

The USD/JPY pair had a very choppy session during the day on Friday as the 102.50 level continues offer quite a bit of support. I believe that this market will react very violently to the US presidential election, and as a result it’s very difficult to trade this market between now and then. However, if we get some type of earth shattering newsflash of the weekend, that could influence where traders and that the elections going to go. A break above the top of the hammer from the Thursday session sends the USD/JPY pair to the 105 handle in my estimation. A break down below the 102.50 level is negative, but there so much in the way of noise just below their that I’m not comfortable shorting this market. So in essence, I either am going to be long of this market or on the sidelines.

AUD/USD

The AUD/USD pair initially fell on Friday, but then found quite a bit of support at the 0.7650 level. In the end, we ended up forming a hammer which of course is a very bullish sign but it is sitting just underneath what a bit of resistance. With this in mind, I think that the market will probably do very little, at least not until the election results are and which is going to be late on Tuesday. If we pullback, I might be able to buy a supportive candle as offering “value”, but unless we get some type of massive breakout in the gold markets, I just don’t see how the Australian dollar will break above the important 0.7750 level.

If it does break above there that would be an extraordinarily strong sign, especially if it’s before the election results. I would immediately start going long, but I ultimately believe that we are going to see more choppiness than anything else at this point.