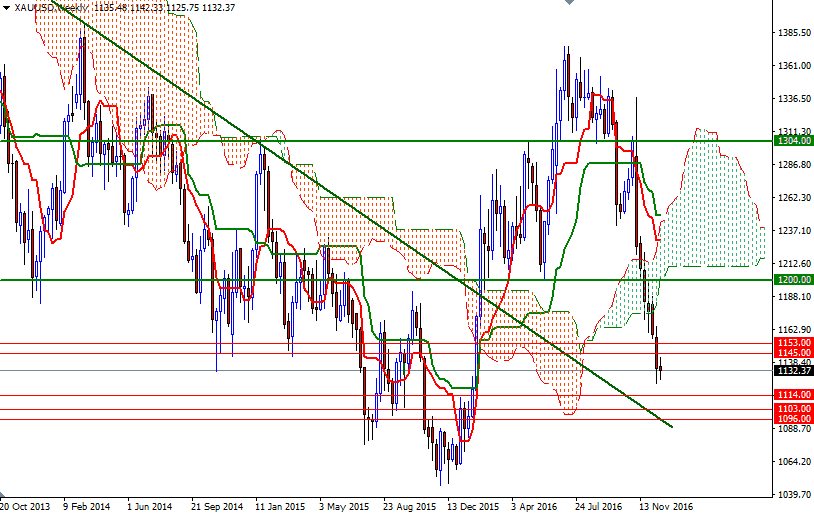

Gold prices ended Tuesday's session down $5.79, pushed lower by climbing stocks and a stronger dollar. The XAU/USD pair traded as low as $1125.75 an ounce before recovering to $1132.37. Expectations for a faster pace of U.S. interest rate hikes next year are likely to depress the attractiveness of gold but prices are showing a tightening trading range, which is symptomatic of a pending strong move either way.

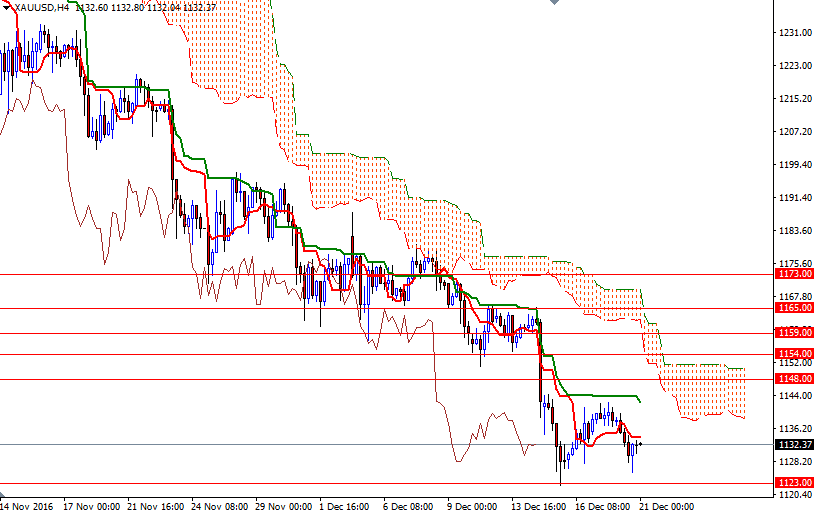

The short-term outlook is bearish with prices residing below the daily and 4-hourly Ichimoku clouds. The key resistance overhead in the 1148/5 area remains untested and intact. However, the downside will be limited unless prices make a sustained break below the 1125/3 zone where the market has found some support lately.

If prices passes through 1148/5, then the 1154/3 zone will probably be the next stop. The bulls will have to overcome this barrier in order to set sail for 1160/59. Beyond that, the bears will try to increase the pressure in the 1167/5 region. A break below the 1125/3 support would open up the risk of a move towards 1114/1. Closing above 1111 would indicate that the bears are getting ready to challenge 1103.