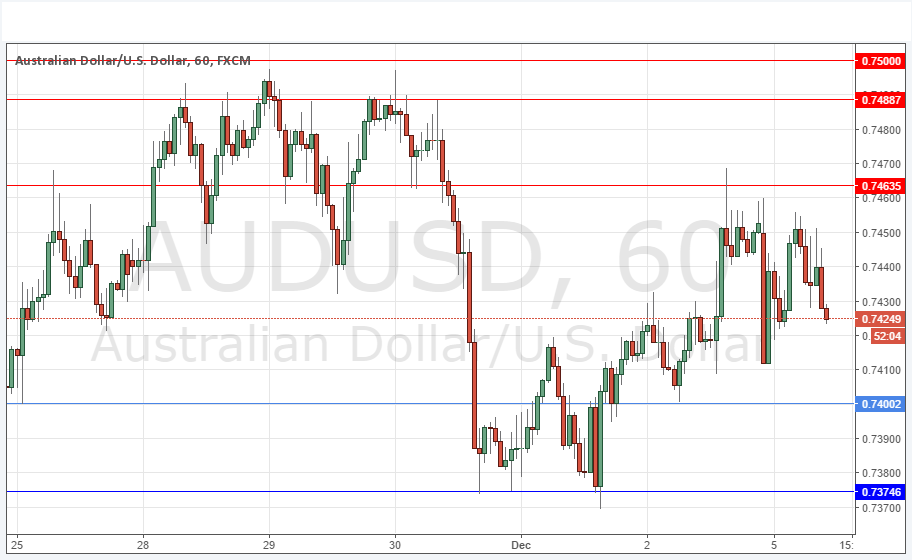

AUD/USD Signal Update

Last Thursday’s signals produced a profitable short trade following the bearing engulfing pin candle on the hourly chart rejecting the identified resistance level at 0.7432.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be entered between 8am New York time and 5pm Tokyo time, over the next 24-hours period.

Short Trade 1

Go short following some bearish price action on the H1 time frame immediately upon the first touch of 0.7464.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trades

Go long following some bullish price action on the H1 time frame immediately upon the first touch of 0.7400.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

This pair is best described as in a broad long-term consolidation pattern, but with quite large swings. This makes it a good candidate for trading support and resistance.

There is a lot of resistance above 0.7450.

The AUD news due later could push the price out of its range.

Concerning the USD, there will be a release of ISM Non-Manufacturing PMI data at 3pm London time. Regarding the AUD, there will be a release of the RBA Rate Statement and Cash Rate at 3:30am.