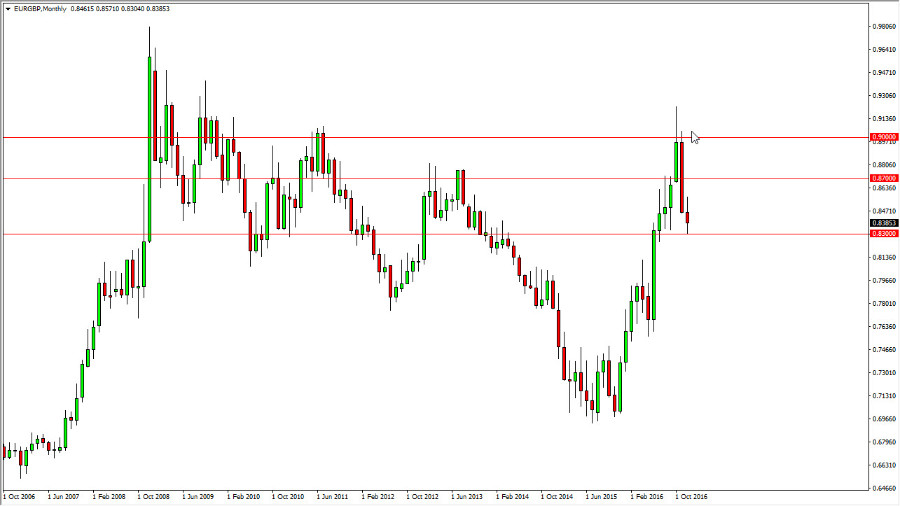

This pair is to be an interesting to watch during the coming year. The reason I say this is that we of course have a lot of bearish pressure on the British pound overall due to the “Brexit”, but quite frankly I think by the end of the gear it will become obvious to just about everyone that the United Kingdom made the smart choice by leaving. After all, the British economy isn’t exactly collapsing, but at the same time we see major problems in the European Union on economic, political, and demographic fronts. Given enough time, I actually believe that the Euro will cease to exist. The European Union is rapidly proving itself a failed experiment, and when it falls apart the British will have the cushion of having their own currency and now more importantly: not part of the group. Full disclaimer though, this isn’t happening this year.

Cracks in the wall

However, what is going to start happening this year is that Eurosceptic parties are going to take control in several countries. This will get the ball rolling for a dismantling of the European Union, or at the very least a shrinking of it. As that happens, confidence in the Euro will continue to sink. I think by the time this year is over, attitudes and outlook will be quite a bit different than we currently have.

A break below the 0.83 level sends this market looking for the 0.80 handle. That has been a relatively important level in the past, and if we break down below there I think that this pair will really start to fall apart, eventually reaching as low as the 0.70 level. In fact, that is my target for the end of the year it’s essentially a “round-trip” from summer of 2015. However, keep in mind that this pair does tend to move slowly, so it will be in fits and starts.