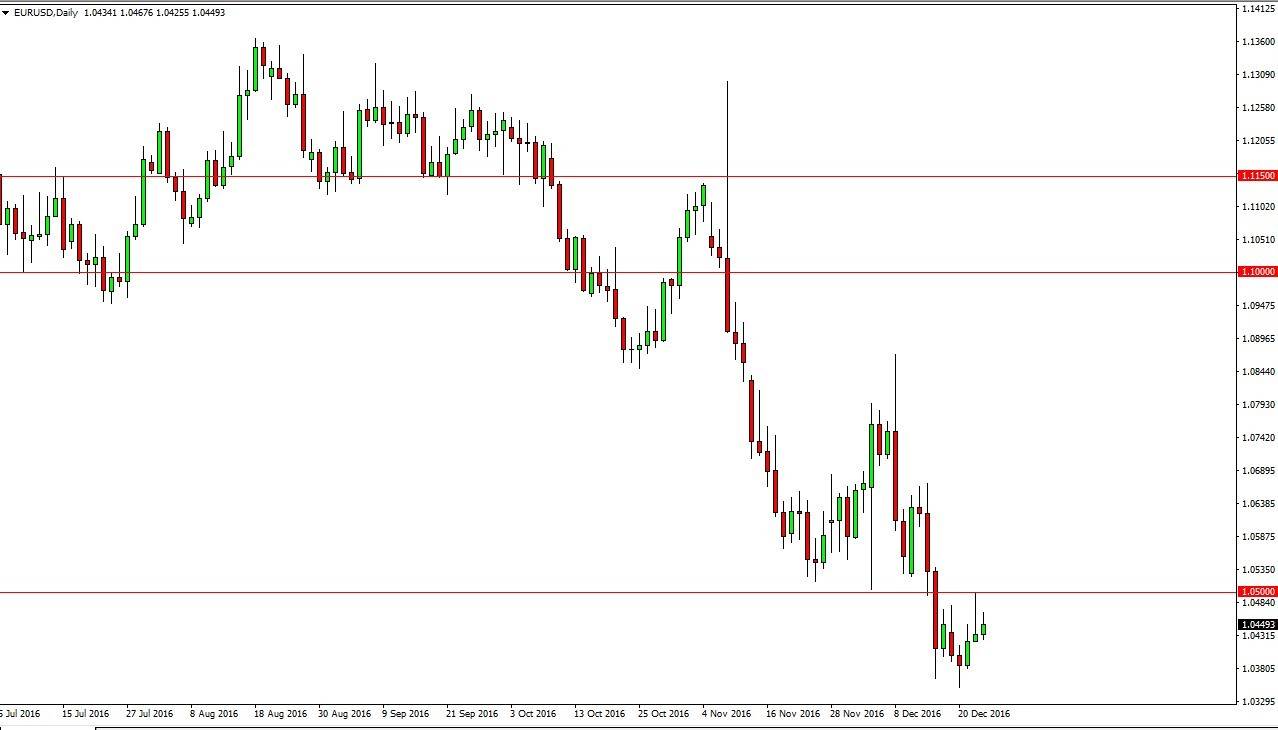

EUR/USD

The EUR/USD pair rallied on Friday, but continues to see a lot of resistance at the 1.05 level. This area should continue to be a ‘ceiling’ in this pair, especially after the previous support we had seen at this level. The European Central Bank extended quantitative easing by at least 9 months, and this will work against the value of the Euro longer-term, as the markets will also focus on the possible interest rate hikes coming out of the United States. This of course keeps the value of the Dollar high, and the Euro being so weak makes this a ‘perfect storm’ for traders, and will make people look to sell rallies repeatedly on signs of exhaustion near this level. Longer-term, I believe that the pair is going to reach parity.

GBP/USD

The British pound initially fell on Friday, but bounced enough to form a hammer. This could be a sign of an impending bounce in this market, and a break above the top of the hammer would send this market reaching higher – maybe to the 1.25 level. This area should continue to offer resistance that keeps the pair in a downtrend. Alternately, the market breaking below the hammer sends this pair looking for the 1.21 level underneath. The area then extends to the 1.20 level overall, which is a major support barrier. I think we are going to test it again, but it will be choppy between now and then. I look at short-term rallies as potential value in the US dollar.

Either way, I have no interest in buying this pair now. I think we still are working on a longer-term ‘base’ in this pair to turn things around. I also know on the longer-term charts that there is an even more massive level of support at the 1.15 handle from the monthly timeframe.