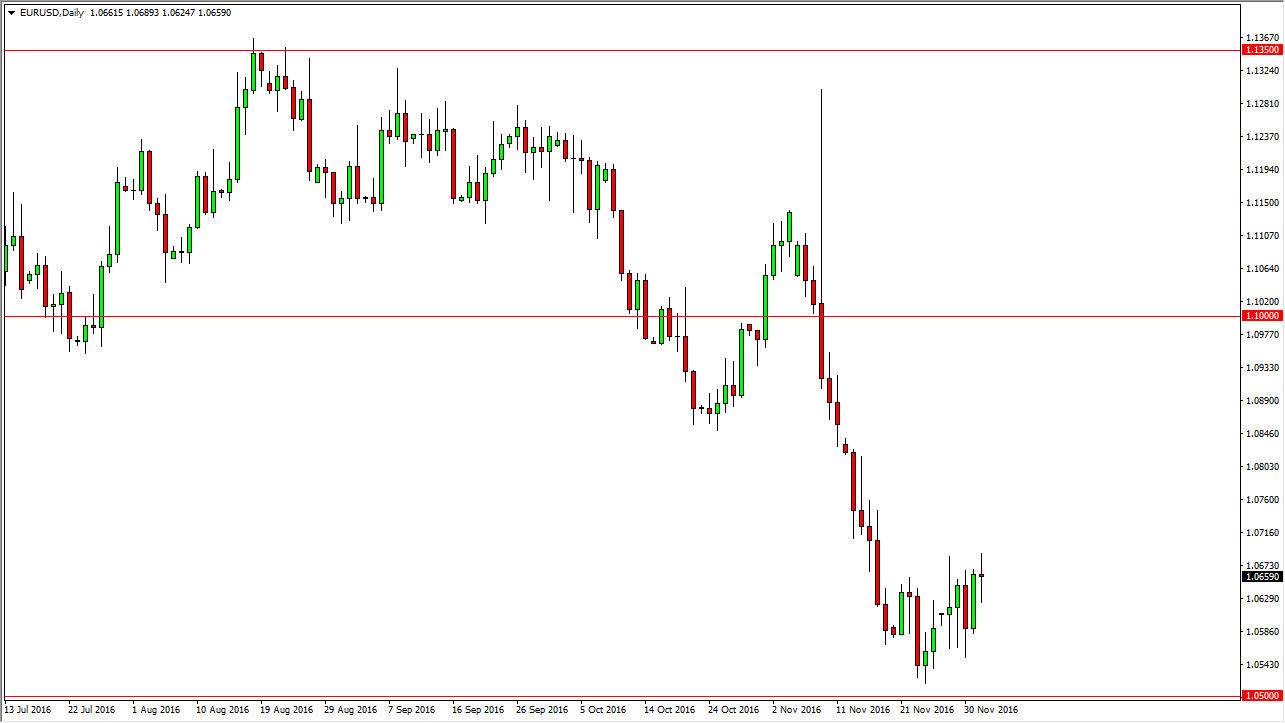

EUR/USD

The Euro initially fell on Friday but turned around to form a slightly positive looking hammer. The market is most certainly in a downtrend at the moment though, so I think that any bouncer here will be short-lived at best. Because of this, I don’t look at this is a buying opportunity but rather a selling opportunity about to happen. I think there should be significant amount of resistance at the 1.07 level, and most certainly the 1.0850 level. Sooner or later, we will get an exhaustive candle that we can take advantage of and start selling in order to pick up value in the US dollar. This rally is simply going to be an opportunity to get short yet again in a market that I believe will eventually break down below the 1.05 handle.

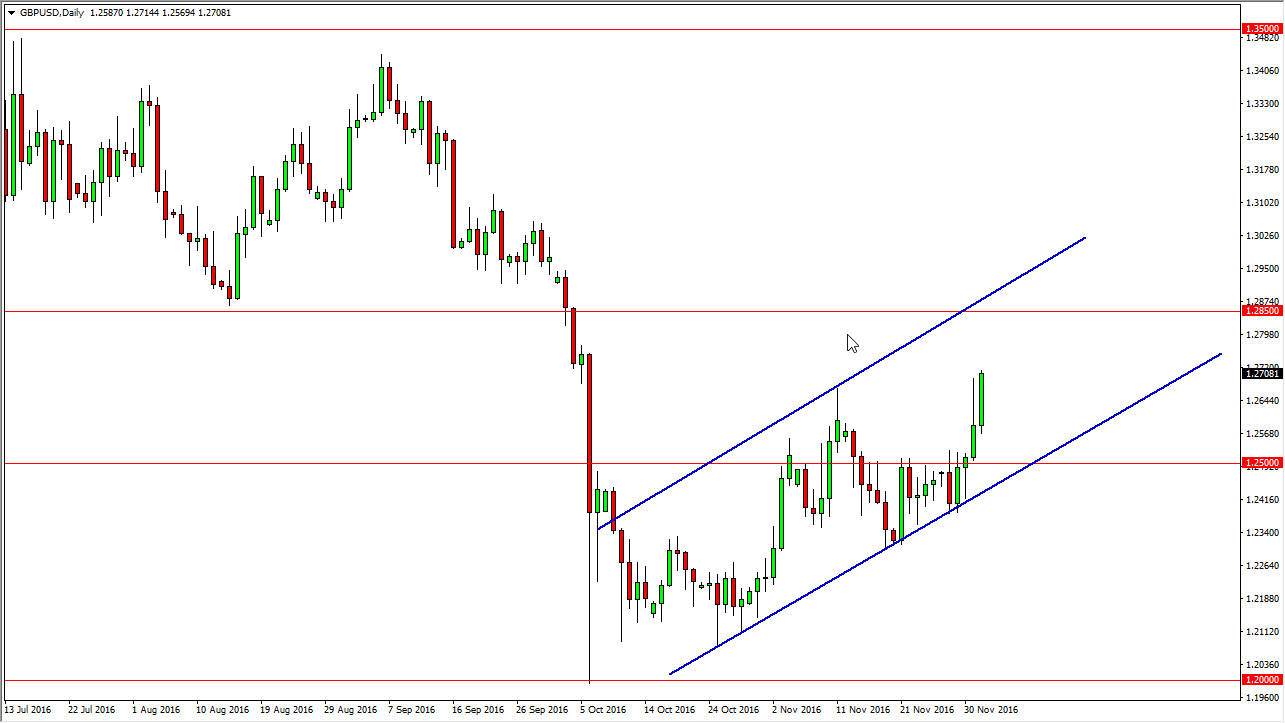

GBP/USD

The British pound broke out during the day on Friday, breaking the top of the shooting star from the Thursday session. This is a bullish move and I think will probably going to try to grind our way towards the 1.2850 region. It’s there were expect to see a lot of selling pressure though, so I believe that it’s only a matter of time before we can start shorting again based upon the longer-term charts. In the meantime, this looks like a nice short-term uptrend that should continue. A bit of a reprieve for the British pound was overdue, so quite frankly none of this surprises me.

In the end, though, the US dollar is the strongest currency in the world and that should probably be the case going forward. Because of this, I believe that sooner or later the longer-term downtrend continues, and that the real money will be made to the downside. In the short-term though, I do think that there is an argument to be made for a small and short-lived buying opportunity.