Gold rose on Monday, rebounding from 10 month lows reached earlier in the session, as the dollar gave up some of its recent gains. The XAU/USD pair initially tested the support at around the 1153 level but the market reacted bullishly after hitting that low and climbed back above 1160 level. The market’s focus is now on the Fed’s final policy meeting of 2016. Several Fed policymakers, including chair Janet Yellen, have said the economy “is making very good progress” toward the central bank’s goals and a rate hike could well become appropriate relatively soon. At this point, I think the most important question is, how aggressive will the Fed get next year?

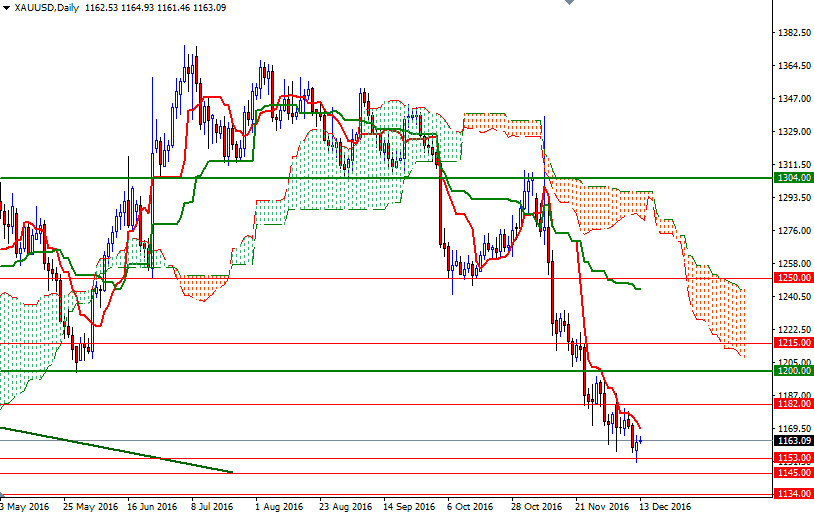

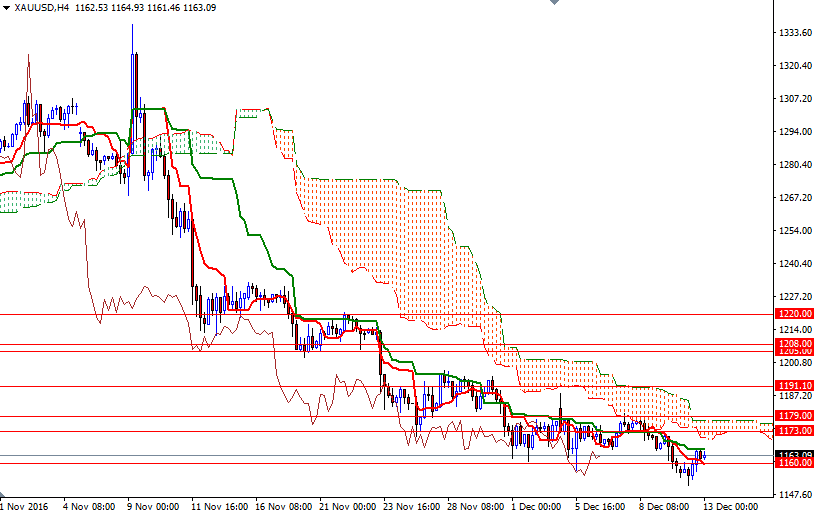

The picture continues to be bearish, with the market residing below the Ichimoku clouds on the weekly and daily time frames. Technically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. Plus the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are negatively aligned on both charts. The bears have been dominant for the past five weeks but there is a key support down below in the 1148/5 zone (which will eventually be tested if prices successfully drop through 1153) so I advise a bit of caution, as it may remain intact ahead of Fed’s statement.

If XAU/USD passes through 1166/5 it wouldn’t be so surprising to see some short-side profit taking and a push up towards the 1173/0 zone where the bottom of the 4-hourly clouds sits. The bulls have to push prices beyond 1173 so that they can have a chance to challenge the bears in the 1182/79 area. A daily close above 1182 is essential for a continuation towards 1191/88. To the downside, the initial support stands at 1160/59, followed by 1154/3. If the bears penetrate this support, the 1148/5 region could be the next port of call. Breaking below this support would open up the risk of a move towards the 1134 level.